Vista Gold to Present at the Mining Forum Europe 2025 Conference

Denver, Colorado, March 28, 2025 – Vista Gold Corp. (NYSE American and TSX: VGZ) announced today that Frederick H. Earnest, President and CEO of Vista, will be speaking at the Mining Forum Europe 2025 conference in Zurich, Switzerland. Mr. Earnest’s presentation is scheduled for Wednesday, April 2, at 1:10 pm Zurich time (5:10 a.m. MDT or 7:10 a.m. EDT). The session will be live-streamed and available for on-demand viewing starting Friday, April 4. It can be accessed on the Company's website at www.vistagold.com. Additionally, Vista's management team will host a series of meetings with institutional investors and others during the conference from March 31 to April 2, 2025.

Presentation Webcast Link:

https://europe.miningforum.com/member-webcast/3749/

About Vista Gold Corp.

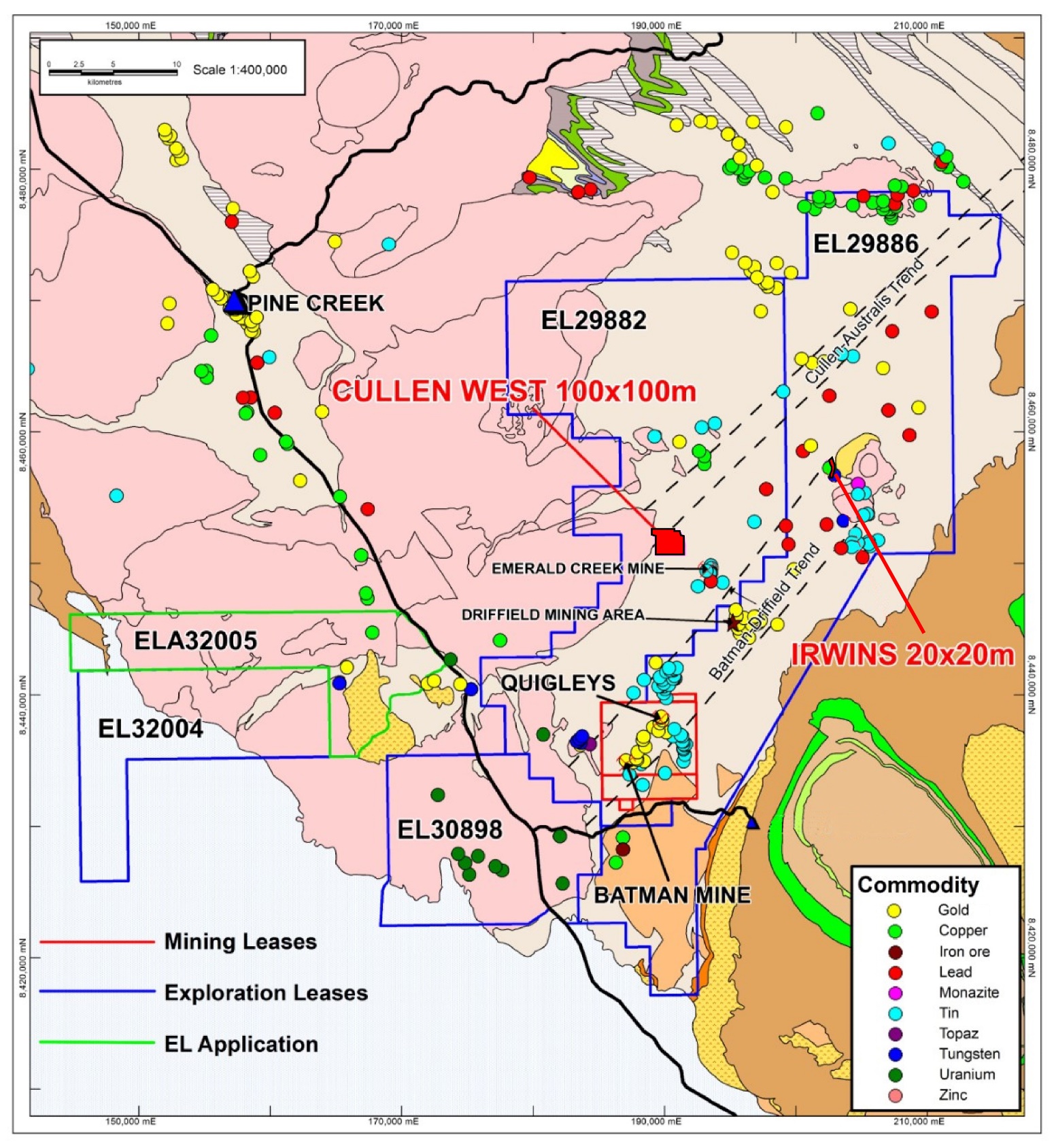

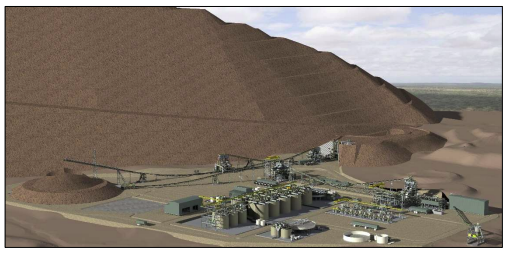

Vista holds the Mt Todd gold project, a ready-to-build development-stage gold deposit located in the Tier-1 mining jurisdiction of Northern Territory, Australia. Vista is positioning Mt Todd as a leading development opportunity within the gold sector. Mt Todd offers significant scale, development optionality, growth opportunities, advanced local infrastructure, community support, and demonstrated economic feasibility. All major environmental and operating permits necessary to commence development of Mt Todd are in place.

For further information about Vista or Mt Todd, please contact Pamela Solly, Vice President of Investor Relations, at (720) 981-1185 or visit the Company’s website at www.vistagold.com.

Forward Looking Statements

This news release contains forward-looking statements within the meaning of the U.S. Securities Act of 1933, as amended, and U.S. Securities Exchange Act of 1934, as amended, and forward-looking information within the meaning of Canadian securities laws. All statements, other than statements of historical facts, included in this news release that address activities, events or developments that we expect or anticipate will or may occur in the future, including such things as the Company will be presenting at the Mining Forum Europe 2025 Conference; Vista's management team will host a series of meetings with institutional investors and others during the conference from March 31 to April 2, 2025; the Company’s belief that Mt Todd is a ready-to-build development-stage gold deposit and that the Northern Territory, Australia is a Tier-1 jurisdiction; the Company’s belief that Mt Todd offers significant scale, development optionality, growth opportunities, advanced local infrastructure, community support, and demonstrated economic feasibility; the Company’s belief that all major environmental and operating permits necessary to commence development of Mt Todd are in place are forward-looking statements and forward-looking information. The material factors and assumptions used to develop the forward-looking statements and forward-looking information contained in this news release include the following: the Company’s forecasts and expected cash flows; the Company’s projected capital and operating costs; the Company’s expectations regarding mining and metallurgical recoveries; mine life and production rates; that laws or regulations impacting mine development or mining activities will remain consistent; the Company’s approved business plans, mineral resource and reserve estimates and results of preliminary economic assessments; preliminary feasibility studies and feasibility studies on the Company’s projects, if any; the Company’s experience with regulators; political and social support of the mining industry in Australia; the Company’s experience and knowledge of the Australian mining industry and the Company’s expectations of economic conditions and the price of gold. When used in this news release, the words “optimistic,” “potential,” “indicate,” “expect,” “intend,” “hopes,” “believe,” “may,” “will,” “if,” “anticipate” and similar expressions are intended to identify forward-looking statements and forward-looking information. These statements involve known and unknown risks, uncertainties and other factors which may cause the actual results, performance or achievements of the Company to be materially different from any future results, performance or achievements expressed or implied by such statements. Such factors include, among others, uncertainty of resource and reserve estimates, uncertainty as to the Company’s future operating costs and ability to raise capital; risks relating to cost increases for capital and operating costs; risks of shortages and fluctuating costs of equipment or supplies; risks relating to fluctuations in the price of gold; the inherently hazardous nature of mining-related activities; potential effects on the Company’s operations of environmental regulations in the countries in which it operates; risks due to legal proceedings; risks relating to political and economic instability in certain countries in which it operates; uncertainty as to the results of bulk metallurgical test work; and uncertainty as to completion of critical milestones for Mt Todd; as well as those factors discussed under the headings “Note Regarding Forward-Looking Statements” and “Risk Factors” in the Company’s latest Annual Report on Form 10-K as filed in February 2025, and other documents filed with the U.S. Securities and Exchange Commission and Canadian securities regulatory authorities. Although the Company has attempted to identify important factors that could cause actual results to differ materially from those described in forward-looking statements and forward-looking information, there may be other factors that cause results not to be as anticipated, estimated or intended. Except as required by law, the Company assumes no obligation to publicly update any forward-looking statements or forward-looking information whether as a result of new information, future events or otherwise.

Pamela Solly

Vice President of Investor Relations

(720) 981-1185

www.vistagold.com

Vista Gold Publishes 2024 Environmental, Social and Governance Report

DENVER--(BUSINESS WIRE)-- Vista Gold Corp. (NYSE American and TSX: VGZ) announced today the publication of its 2024 Environmental, Social and Governance ("ESG") Report. The ESG Report provides transparency and outlines progress on the Company’s ESG performance in 2024. It also defines the Company’s ESG goals and key initiatives for the coming year.

Frederick H. Earnest, President and CEO of Vista, commented, “I am pleased to announce the release of our 2024 ESG Report, sharing insights into our progress and outlining our vision for the future. We recognize the importance of conducting our business in a responsible and sustainable manner. We are committed to continuously aligning our business practices with current and emerging ESG principles to drive long-term success and create a positive impact through our operations.”

Vista’s 2024 ESG Report is available on the Company’s website at www.vistagold.com.

About Vista Gold Corp.

Vista holds the Mt Todd gold project, a ready-to-build development-stage gold deposit located in the Tier-1 mining jurisdiction of Northern Territory, Australia. Vista is positioning Mt Todd as a leading development opportunity within the gold sector. Mt Todd offers significant scale, development optionality, growth opportunities, advanced local infrastructure, community support, and demonstrated economic feasibility. All major environmental and operating permits necessary to initiate development of Mt Todd are in place.

Vista’s strategy is to advance Mt Todd in ways that efficiently position the project for development while exercising the discipline necessary to best realize value at the right time. Vista believes its strategy of advancing Mt Todd in this manner will deliver a more fully valued project to its shareholders.

For further information about Vista or Mt Todd, please contact Pamela Solly, Vice President of Investor Relations, at (720) 981-1185 or visit the Company’s website at www.vistagold.com.

Forward Looking Statements

This news release contains forward-looking statements within the meaning of the U.S. Securities Act of 1933, as amended, and U.S. Securities Exchange Act of 1934, as amended, and forward-looking information within the meaning of Canadian securities laws. All statements, other than statements of historical facts, included in this news release that address activities, events or developments that we expect or anticipate will or may occur in the future, including such things as our belief that the 2024 ESG Report provides transparency and outlines progress on the Company’s ESG performance in 2024; the Company is committed to continuously aligning its business practices with current and emerging ESG principles to drive long-term success and create a positive impact through its operations; the Company’s belief that Mt Todd is a ready-to-build development-stage gold deposit and that the Northern Territory, Australia is a Tier-1 jurisdiction; the Company’s belief that Mt Todd offers significant scale, development optionality, growth opportunities, advanced local infrastructure, community support, and demonstrated economic feasibility; statements related to Vista’s strategy, including Vista’s strategy is to advance Mt Todd in ways that efficiently position the project for development; and Vista’s belief that its strategy of advancing Mt Todd in this matter will deliver a more fully valued project to its shareholders. The material factors and assumptions used to develop the forward-looking statements and forward-looking information contained in this news release include the following: the Company’s forecasts and expected cash flows; the Company’s projected capital and operating costs; the Company’s expectations regarding mining and metallurgical recoveries; mine life and production rates; that laws or regulations impacting mine development or mining activities will remain consistent; the Company’s approved business plans, mineral resource and reserve estimates and results of preliminary economic assessments; preliminary feasibility studies and feasibility studies on the Company’s projects, if any; the Company’s experience with regulators; political and social support of the mining industry in Australia; the Company’s experience and knowledge of the Australian mining industry and the Company’s expectations of economic conditions and the price of gold. When used in this news release, the words “optimistic,” “potential,” “indicate,” “expect,” “intend,” “hopes,” “believe,” “may,” “will,” “if,” “anticipate” and similar expressions are intended to identify forward-looking statements and forward-looking information. These statements involve known and unknown risks, uncertainties and other factors which may cause the actual results, performance or achievements of the Company to be materially different from any future results, performance or achievements expressed or implied by such statements. Such factors include, among others, uncertainty of resource and reserve estimates, uncertainty as to the Company’s future operating costs and ability to raise capital; risks relating to cost increases for capital and operating costs; risks of shortages and fluctuating costs of equipment or supplies; risks relating to fluctuations in the price of gold; the inherently hazardous nature of mining-related activities; potential effects on the Company’s operations of environmental regulations in the countries in which it operates; risks due to legal proceedings; risks relating to political and economic instability in certain countries in which it operates; uncertainty as to the results of bulk metallurgical test work; and uncertainty as to completion of critical milestones for Mt Todd; as well as those factors discussed under the headings “Note Regarding Forward-Looking Statements” and “Risk Factors” in the Company’s latest Annual Report on Form 10-K as filed in February 2025, and other documents filed with the U.S. Securities and Exchange Commission and Canadian securities regulatory authorities. Although the Company has attempted to identify important factors that could cause actual results to differ materially from those described in forward-looking statements and forward-looking information, there may be other factors that cause results not to be as anticipated, estimated or intended. Except as required by law, the Company assumes no obligation to publicly update any forward-looking statements or forward-looking information whether as a result of new information, future events or otherwise.

Pamela Solly

Vice President of Investor Relations

(720) 981-1185

Vista Gold Corp. Announces 2024 Financial Results

DENVER--(BUSINESS WIRE)-- Vista Gold Corp. (NYSE American and TSX: VGZ) (“Vista” or the “Company”) today announced its audited financial results for the year ended December 31, 2024, with cash totaling $16.9 million at year-end. All dollar amounts in this press release are in U.S. dollars.

Frederick H. Earnest, President and CEO of Vista, stated, “Our achievements in 2024 underscore our commitment to creating greater value for our shareholders and positioning Vista and Mt Todd for long-term success. Receipt of the remaining proceeds under our 2023 royalty transaction enabled us to advance Mt Todd work programs and end the year with a strong balance sheet. We efficiently completed the 2024 drilling program and several other studies, leading to the decision to undertake a new Mt Todd feasibility study with an ore throughput rate of 15,000 tonnes per day.

“This study aims to demonstrate a development alternative for Mt Todd which will place it among the most attractive ready-to-build opportunities within the gold sector. In planning this study, we focused on several factors that are consistently recognized as value drivers for new projects. Our goals are to reduce initial capex by 60% to approximately $400 million, increase the reserve grade to 1 gram gold per tonne by applying a higher cut-off grade, and achieve average annual gold production ranging from 150,000 to 200,000 ounces.

“We are focused on advancing Mt Todd in ways that demonstrate the underlying value of the project and position it for near-term development, while maintaining the discipline necessary to best realize value at the right time.”

Summary of Financial Results

Vista reported consolidated net income of $11.2 million or $0.09 per common share for the year ended December 31, 2024, compared to a consolidated net loss of $6.6 million, or $0.05 per common share for the year ended December 31, 2023. The 2024 financial results benefited from a $16.9 million gain on grant of royalty interest in Mt Todd, a $0.8 million gain on sale of mill equipment, and continued focus on cost controls.

Cash and cash equivalents totaled $16.9 million as of December 31, 2024, compared to $6.1 million at December 31, 2023. In the first half of 2024, the Company received the remaining royalty proceeds in the amount of $17.0 million under its 2023 royalty transaction. The Company continued to have no debt.

Management Conference Call

Management’s conference call to review financial results for the year ended December 31, 2024 and to discuss corporate and project activities is scheduled for March 6, 2025 at 2:00 p.m. MST (4:00 p.m. EST).

Participant Toll Free: +1 (800) 717-1738

Participant International: +1 (289) 514-5100

Conference ID: 38668

This call will be archived and available at www.vistagold.com after March 6, 2025. An audio replay will also be available through March 20, 2025 by calling toll-free in North America +1 (888) 660-6264 or +1 (289) 819-1325 using passcode 38668#.

If you are unable to access the audio or phone-in on the day of the conference call, please email your questions to

About Vista Gold Corp.

Vista holds the Mt Todd gold project, a ready-to-build development-stage gold deposit located in the Tier-1 mining jurisdiction of Northern Territory, Australia. Vista is positioning Mt Todd as a leading development opportunity within the gold sector. Mt Todd offers significant scale, development optionality, growth opportunities, advanced local infrastructure, community support, and demonstrated economic feasibility. All major environmental and operating permits necessary to initiate development of Mt Todd are in place.

Vista’s strategy is to advance Mt Todd in ways that efficiently position the project for development while exercising the discipline necessary to best realize value at the right time. Vista believes its strategy of advancing Mt Todd in this manner will deliver a more fully valued project to its shareholders.

For further information about Vista or Mt Todd, please contact Pamela Solly, Vice President of Investor Relations, at (720) 981-1185 or visit the Company’s website at www.vistagold.com.

Forward Looking Statements

This news release contains forward-looking statements within the meaning of the U.S. Securities Act of 1933, as amended, and U.S. Securities Exchange Act of 1934, as amended, and forward-looking information within the meaning of Canadian securities laws. All statements, other than statements of historical facts, included in this news release that address activities, events or developments that we expect or anticipate will or may occur in the future are forward-looking statements and forward-looking information. These forward-looking statements and forward-looking information include, but are not limited to statements regarding such things as the fourth quarter and fiscal year financial results of the Company; the Company’s belief that the receipt of the remaining proceeds under its 2023 royalty transaction enabled the Company to end the year with a strong balance sheet; the Company’s belief that it efficiently completed the 2024 drilling program and several other studies the new Mt Todd feasibility study aims to demonstrate a development alternative for Mt Todd which will place it among the most attractive ready-to-build opportunities within the gold sector;; the Company’s goals to reduce initial capex by 60% to approximately $400 million, increase the reserve grade to 1 gram gold per tonne by applying a higher cut-off grade, and achieve average annual gold production ranging from 150,000 to 200,000 ounces; the Company’s belief that Mt Todd is a ready-to-build development-stage gold deposit and that the Northern Territory, Australia is a Tier-1 jurisdiction; the Company’s belief that Mt Todd offers significant scale, development optionality, growth opportunities, advanced local infrastructure, community support, and demonstrated economic feasibility; statements related to Vista’s strategy, including Vista’s strategy is to advance Mt Todd in ways that efficiently position the project for development; and Vista’s belief that its strategy of advancing Mt Todd in this matter will deliver a more fully valued project to its shareholders. The material factors and assumptions used to develop the forward-looking statements and forward-looking information contained in this news release include the following: the Company’s forecasts and expected cash flows; the Company’s projected capital and operating costs; the Company’s expectations regarding mining and metallurgical recoveries; mine life and production rates; that laws or regulations impacting mine development or mining activities will remain consistent; the Company’s approved business plans, mineral resource and reserve estimates and results of preliminary economic assessments; preliminary feasibility studies and feasibility studies on the Company’s projects, if any; the Company’s experience with regulators; political and social support of the mining industry in Australia; the Company’s experience and knowledge of the Australian mining industry and the Company’s expectations of economic conditions and the price of gold. When used in this news release, the words “optimistic,” “potential,” “indicate,” “expect,” “intend,” “hopes,” “believe,” “may,” “will,” “if,” “anticipate” and similar expressions are intended to identify forward-looking statements and forward-looking information. These statements involve known and unknown risks, uncertainties and other factors which may cause the actual results, performance or achievements of the Company to be materially different from any future results, performance or achievements expressed or implied by such statements. Such factors include, among others, uncertainty of resource and reserve estimates, uncertainty as to the Company’s future operating costs and ability to raise capital; risks relating to cost increases for capital and operating costs; risks of shortages and fluctuating costs of equipment or supplies; risks relating to fluctuations in the price of gold; the inherently hazardous nature of mining-related activities; potential effects on the Company’s operations of environmental regulations in the countries in which it operates; risks due to legal proceedings; risks relating to political and economic instability in certain countries in which it operates; uncertainty as to the results of bulk metallurgical test work; and uncertainty as to completion of critical milestones for Mt Todd; as well as those factors discussed under the headings “Note Regarding Forward-Looking Statements” and “Risk Factors” in the Company’s latest Annual Report on Form 10-K as filed in February 2025, and other documents filed with the U.S. Securities and Exchange Commission and Canadian securities regulatory authorities. Although the Company has attempted to identify important factors that could cause actual results to differ materially from those described in forward-looking statements and forward-looking information, there may be other factors that cause results not to be as anticipated, estimated or intended. Except as required by law, the Company assumes no obligation to publicly update any forward-looking statements or forward-looking information whether as a result of new information, future events or otherwise.

Pamela Solly, Vice President of Investor Relations

(720) 981-1185

www.vistagold.com

Vista Gold to Participate in the Prospectors & Developers Association of Canada 2025 Convention

DENVER--(BUSINESS WIRE)-- Vista Gold Corp. (NYSE American and TSX: VGZ) today announced that it will be participating in the upcoming Prospectors & Developers Association of Canada 2025 Convention taking place March 2-5, 2025, at the Metro Toronto Convention Centre in Toronto, Canada.

The Company invites attendees to visit its booth for one-on-one discussions with Vista’s management team, and to learn about the changes the Company is making to bring Mt Todd to the forefront of ready-to-build gold projects and the value-potential this creates. Frederick H. Earnest, President and CEO of Vista, will also host a series of meetings and provide interviews throughout the event.

Vista Gold Exhibition Dates: March 2-5, 2025

Location: Metro Toronto Convention Centre – Investors Exchange Hall

Booth Number: 2235 – Located just inside the Investors Exchange Hall Entrance

About Vista Gold Corp.

Vista holds the Mt Todd gold project, a ready-to-build development-stage gold deposit located in the Tier-1 mining jurisdiction of Northern Territory, Australia. Vista is positioning Mt Todd as a leading development opportunity within the gold sector. Mt Todd offers significant scale, development optionality, growth opportunities, advanced local infrastructure, community support, and demonstrated economic feasibility. All major environmental and operating permits necessary to commence development of Mt Todd are in place.

Vista’s strategy is to advance Mt Todd in ways that efficiently position the project for development while exercising the discipline necessary to best realize value at the right time. Vista believes its strategy of advancing Mt Todd in this manner will deliver a more fully valued project to its shareholders.

For further information about Vista or Mt Todd, please contact Pamela Solly, Vice President of Investor Relations, at (720) 981-1185 or visit the Company’s website at www.vistagold.com.

Forward Looking Statements

This news release contains forward-looking statements within the meaning of the U.S. Securities Act of 1933, as amended, and U.S. Securities Exchange Act of 1934, as amended, and forward-looking information within the meaning of Canadian securities laws. All statements, other than statements of historical facts, included in this news release that address activities, events or developments that we expect or anticipate will or may occur in the future, including such things as the Company will be participating in the upcoming Prospectors & Developers Association of Canada 2025 Convention taking place March 2-5, 2025; the Company invites attendees to visit its booth for one-on-one discussions with Vista’s management team, and to learn about the changes the Company is making to bring Mt Todd to the forefront of ready-to-build gold projects and the value-potential this creates; Frederick H. Earnest, President and CEO of Vista, will also host a series of meetings and provide interviews throughout the event; the Company’s belief that Mt Todd is a ready-to-build development-stage gold deposit and that the Northern Territory, Australia is a Tier-1 jurisdiction; the Company’s belief that Mt Todd offers significant scale, development optionality, growth opportunities, advanced local infrastructure, community support, and demonstrated economic feasibility; statements related to the Company’s strategy, including advancing Mt Todd in ways that efficiently position the project for development while exercising the discipline necessary to best realize value at the right time and the Company’s belief that its strategy of advancing Mt Todd in this matter will deliver a more fully valued project to its shareholders are forward-looking statements and forward-looking information. The material factors and assumptions used to develop the forward-looking statements and forward-looking information contained in this news release include the following: the Company’s forecasts and expected cash flows; the Company’s projected capital and operating costs; the Company’s expectations regarding mining and metallurgical recoveries; mine life and production rates; that laws or regulations impacting mine development or mining activities will remain consistent; the Company’s approved business plans, mineral resource and reserve estimates and results of preliminary economic assessments; preliminary feasibility studies and feasibility studies on the Company’s projects, if any; the Company’s experience with regulators; political and social support of the mining industry in Australia; the Company’s experience and knowledge of the Australian mining industry and the Company’s expectations of economic conditions and the price of gold. When used in this news release, the words “optimistic,” “potential,” “indicate,” “expect,” “intend,” “hopes,” “believe,” “may,” “will,” “if,” “anticipate” and similar expressions are intended to identify forward-looking statements and forward-looking information. These statements involve known and unknown risks, uncertainties and other factors which may cause the actual results, performance or achievements of the Company to be materially different from any future results, performance or achievements expressed or implied by such statements. Such factors include, among others, uncertainty of resource and reserve estimates, uncertainty as to the Company’s future operating costs and ability to raise capital; risks relating to cost increases for capital and operating costs; risks of shortages and fluctuating costs of equipment or supplies; risks relating to fluctuations in the price of gold; the inherently hazardous nature of mining-related activities; potential effects on the Company’s operations of environmental regulations in the countries in which it operates; risks due to legal proceedings; risks relating to political and economic instability in certain countries in which it operates; uncertainty as to the results of bulk metallurgical test work; and uncertainty as to completion of critical milestones for Mt Todd; as well as those factors discussed under the headings “Note Regarding Forward-Looking Statements” and “Risk Factors” in the Company’s latest Annual Report on Form 10-K as filed in March 2024, and other documents filed with the U.S. Securities and Exchange Commission and Canadian securities regulatory authorities. Although the Company has attempted to identify important factors that could cause actual results to differ materially from those described in forward-looking statements and forward-looking information, there may be other factors that cause results not to be as anticipated, estimated or intended. Except as required by law, the Company assumes no obligation to publicly update any forward-looking statements or forward-looking information whether as a result of new information, future events or otherwise.

Pamela Solly

Vice President of Investor Relations

(720) 981-1185

Vista Gold 2025 Initiatives Pave the Way for Value Realization at Mt Todd

Denver, Colorado, February 19, 2025 – Vista Gold Corp. (NYSE American and TSX: VGZ) today announced its 2025 strategic outlook.

Frederick H. Earnest, President and CEO of Vista, commented, “Our key strategic focus in 2025 is to complete the Mt Todd feasibility study and leverage the results to deliver value to our shareholders. Momentum continues to build in the gold sector and the capital markets are beginning to recognize the value of advanced-staged gold development projects. We believe that the lower cost, 15,000 tonne per day development strategy in this feasibility study will attract interest from a broad range of investors seeking ready-to-build gold projects like Mt Todd, ultimately unlocking significant value for our shareholders.”

Key 2025 Initiatives

Safety

Vista's highest continual priority is the safety and well-being of its employees. As the Company continues to prioritize and uphold its health and safety initiatives, Vista and Mt Todd proudly mark 1,194 days without a lost time incident. The Company remains committed to its health and safety programs and is focused on building upon this achievement.

Mt Todd Feasibility Study

Completing the Mt Todd feasibility study is key to creating long-term value for Vista and its shareholders. It represents a key deliverable in consolidating Mt Todd’s position as a leading development opportunity in the gold sector. The feasibility study aims to increase the reserve grade to 1 gram gold per tonne by applying a higher cut-off grade, while also reducing initial capex by 60% to $400 million. The study targets average annual gold production ranging from 150,000 to 200,000 ounces from 15,000 tonnes per day ore throughput. By utilizing contract mining, third-party power generation, and established construction practices commonly used in Australia, the Company believes there is opportunity to maintain high capital efficiency at this project scale, preserve the potential for future expansion, and deliver strong economic returns. The feasibility study is progressing as planned, with completion anticipated mid-2025.

Strategy

Vista’s strategy is to efficiently advance Mt Todd in ways that demonstrate the underlying value of the project and position it for near-term development, while maintaining the discipline necessary to best realize value at the right time. The Company anticipates that the results of the Mt Todd feasibility study will be a catalyst to attract a broad range of investors seeking ready-to-build gold projects. Vista remains committed to actively pursuing strategic transactions that maximize value for its shareholders.

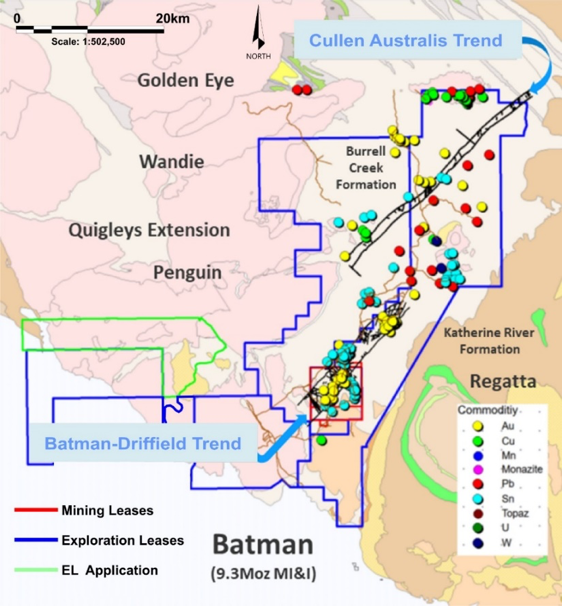

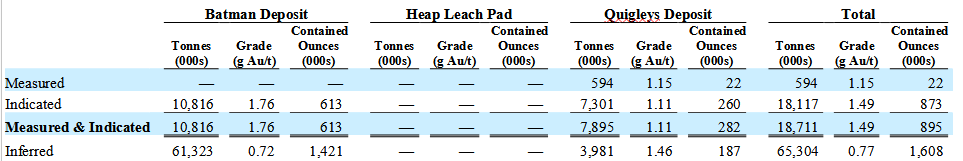

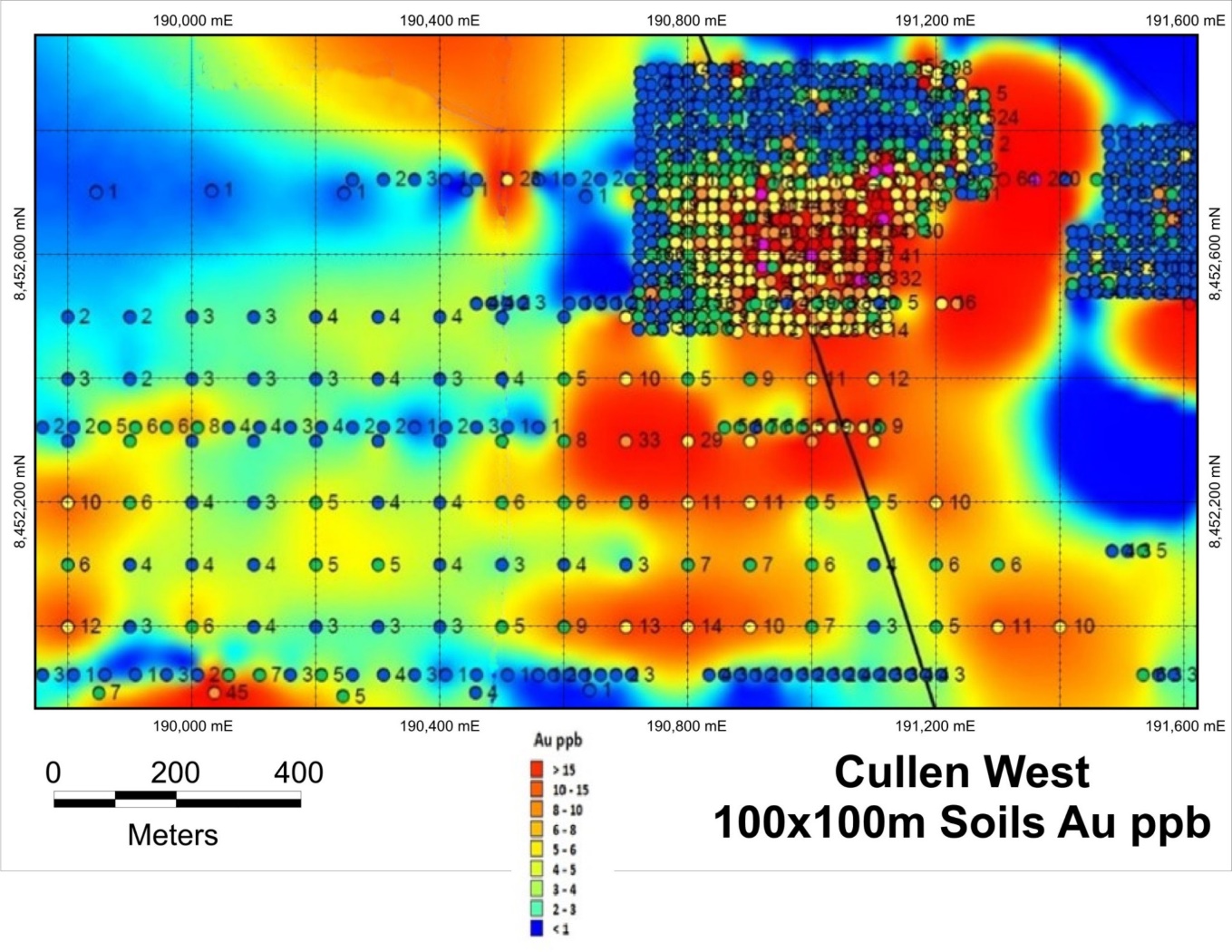

New Mineral Resource Estimate

In conjunction with the upcoming Mt Todd feasibility study, a new mineral resource estimate is being developed to incorporate the results from the 2024 and 2020-2022 drilling programs. The Company’s analysis of the results of these drilling programs indicates potential to add to mineral resources and reserves. The Company plans to announce the new mineral resource estimate as part of the Mt Todd feasibility study, scheduled for completion mid-2025.

ESG

Vista is committed to advancing its Environmental, Social, and Governance initiatives. Details of Vista’s goals and achievements in these and other areas will be included in Vista’s upcoming annual ESG report, expected to be published in the coming weeks.

About Vista Gold Corp.

Vista holds the Mt Todd gold project, a ready-to-build development-stage gold deposit located in the Tier-1 mining jurisdiction of Northern Territory, Australia. Vista is positioning Mt Todd as a leading development opportunity within the gold sector. Mt Todd offers significant scale, development optionality, growth opportunities, advanced local infrastructure, community support, and demonstrated economic feasibility. All major environmental and operating permits necessary to commence development of Mt Todd are in place.

Vista’s strategy is to advance Mt Todd in ways that efficiently position the project for development while exercising the discipline necessary to best realize value at the right time. Vista believes its strategy of advancing Mt Todd in this manner will deliver a more fully valued project to its shareholders.

For further information about Vista or Mt Todd, please contact Pamela Solly, Vice President of Investor Relations, at (720) 981-1185 or visit the Company’s website at www.vistagold.com.

Qualified Person

Maria Vallejo, Vista’s Director of Projects and Technical Services, a Qualified Person as defined by Item 1300 of Regulation S-K under the Securities Exchange Act of 1934, as amended, and Canadian National Instrument 43-101 – Standards of Disclosure for Mineral Projects, has verified the data underlying the information contained herein and has approved this press release. The information contained in this press release is provided as a summary of the 2024 drilling program for the Mt Todd project.

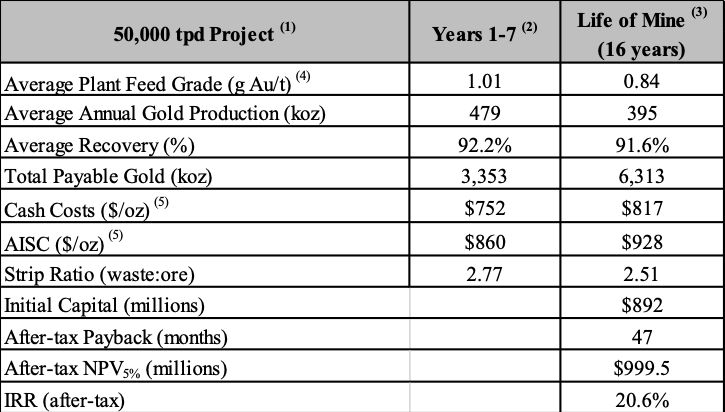

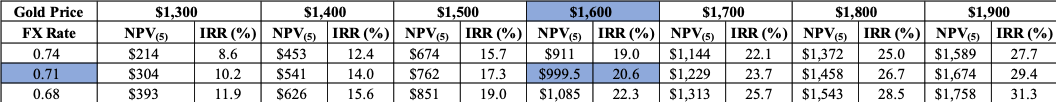

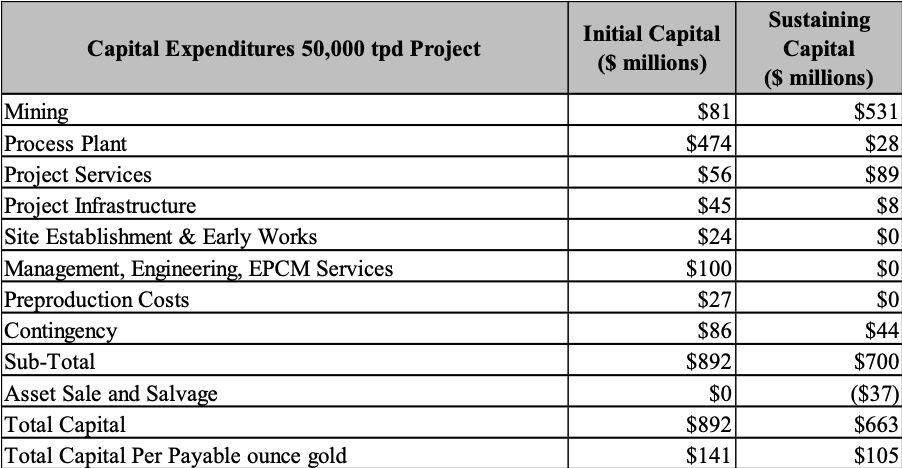

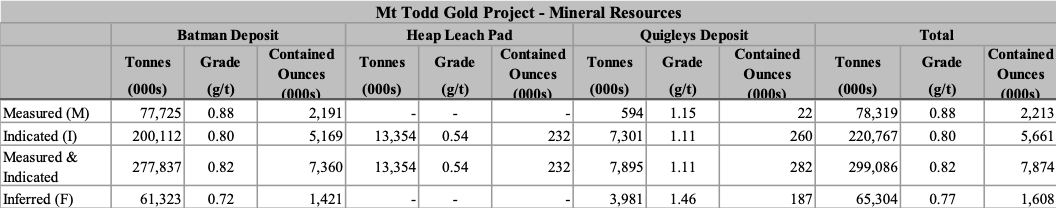

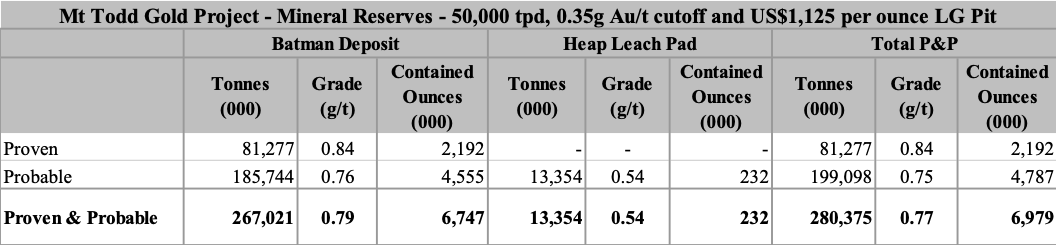

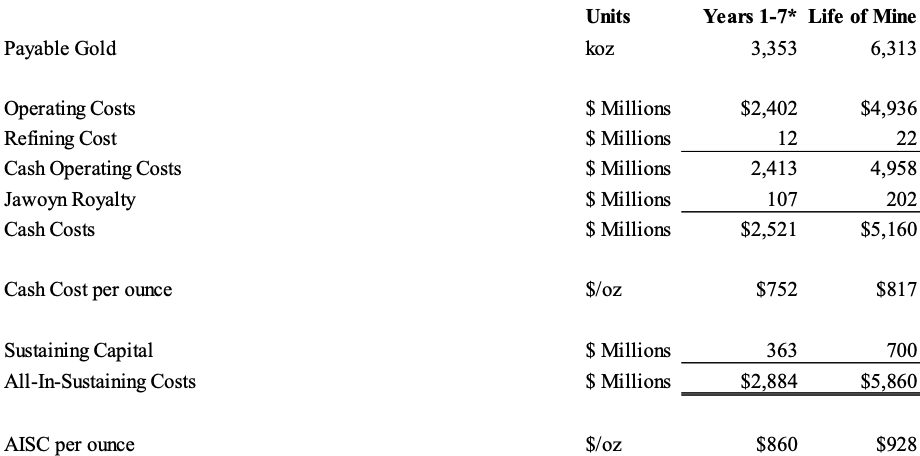

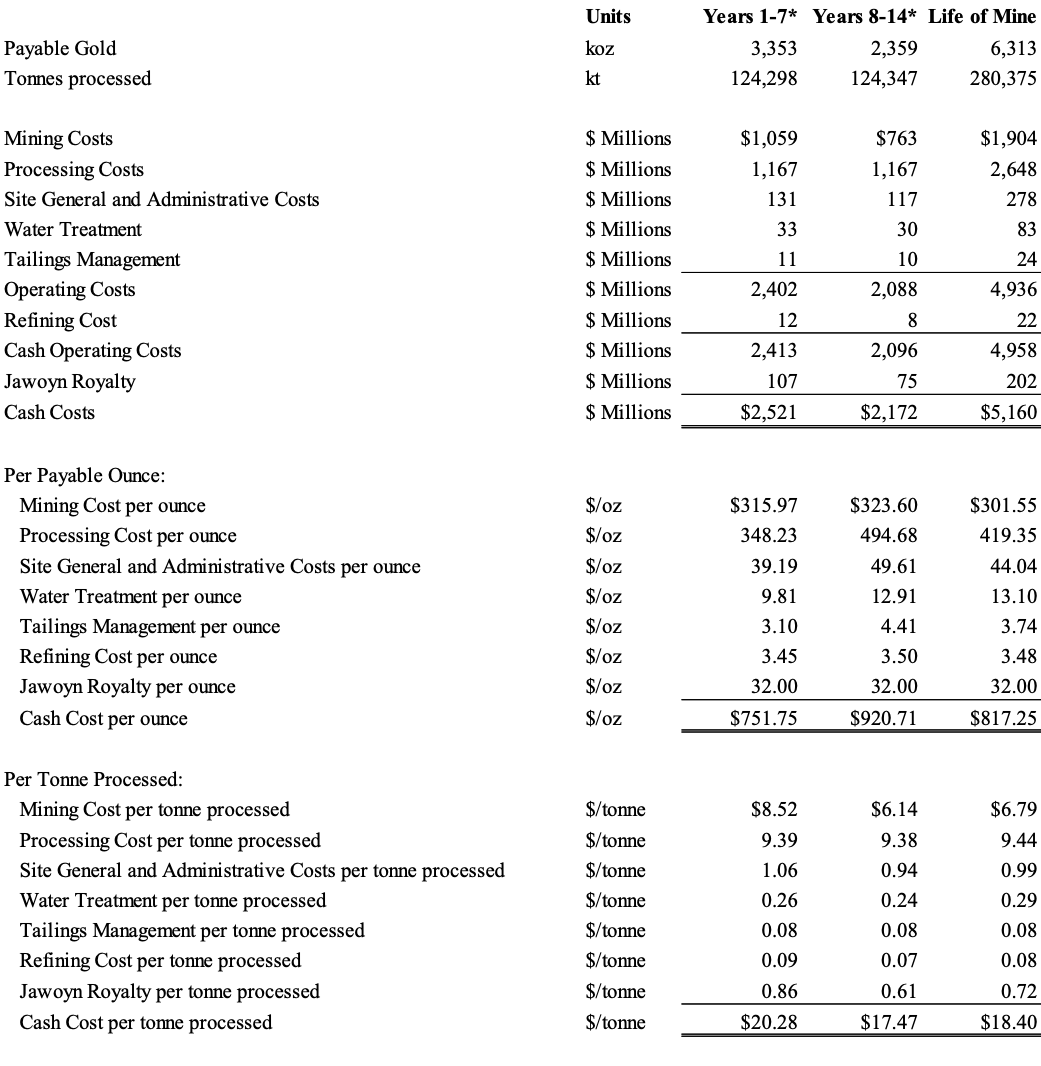

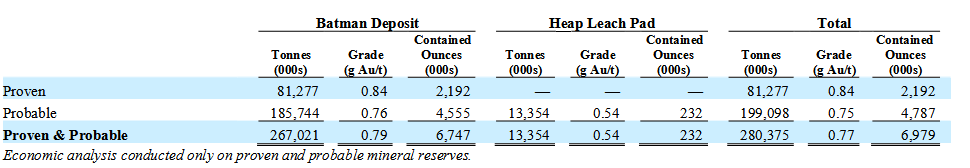

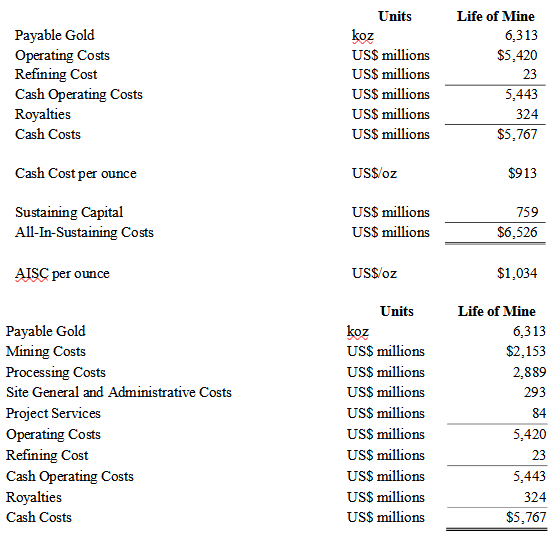

Technical Studies

For more information on the Company’s March 2024 feasibility study, including with respect to mineral resource and mineral reserve estimates, please refer to the technical report summary entitled “SK 1300 Technical Report Summary – Mt Todd Gold Project – 50,000 tpd Feasibility Study – Northern Territory, Australia” with an effective date of March 12, 2024 and an issue date of March 14, 2024 available at www.sec.gov and, for Canadian purposes, the technical report entitled “National Instrument 43-101 Technical Report – Mt Todd Gold Project – 50,000 tpd Feasibility Study – Northern Territory, Australia” with an effective date of March 12, 2024 and an issue date of April 16, 2024 under Vista’s profile at www.sedarplus.ca. For more information on the Company’s 2024 drilling results, please refer to the Company’s previous 2024 and 2025 drilling news releases available under the Company’s profile at www.sedarplus.ca.

Forward Looking Statements

This news release contains forward-looking statements within the meaning of the U.S. Securities Act of 1933, as amended, and U.S. Securities Exchange Act of 1934, as amended, and forward-looking information within the meaning of Canadian securities laws. All statements, other than statements of historical facts, included in this news release that address activities, events or developments that we expect or anticipate will or may occur in the future, including such things as the Company’s belief that its 2025 initiatives pave the way for value realization at Mt Todd; the Company’s belief that its key strategic focus in 2025 to complete the Mt Todd feasibility study will leverage results to deliver value to its shareholders; the Company’s belief that momentum continues to build in the gold sector and the capital markets are beginning to recognize the value of advanced-staged gold development projects; the Company’s belief that the lower cost, 15,000 tonne per day development strategy in this feasibility study will attract interest from a broad range of investors seeking ready-to-build gold projects like Mt Todd, ultimately unlocking significant value for the Company’s shareholders; the Company’s focus on its health and programs; the Company’s belief that completing the Mt Todd feasibility study is key to creating long-term value for the Company and its shareholders; the Company’s belief that the completion of the Mt Todd feasibility study represents a key deliverable in consolidating Mt Todd’s position as a leading development opportunity in the gold sector; the hope and expectation that the Mt Todd feasibility study will increase the reserve grade to 1 gram gold per tonne by applying a higher cut-off grade, while also reducing initial capex by 60% to $400 million; the expectation that the Mt Todd feasibility study targets average annual gold production ranging from 150,000 to 200,000 ounces from 15,000 tonnes per day ore throughput; the Company’s belief that by utilizing contract mining, third-party power generation, and established construction practices commonly used in Australia, there is opportunity to maintain high capital efficiency at this project scale, preserve the potential for future expansion, and deliver strong economic returns; the Company’s belief that the feasibility study is progressing as planned, with completion anticipated mid-2025; the Company’s strategy to efficiently advance Mt Todd in ways that demonstrate the underlying value of the project and position it for near-term development, while maintaining the discipline necessary to best realize value at the right time; the Company’s anticipation that the results of the Mt Todd feasibility study will be a catalyst to attract a broad range of investors seeking ready-to-build gold projects; the Company’s commitment to actively pursuing strategic transactions that maximize value for its shareholders; the Company’s analysis of the results of the 2024 and 2020-2022 drilling programs and its belief that it indicates potential to add to mineral resources and reserves; the Company’s plans to announce the new mineral resource estimate as part of the Mt Todd feasibility study; the Company’s commitment to advancing its Environmental, Social, and Governance initiatives; the inclusion of details of the Company’s goals and achievements in the Company’s upcoming annual ESG report, expected to be published in the coming weeks; the Company’s belief that Mt Todd is a ready-to-build development-stage gold deposit and that the Northern Territory, Australia is a Tier-1 jurisdiction; the Company’s belief that Mt Todd offers significant scale, development optionality, growth opportunities, advanced local infrastructure, community support, and demonstrated economic feasibility; statements related to the Company’s strategy, including the Company’s strategy is to advance Mt Todd in ways that efficiently position the project for development while exercising the discipline necessary to best realize value at the right time and the Company’s belief that its strategy of advancing Mt Todd in this matter will deliver a more fully valued project to its shareholders are forward-looking statements and forward-looking information. The material factors and assumptions used to develop the forward-looking statements and forward-looking information contained in this news release include the following: the Company’s forecasts and expected cash flows; the Company’s projected capital and operating costs; the Company’s expectations regarding mining and metallurgical recoveries; mine life and production rates; that laws or regulations impacting mine development or mining activities will remain consistent; the Company’s approved business plans, mineral resource and reserve estimates and results of preliminary economic assessments; preliminary feasibility studies and feasibility studies on the Company’s projects, if any; the Company’s experience with regulators; political and social support of the mining industry in Australia; the Company’s experience and knowledge of the Australian mining industry and the Company’s expectations of economic conditions and the price of gold. When used in this news release, the words “optimistic,” “potential,” “indicate,” “expect,” “intend,” “hopes,” “believe,” “may,” “will,” “if,” “anticipate” and similar expressions are intended to identify forward-looking statements and forward-looking information. These statements involve known and unknown risks, uncertainties and other factors which may cause the actual results, performance or achievements of the Company to be materially different from any future results, performance or achievements expressed or implied by such statements. Such factors include, among others, uncertainty of resource and reserve estimates, uncertainty as to the Company’s future operating costs and ability to raise capital; risks relating to cost increases for capital and operating costs; risks of shortages and fluctuating costs of equipment or supplies; risks relating to fluctuations in the price of gold; the inherently hazardous nature of mining-related activities; potential effects on the Company’s operations of environmental regulations in the countries in which it operates; risks due to legal proceedings; risks relating to political and economic instability in certain countries in which it operates; uncertainty as to the results of bulk metallurgical test work; and uncertainty as to completion of critical milestones for Mt Todd; as well as those factors discussed under the headings “Note Regarding Forward-Looking Statements” and “Risk Factors” in the Company’s latest Annual Report on Form 10-K as filed in March 2024, and other documents filed with the U.S. Securities and Exchange Commission and Canadian securities regulatory authorities. Although the Company has attempted to identify important factors that could cause actual results to differ materially from those described in forward-looking statements and forward-looking information, there may be other factors that cause results not to be as anticipated, estimated or intended. Except as required by law, the Company assumes no obligation to publicly update any forward-looking statements or forward-looking information whether as a result of new information, future events or otherwise.

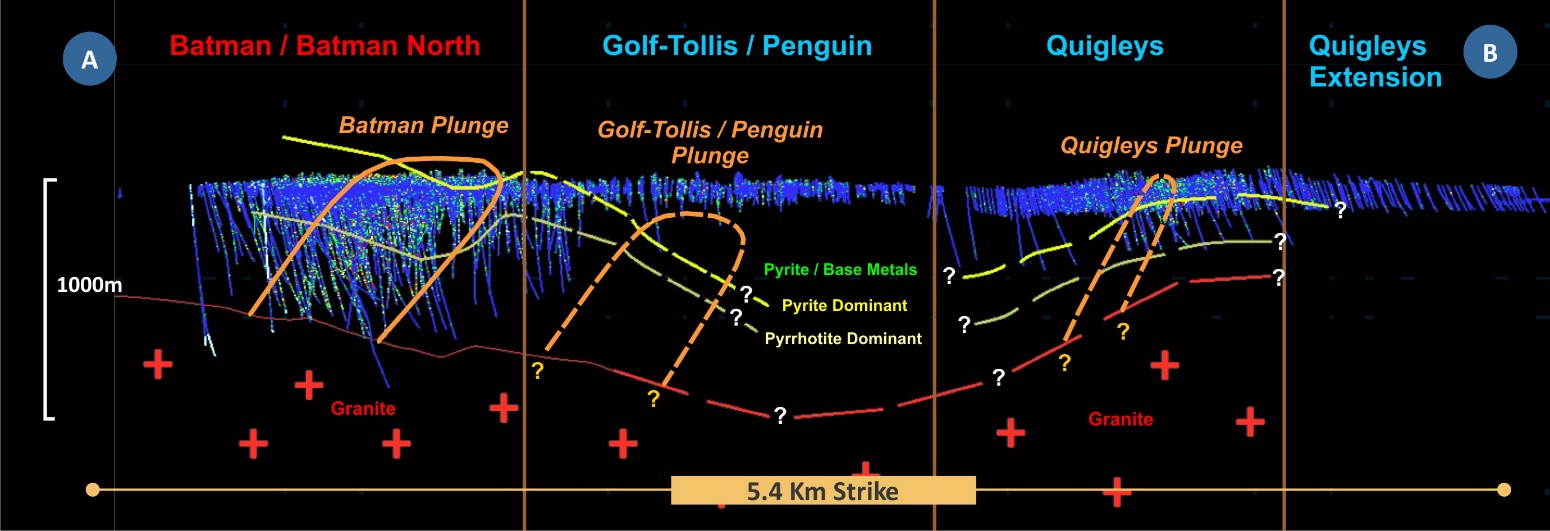

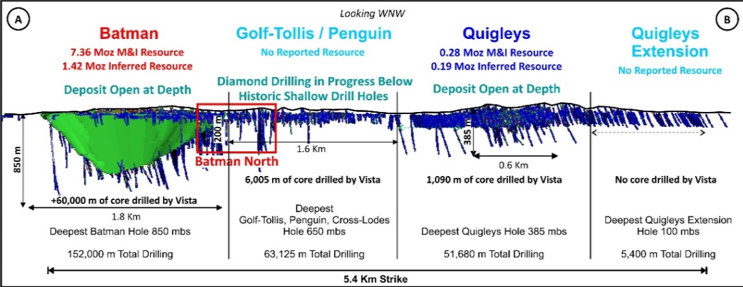

Vista Gold 2024 Drilling Demonstrated Potential to Increase Mt Todd Mineral Reserves

Denver, Colorado, February 4, 2025 – Vista Gold Corp. (NYSE American and TSX: VGZ) announced that the results of its 2024 Mt Todd drilling program indicate the potential to increase gold mineral reserves in the Batman deposit and have successfully delineated the South Cross Lode (“SXL”) over a 400 meter strike length. These drill results, and those from the 2020-2022 drilling program, will be included in the block model for the updated Mt Todd mineral resources estimate and new feasibility study.

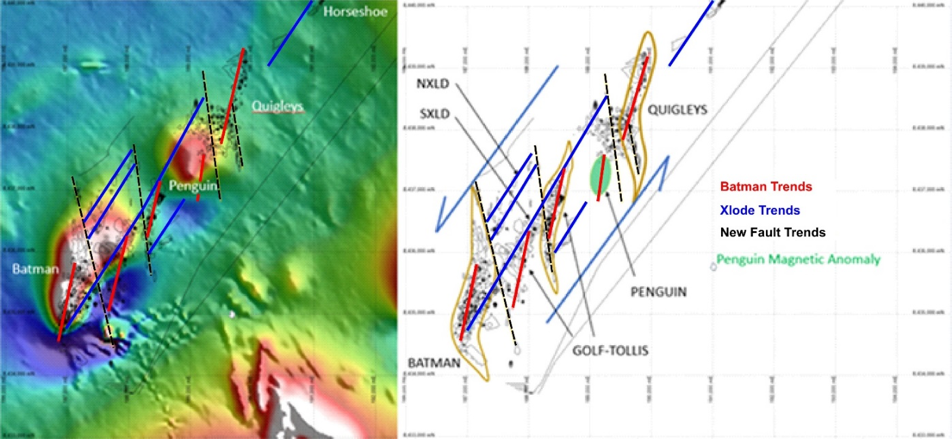

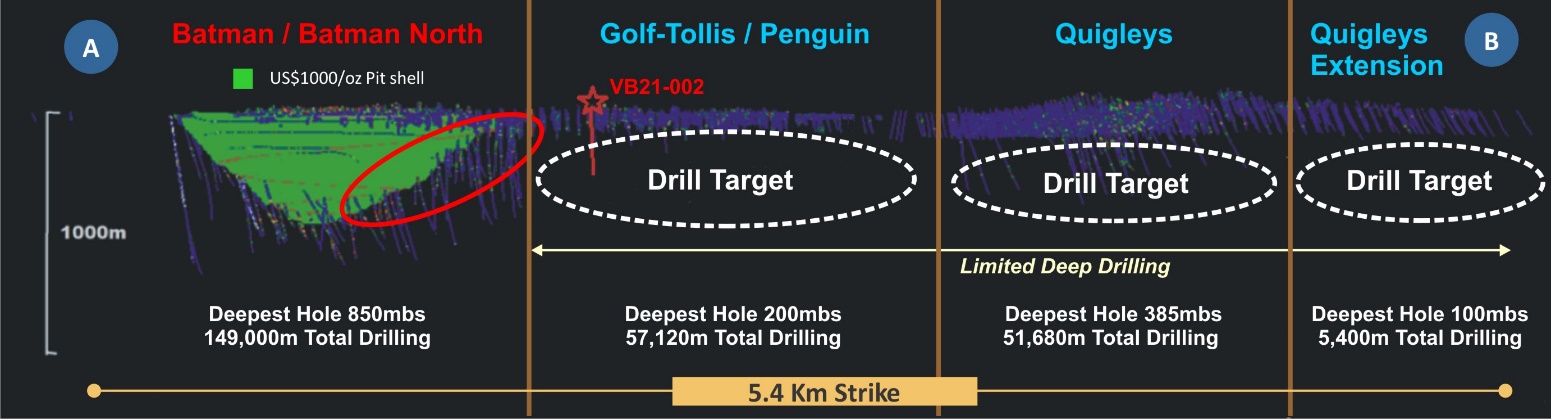

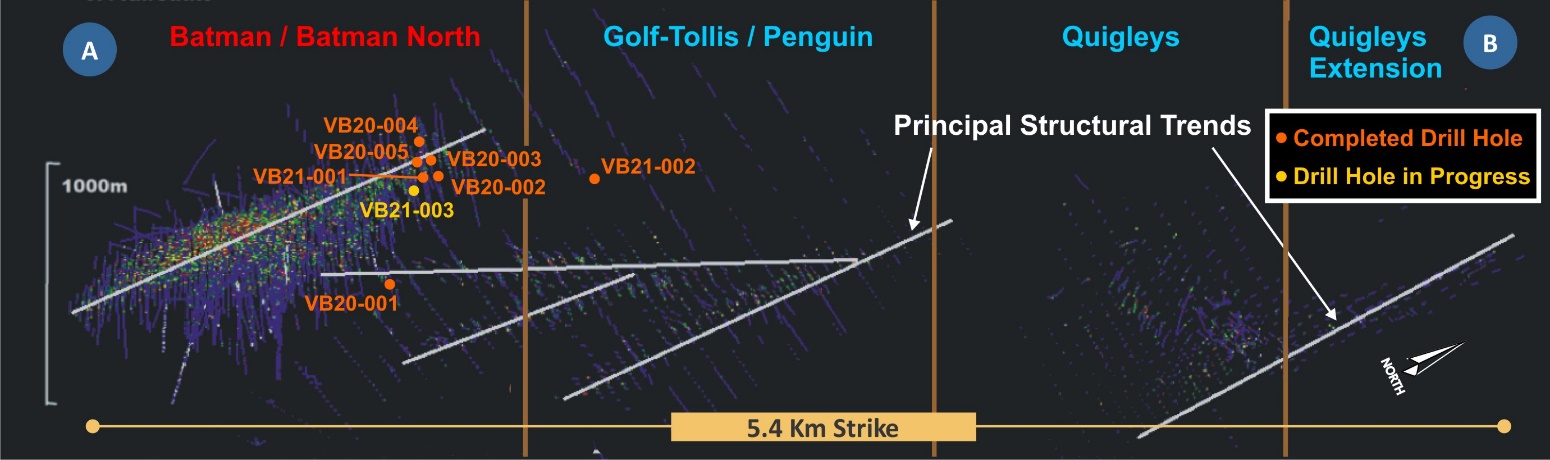

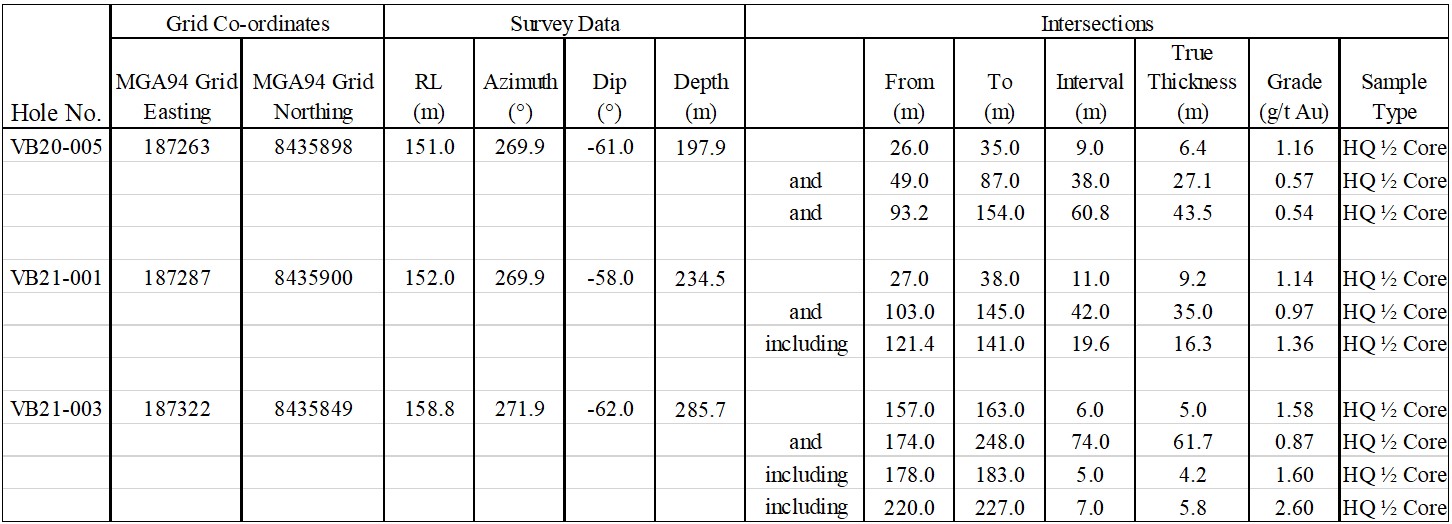

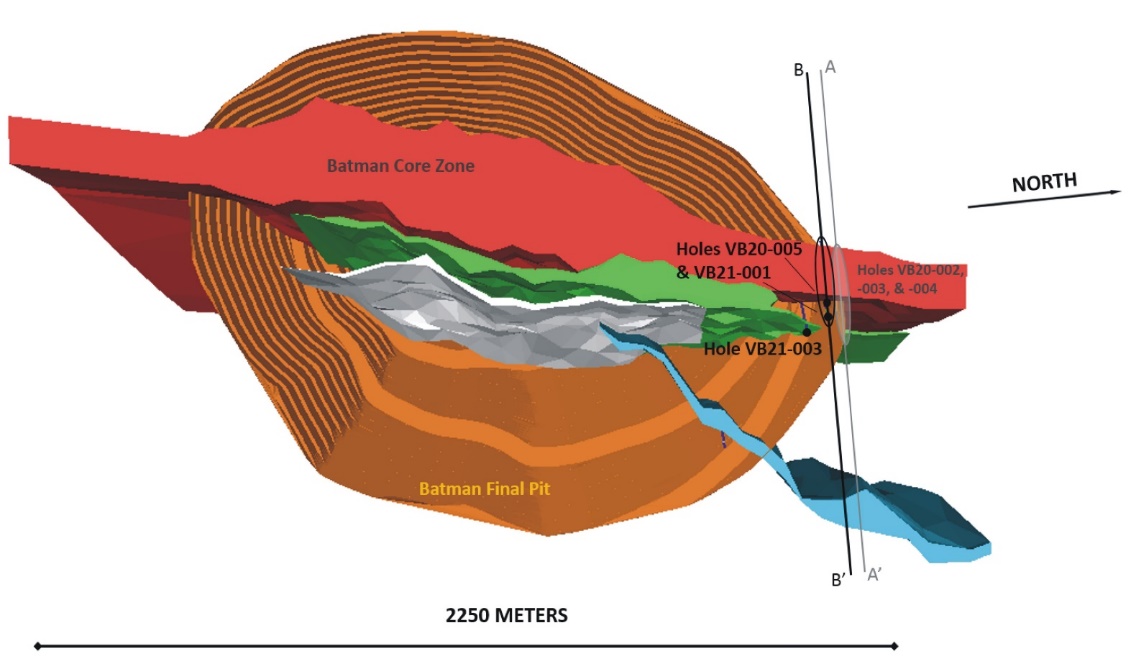

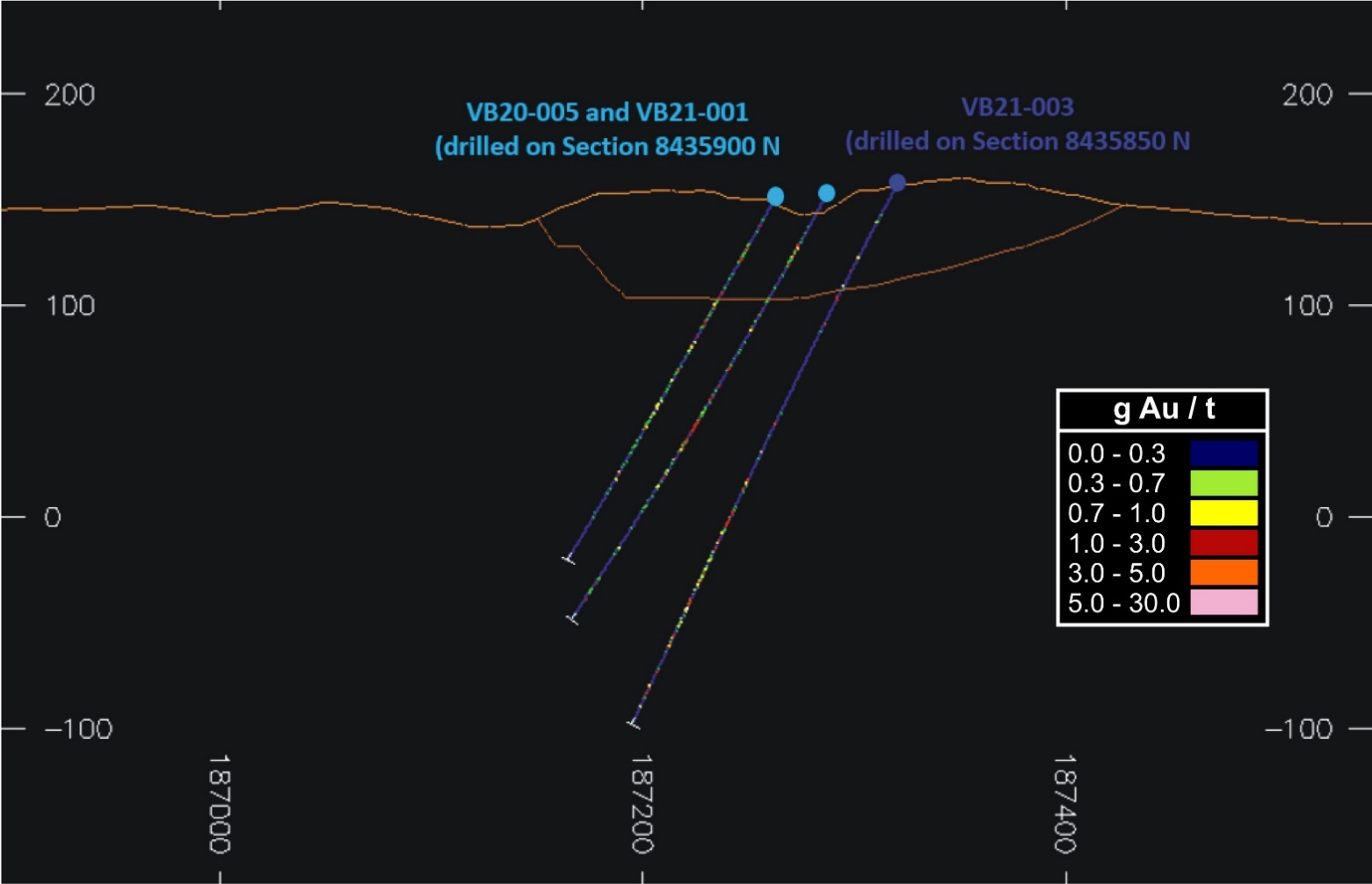

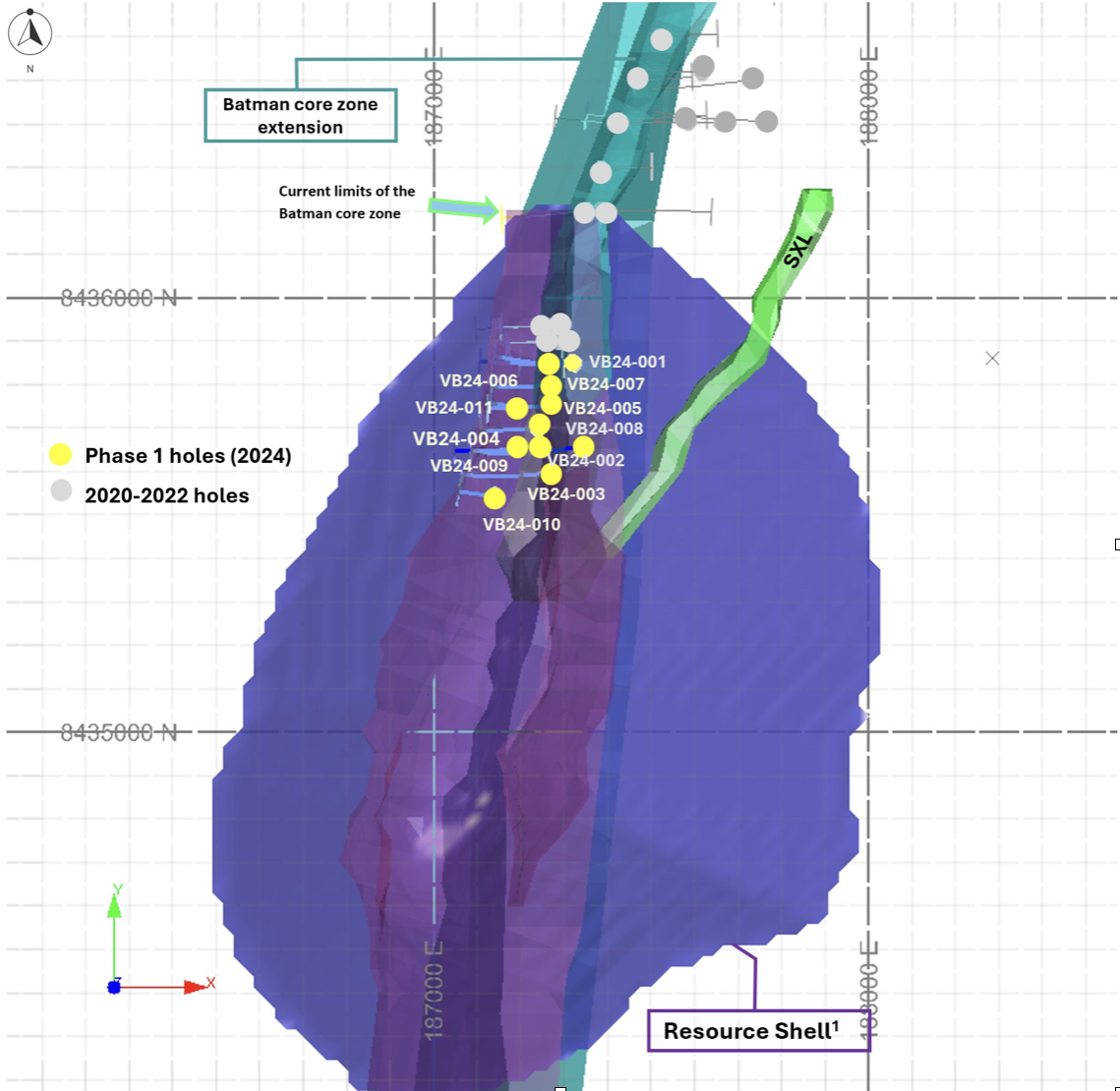

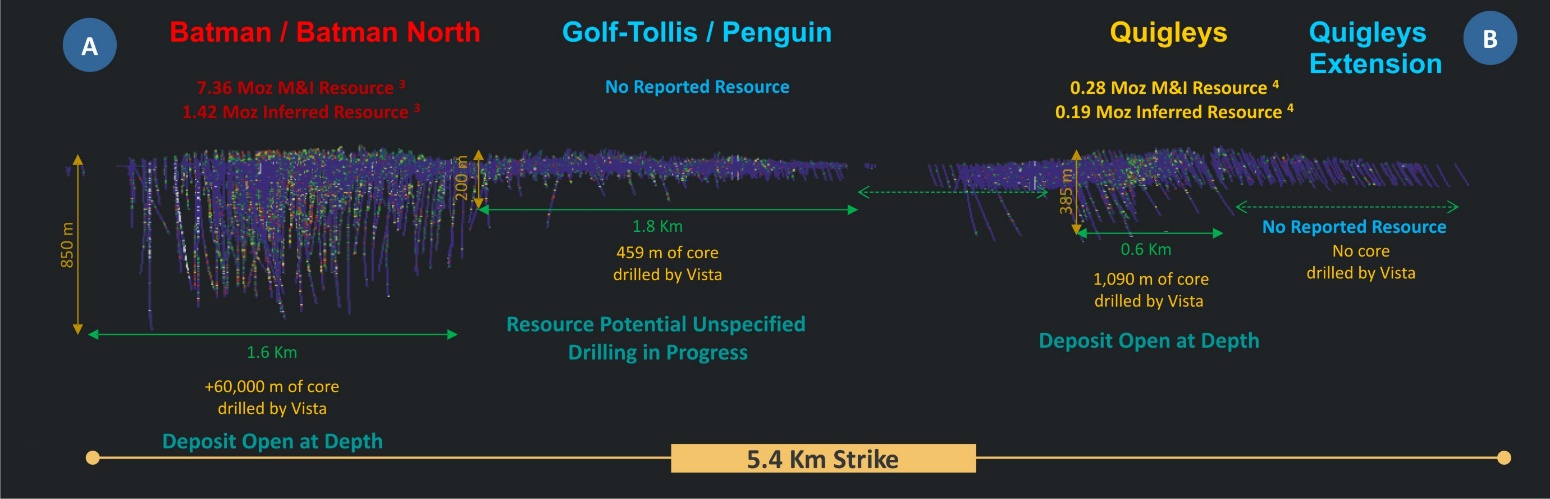

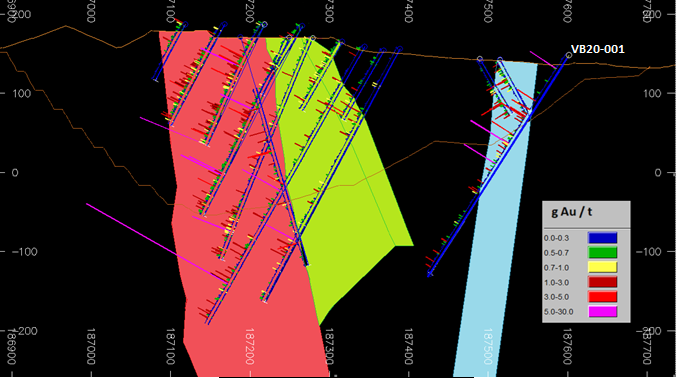

Phase 1 drilling, in conjunction with the 2020-2022 drilling program, provided information to extend the boundaries of the mineralization in the northern section of the Batman deposit. As shown in Figures 2, 3, and 4, drilling intercepted gold grades higher than estimated in the current block model and mineralization outside the limits of the current resource envelope. These results provide a basis to increase gold mineral resources in the area of the Batman deposit and convert a portion of the current mineral resources in this area into proven and probable mineral reserves.

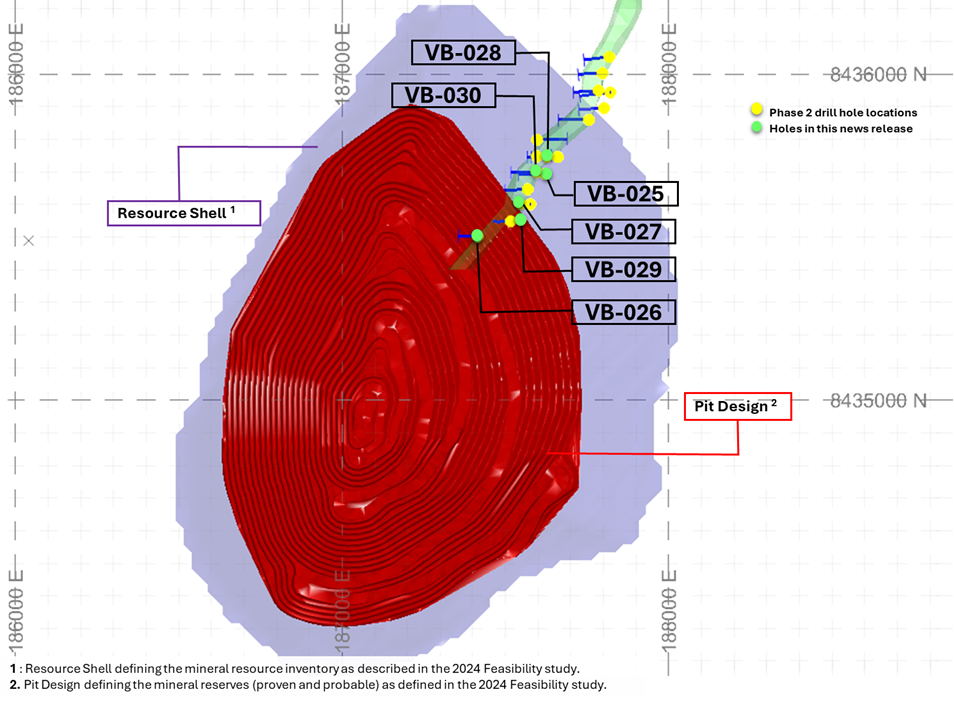

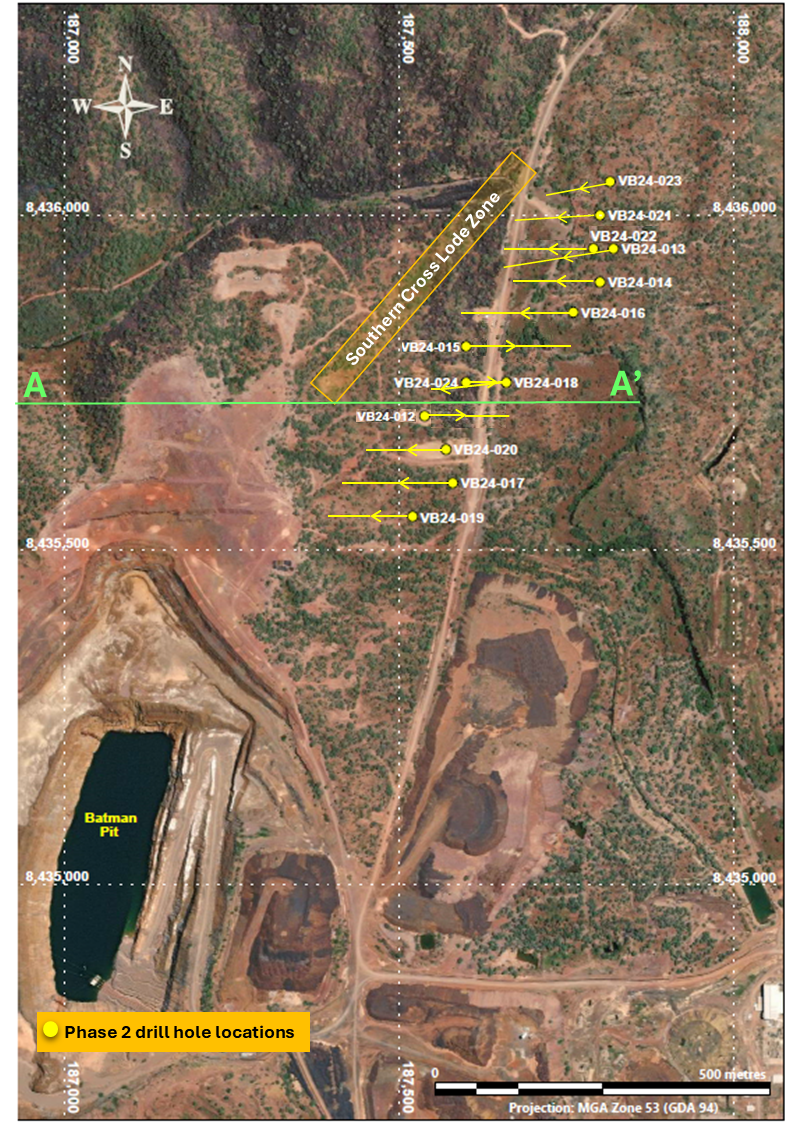

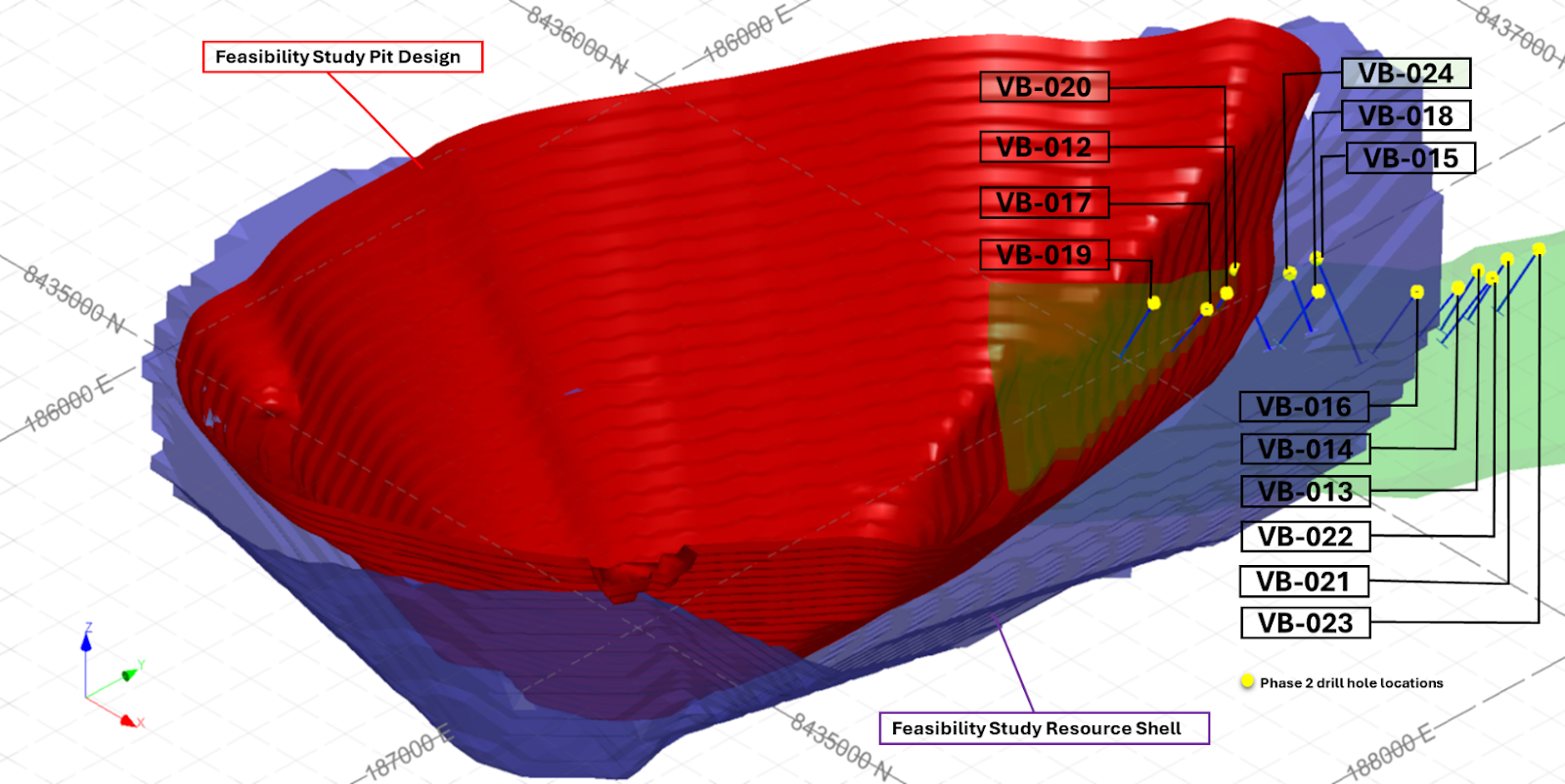

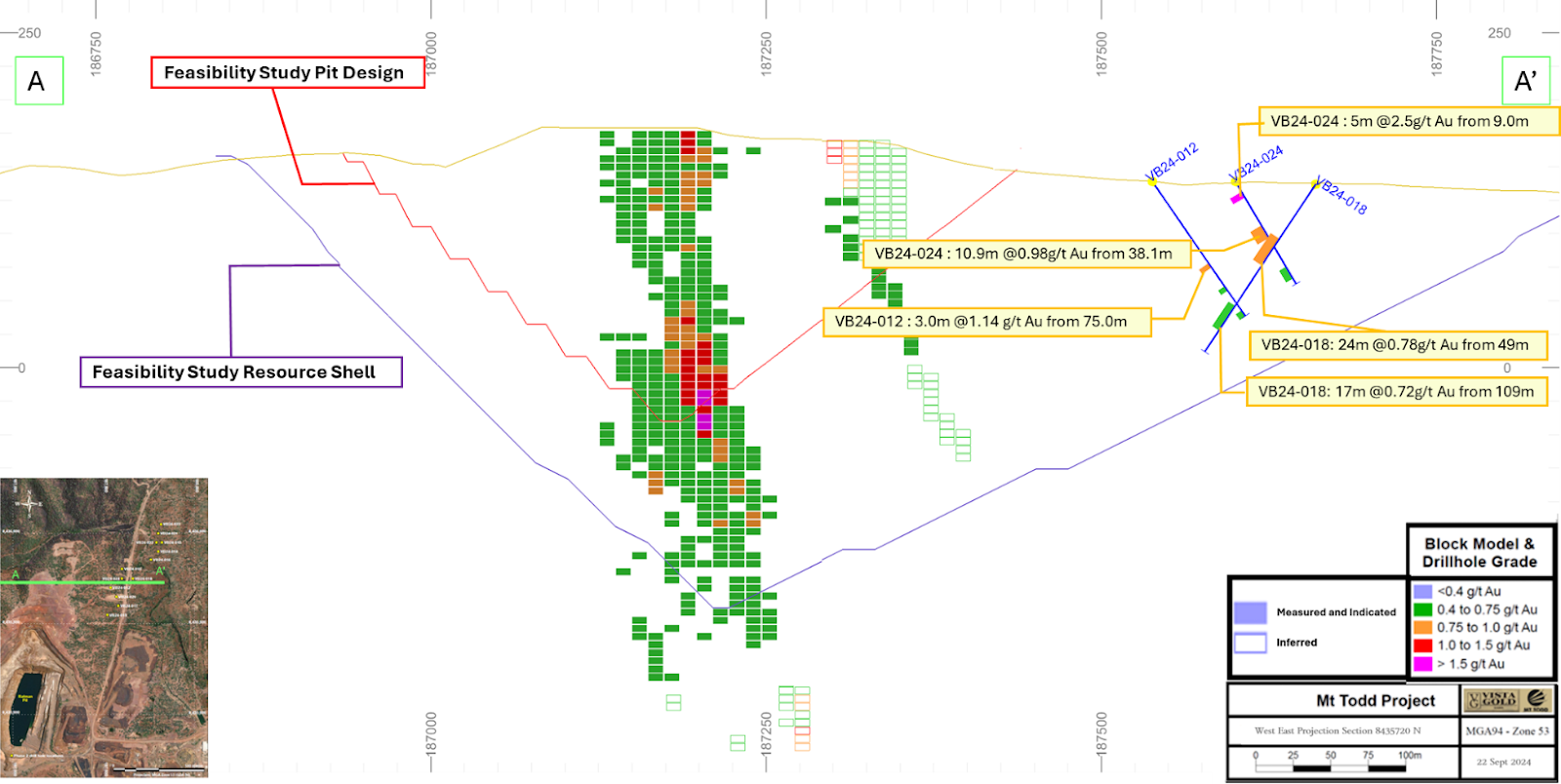

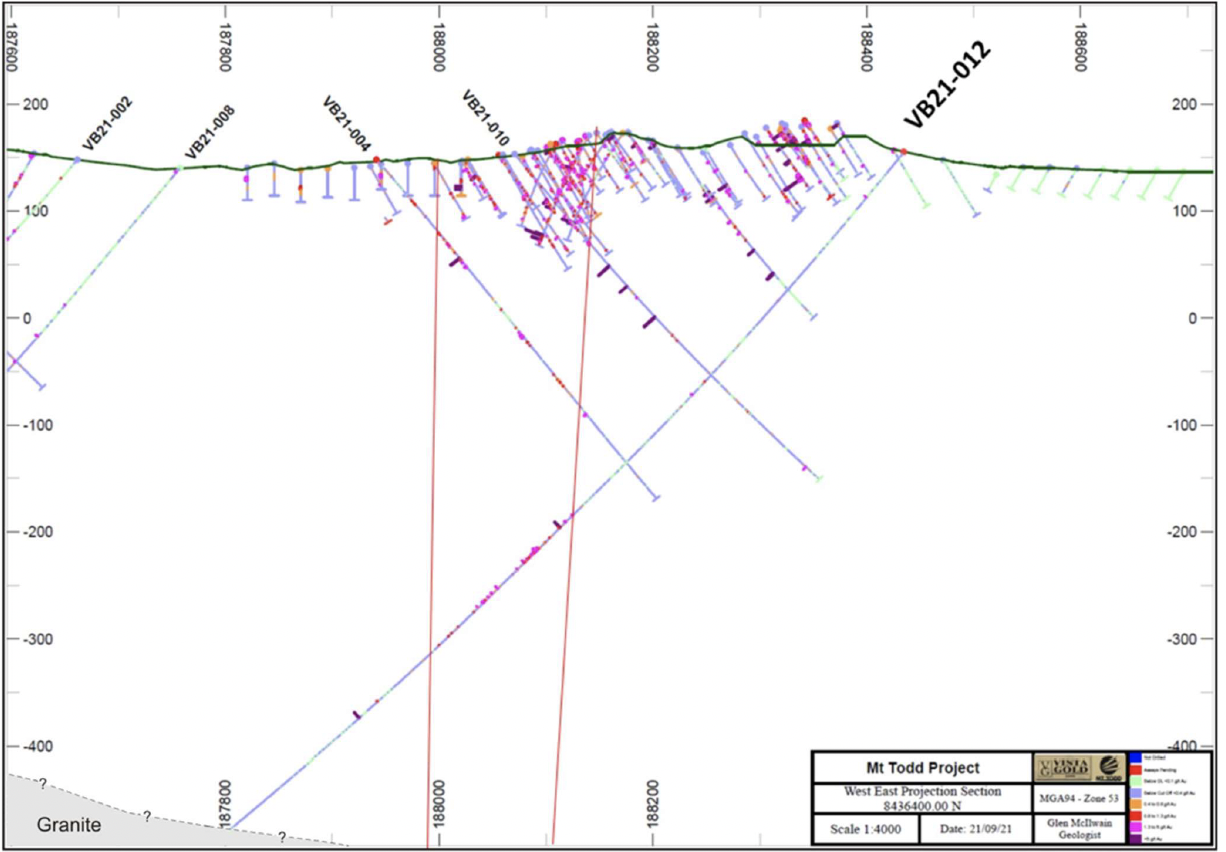

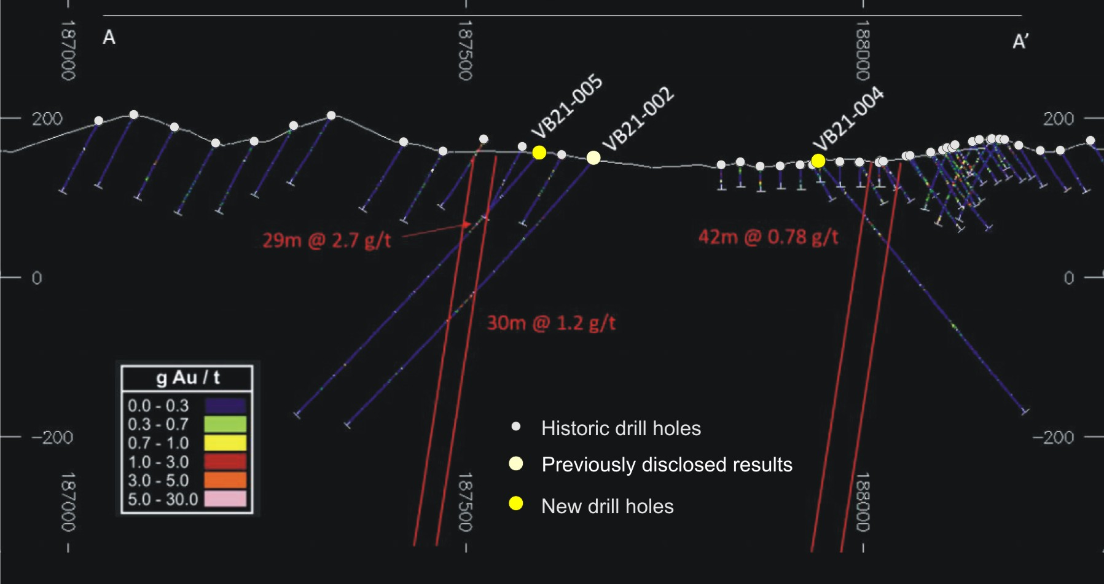

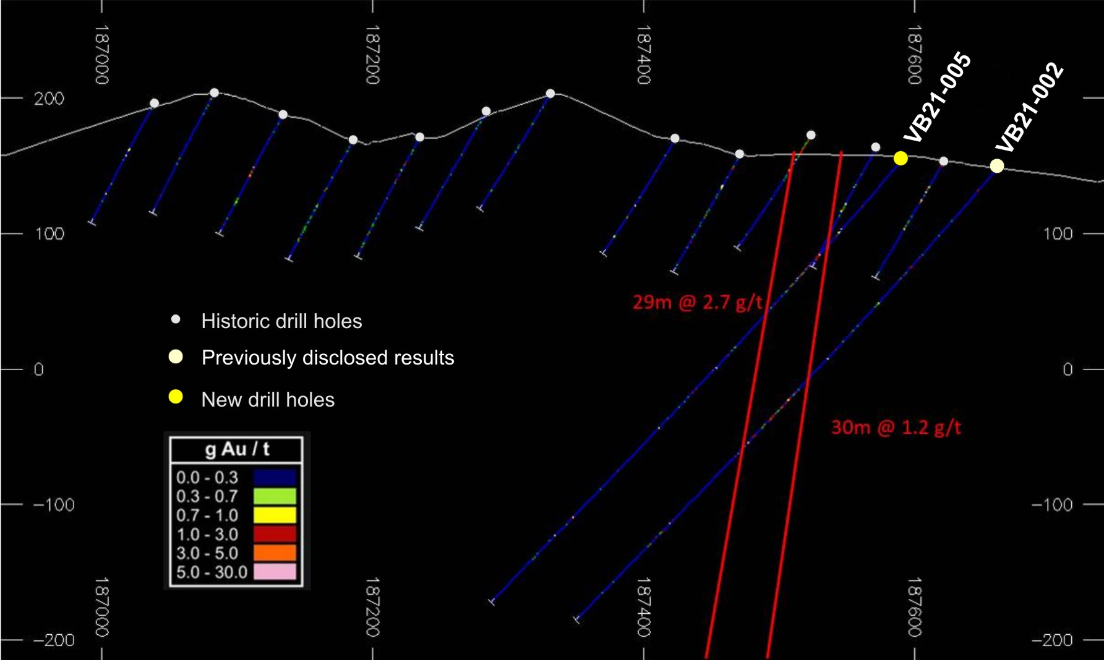

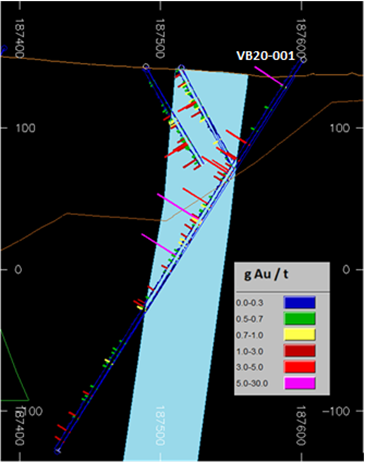

Phase 2 drilling defined the mineralized boundaries of the SXL over the strike length drilled and intersected high-grade sub-structures in the lower portion of thirteen holes, as shown in Figure 5. Additionally, the drill hole spacings are acceptable for the definition of measured and indicated mineral resources. Given the location of the SXL, these drilling results are expected to support the expansion of the mineral resource shell, with the potential to increase gold mineral reserves.

Frederick H. Earnest, President and CEO of Vista, stated, “The results of our 2024 Mt Todd drill program are encouraging. We drilled 34 diamond core holes totaling 6,776 meters and every hole intercepted mineralization, with many holes in Phase 1 encountering higher grades than estimated in the current block model. The results indicate potential to upgrade previously defined mineral resources to mineral reserves and add new mineral resources from an extension to the Batman core zone. We believe we successfully accomplished the objectives of Phase 1 of the drill program.

“The Phase 2 drilling results provide us with a much better understanding of the mineralization in the South Cross Lode. We encountered sheeted-vein mineralization consistent with the Batman deposit in the upper portions of the holes and regularly intersected more distinct, wider, and in many instances, higher grade veins deeper in the drill holes. The discovery of higher-grade and wider veins in the South Cross Lode is exciting and something that we believe merits more analysis.”

Mr. Earnest concluded, “The results from the 2024 and 2020-2022 drilling programs are expected to be included in the mineral resource block model that is currently being completed as part of the recently announced Mt Todd feasibility study. Our analysis of the results of these drilling programs indicates potential to convert mineral resources to mineral reserves at the Mt Todd gold project. The new mineral resource estimate is anticipated to be announced as part of the Mt Todd feasibility study, scheduled for completion mid-2025.”

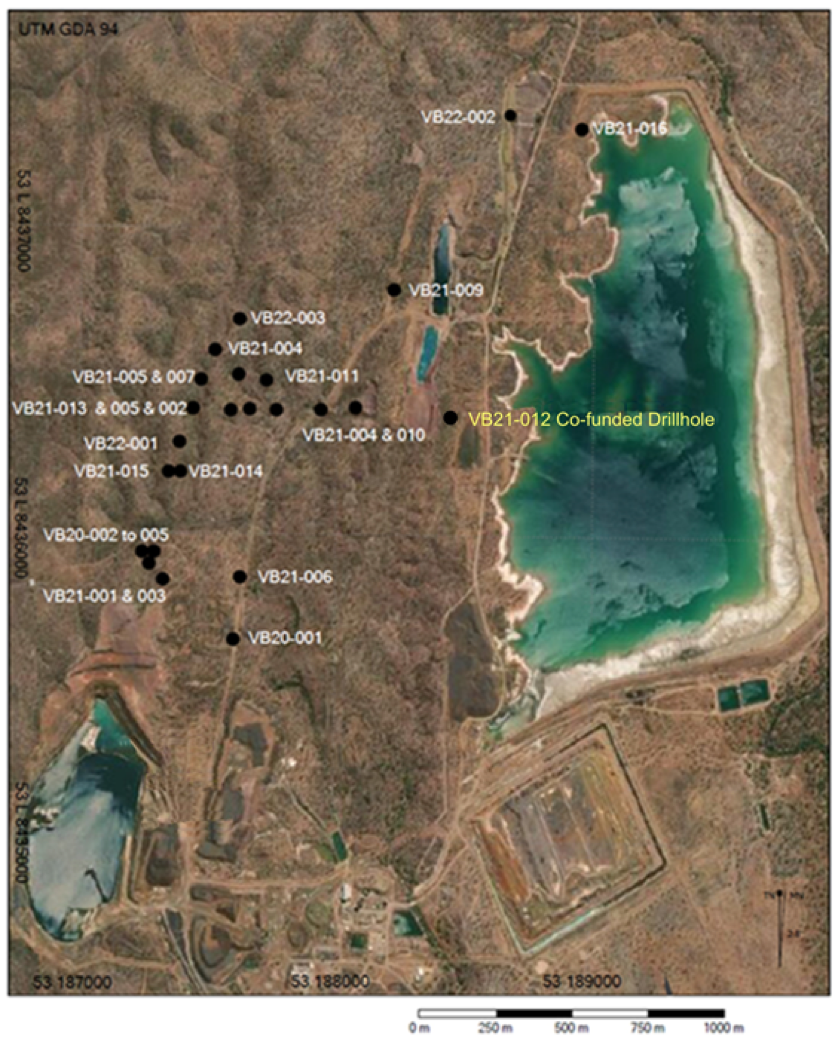

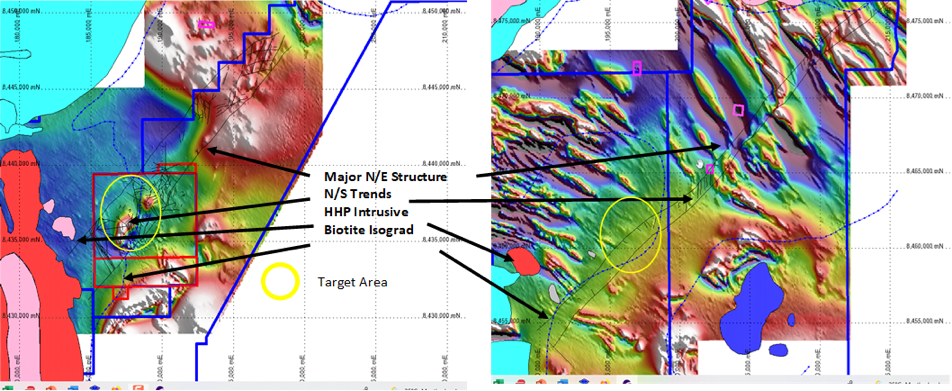

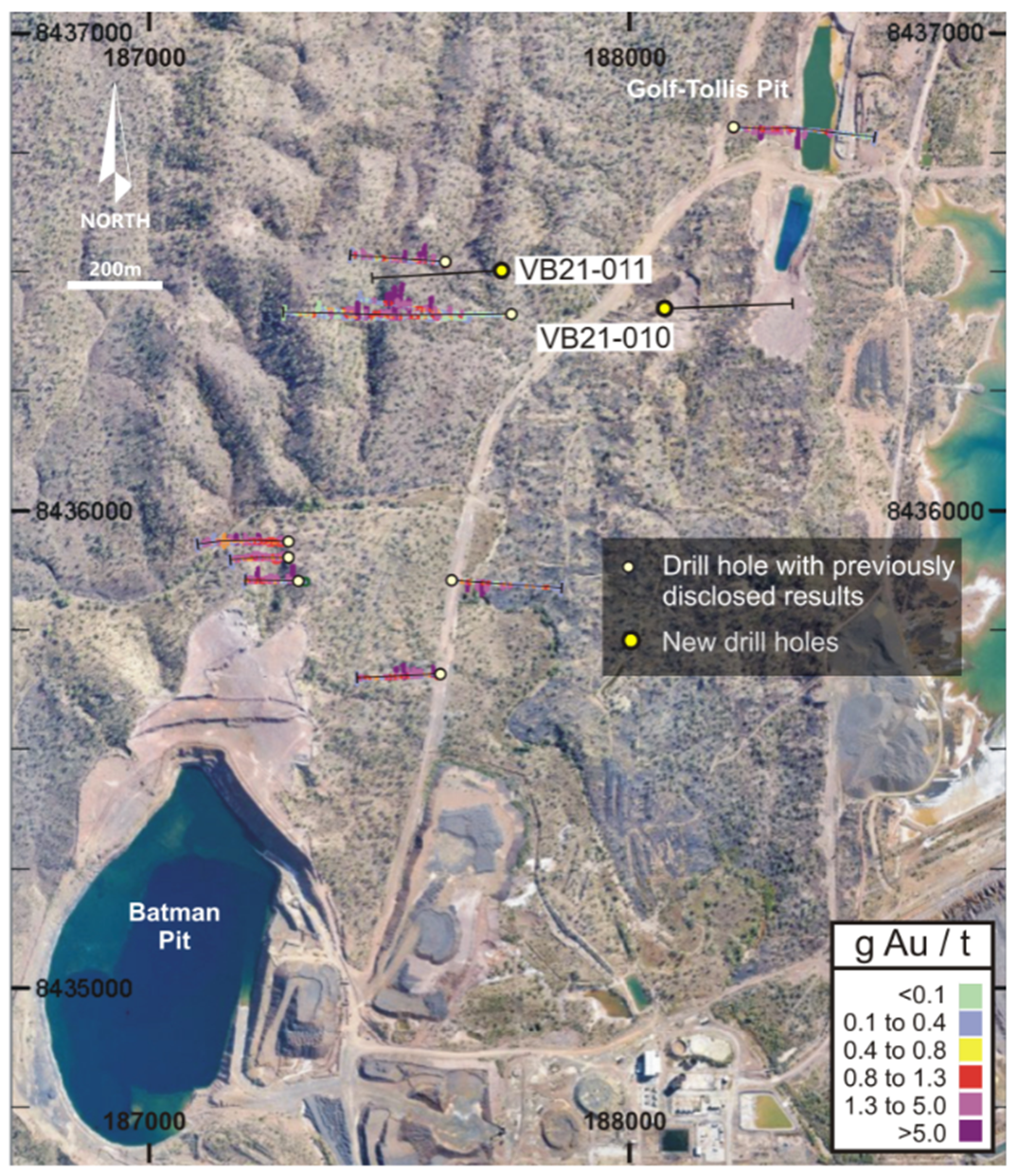

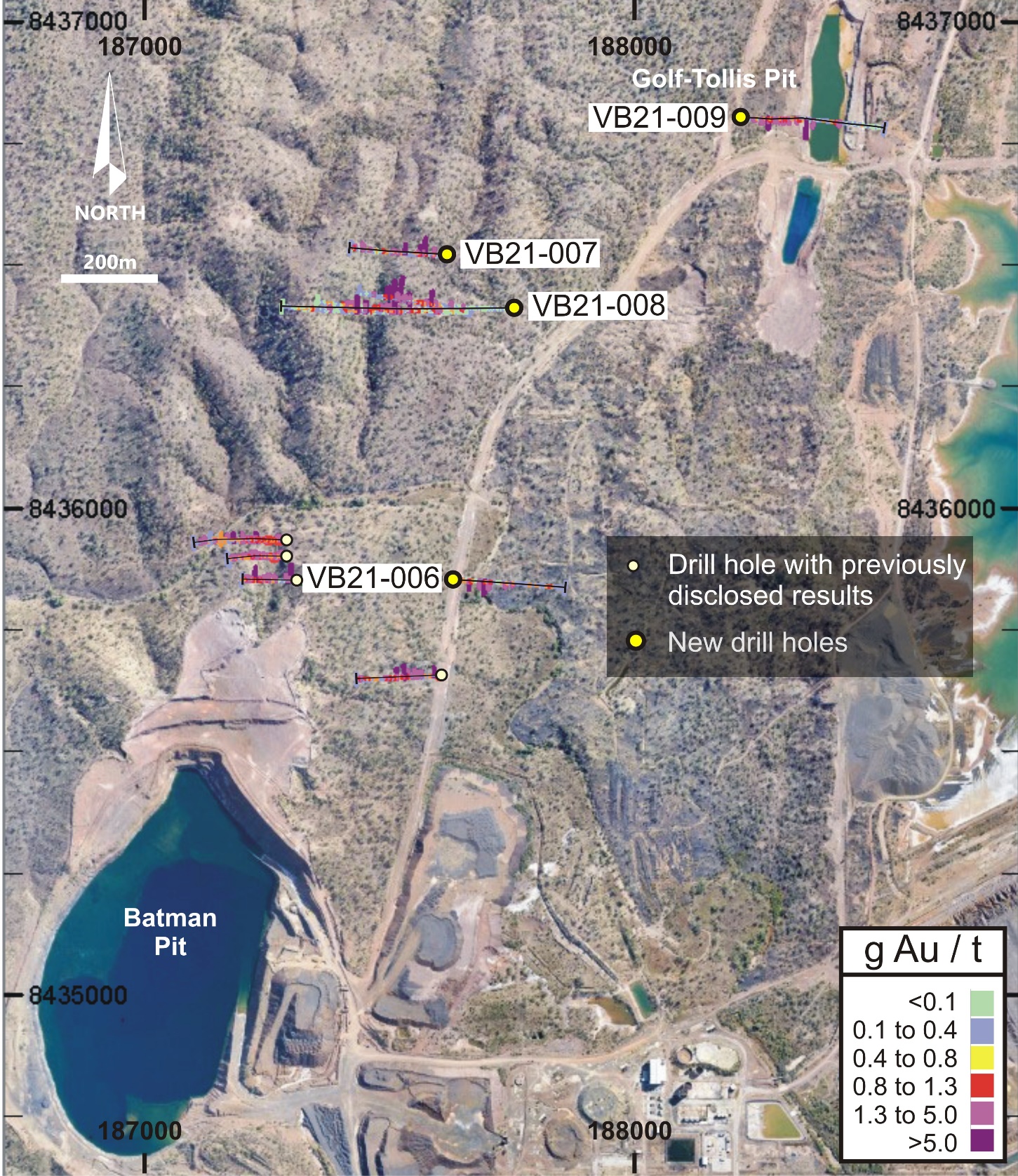

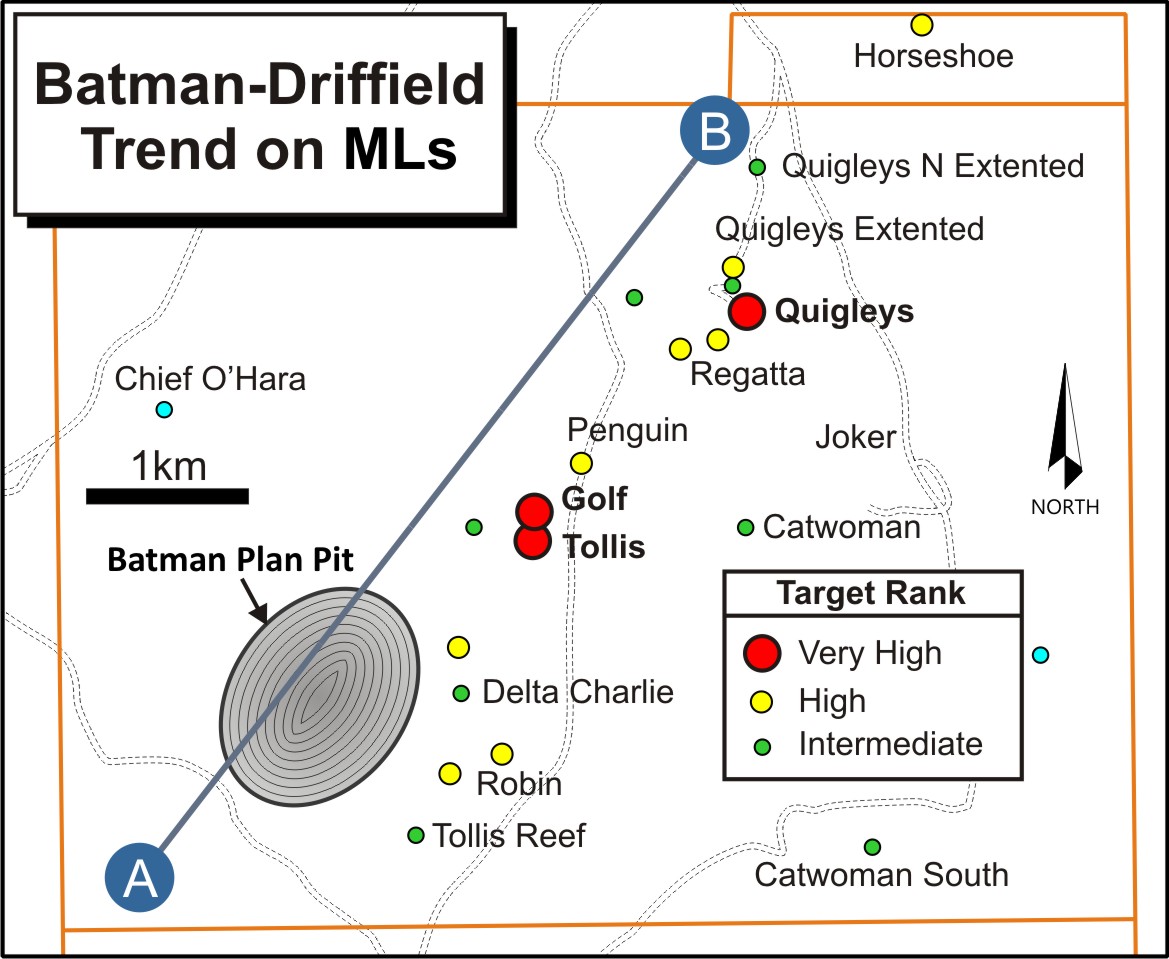

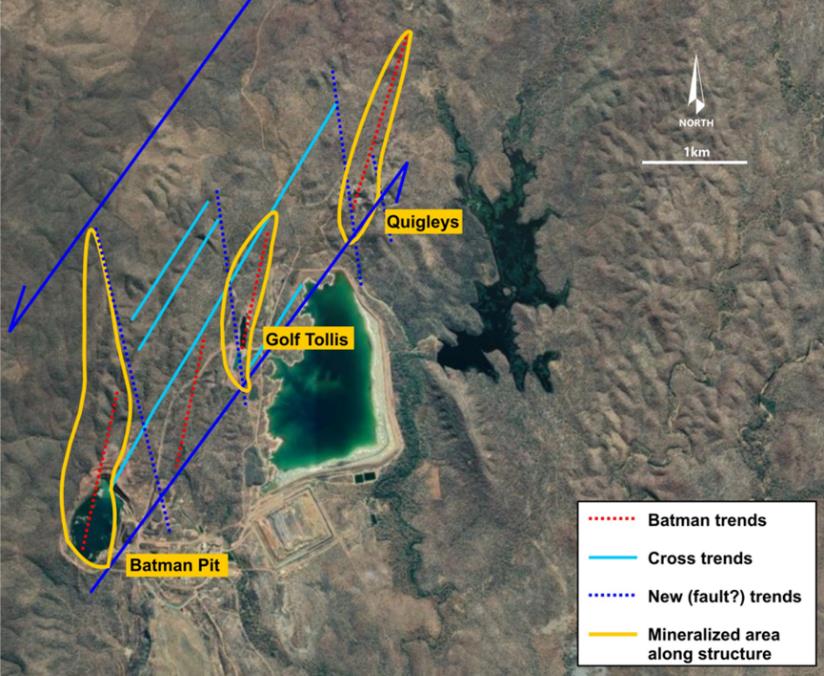

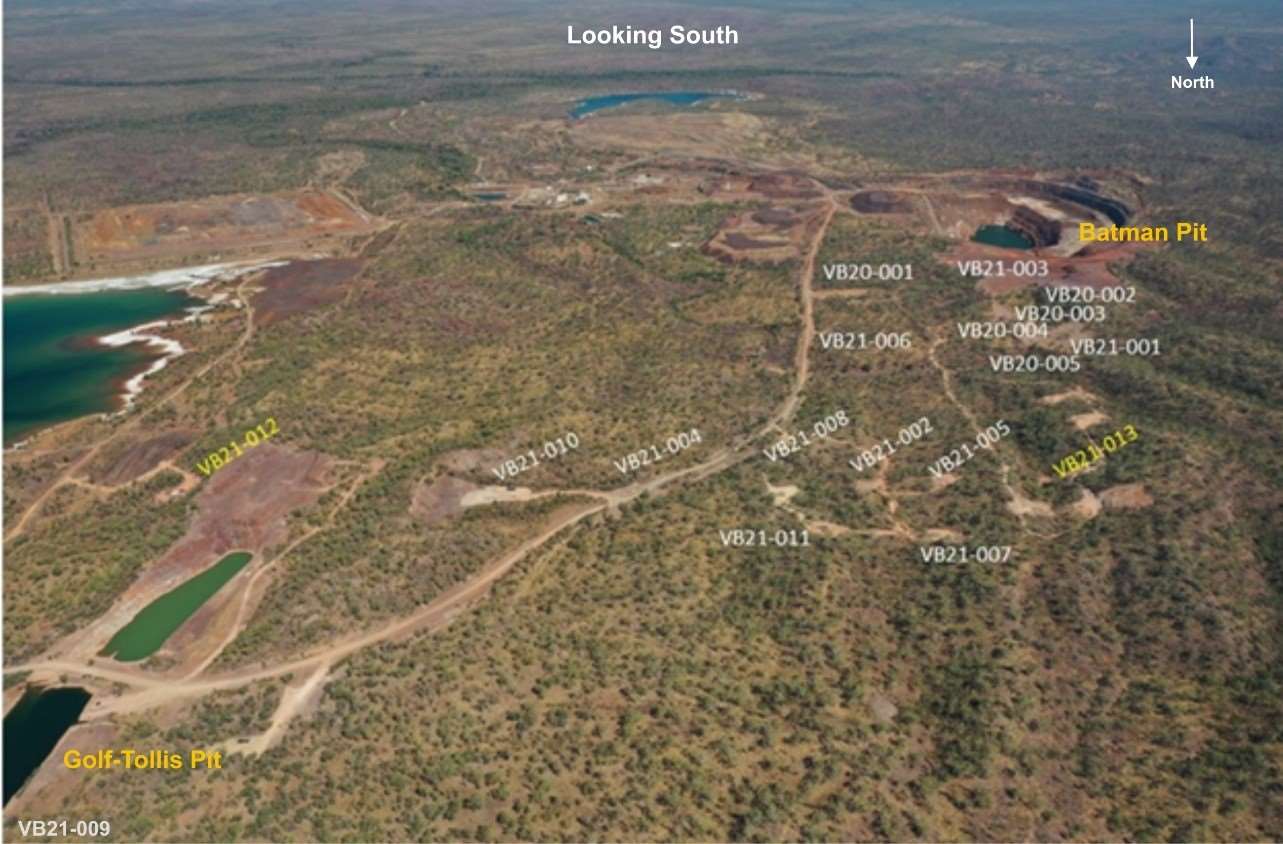

Overview

Phase 1

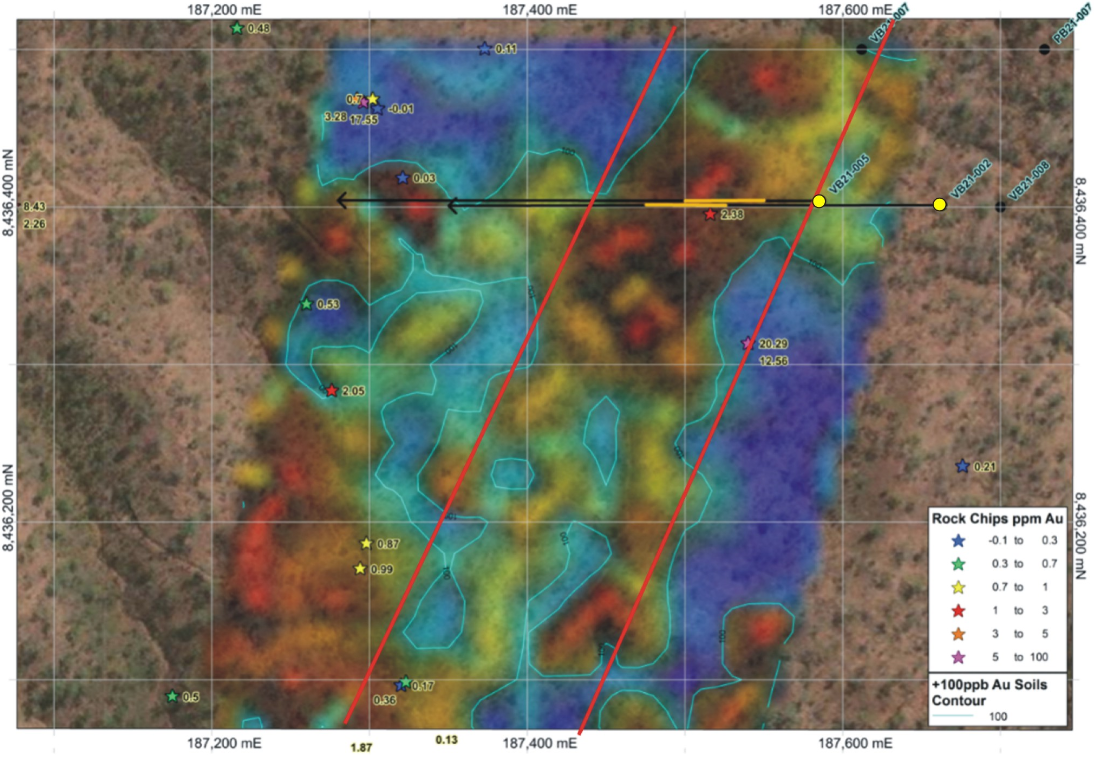

The Phase 1 drilling was designed to augment historical data from reverse circulation (“RC”) drilling and to generally improve the quality of geologic data in the northern part of the Batman deposit. The augmentation was completed through core drilling in the area just south of where drilling was completed in 2020-2022. Figure 1 shows the location of the Phase 1 and relevant 2020-2022 drill holes. The combined results of these drilling programs provide better definition of the mineralized boundaries, continuity, and limits in the north portion of the Batman deposit.

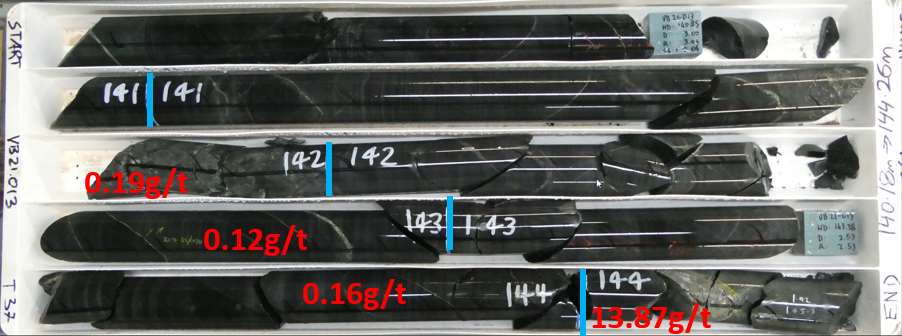

During Phase 1, a total of 11 holes were drilled in the northern end of the Batman deposit including several holes drilled outside the limits of blocks defined in the current mineral resource model. All of the holes were collared within the limits of the pit design for the 2024 Feasibility Study (as defined below). Some holes exceeded our expectations in terms of the length of mineralized intercepts and gold grade, with many intercepts having returned gold grades that exceeded block model values in the current mineral resource model. This has occurred in the past as we have replaced RC drilling data with core drilling data and further demonstrates potential to increase gold mineral reserves in the Batman deposit. See Figures 2, 3, and 4.

Phase 1 drilling is expected to result in an increase in mineral resources in the north end of the Batman deposit. Additionally, we expect this drilling to result in the conversion of inferred mineral resources to measured and indicated mineral resources within the 2024 Feasibility Study pit design. This provides further confidence that mineral reserves will be increased.

The geological characteristics observed in these holes are consistent with the rest of the Batman deposit. While we believe that the metallurgical characteristics of material in the north extension will be very similar to the rest of the Batman deposit, metallurgical testing on samples from this phase of drilling is in progress.

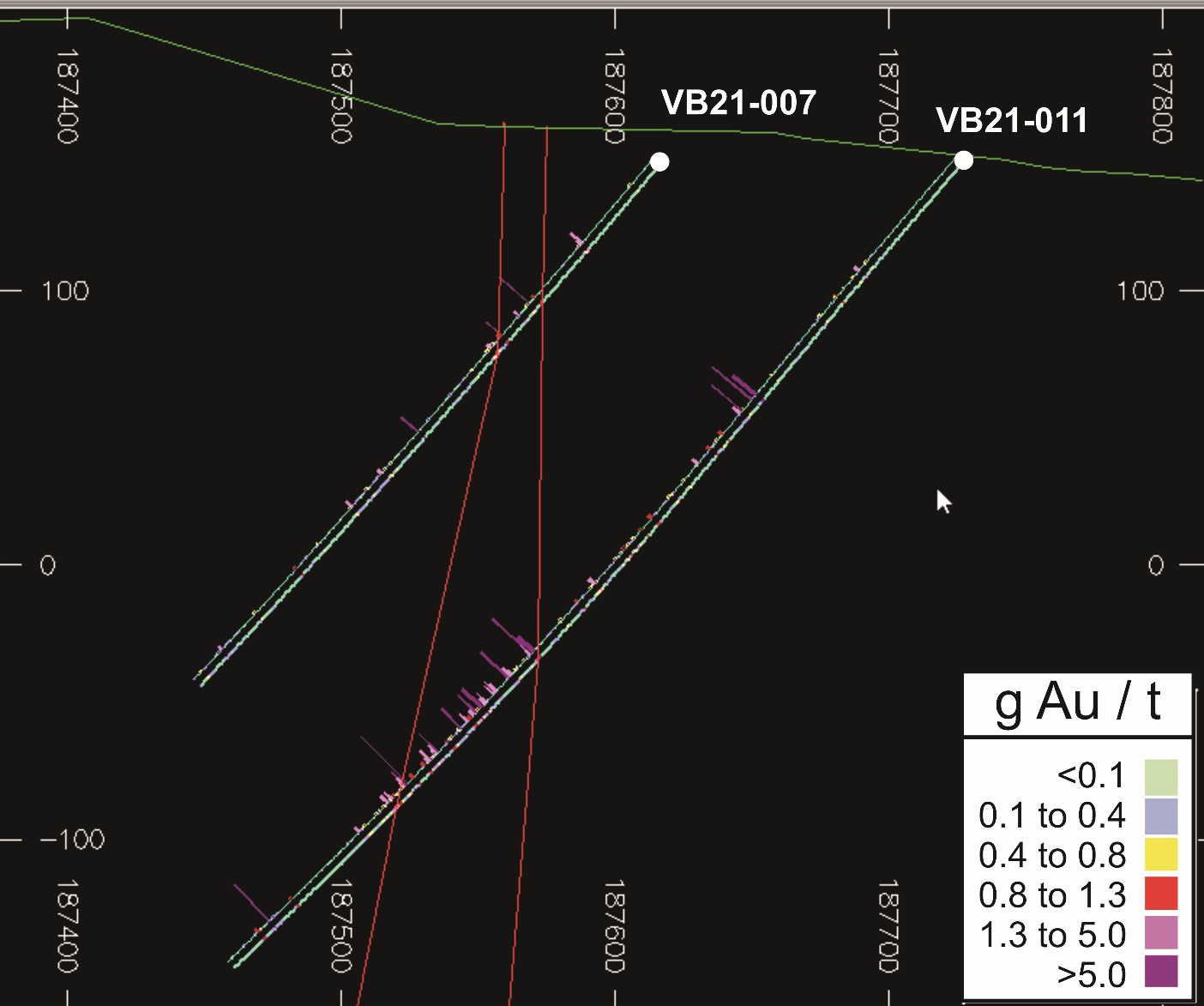

Phase 2

Phase 2 drilling focused on the SXL, a narrower mineralized structure adjacent to the Batman deposit, with a defined strike length of over 400 meters. The 23 holes in Phase 2 delineated the SXL mineralization identified in the data from historical RC drilling holes. The data collected from this drilling define the mineralized boundaries of the SXL structure and demonstrate the potential to increase Mt Todd mineral resources. Phase 2 drilling was conducted with adequate density and spacing to define a portion of the expected increase as measured and indicated mineral resources. Hence, we anticipate that some shallower areas may be included in mineral reserves for the 2025 feasibility study.

The drilling results revealed that the SXL is host to more discreet and, in certain zones, wider high-grade veins with thicknesses that exceed one meter, compared to the thinner, more closely spaced sheeted veins typically observed in the Batman deposit. While we anticipate that the SXL material will be amenable to processing using the same flowsheet as the ore from the Batman deposit, metallurgical testing on samples from the SXL is currently in progress.

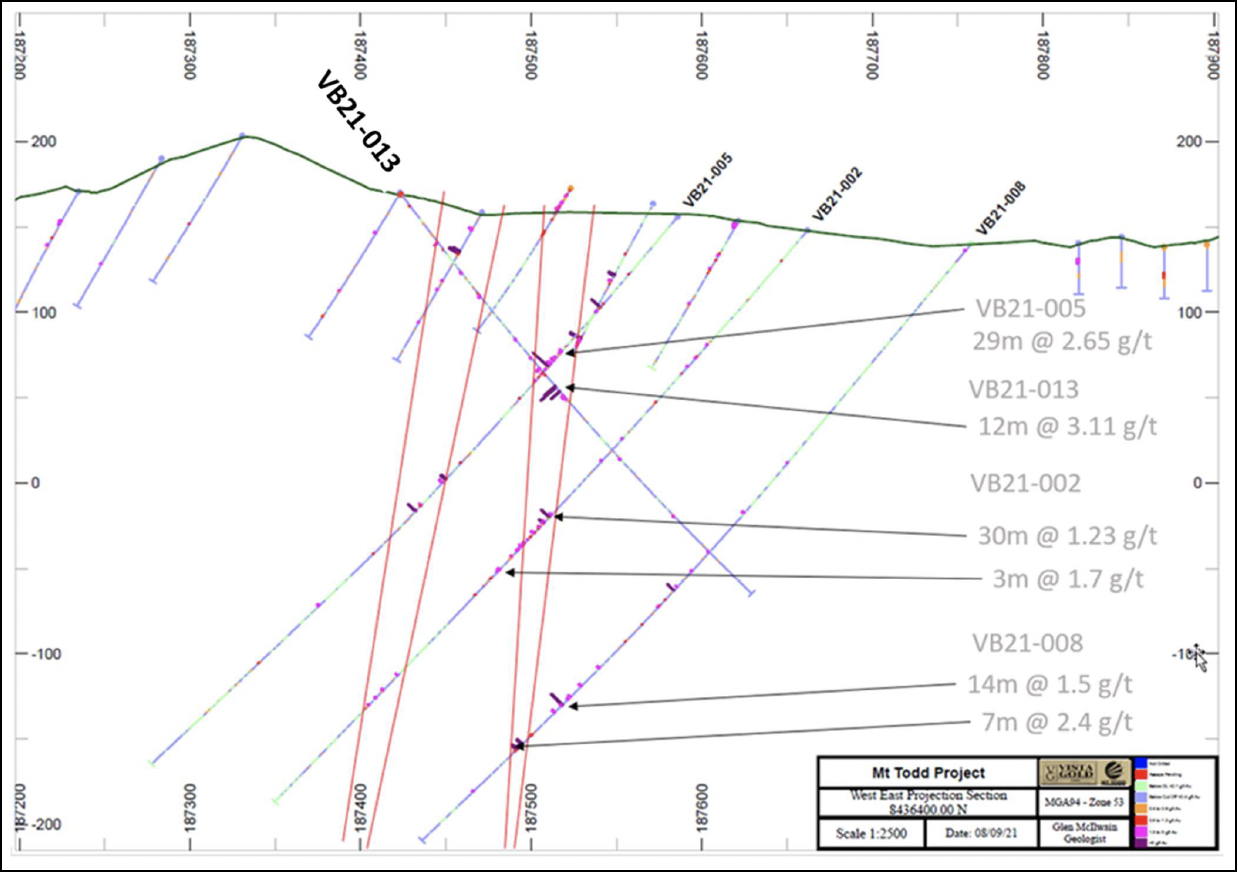

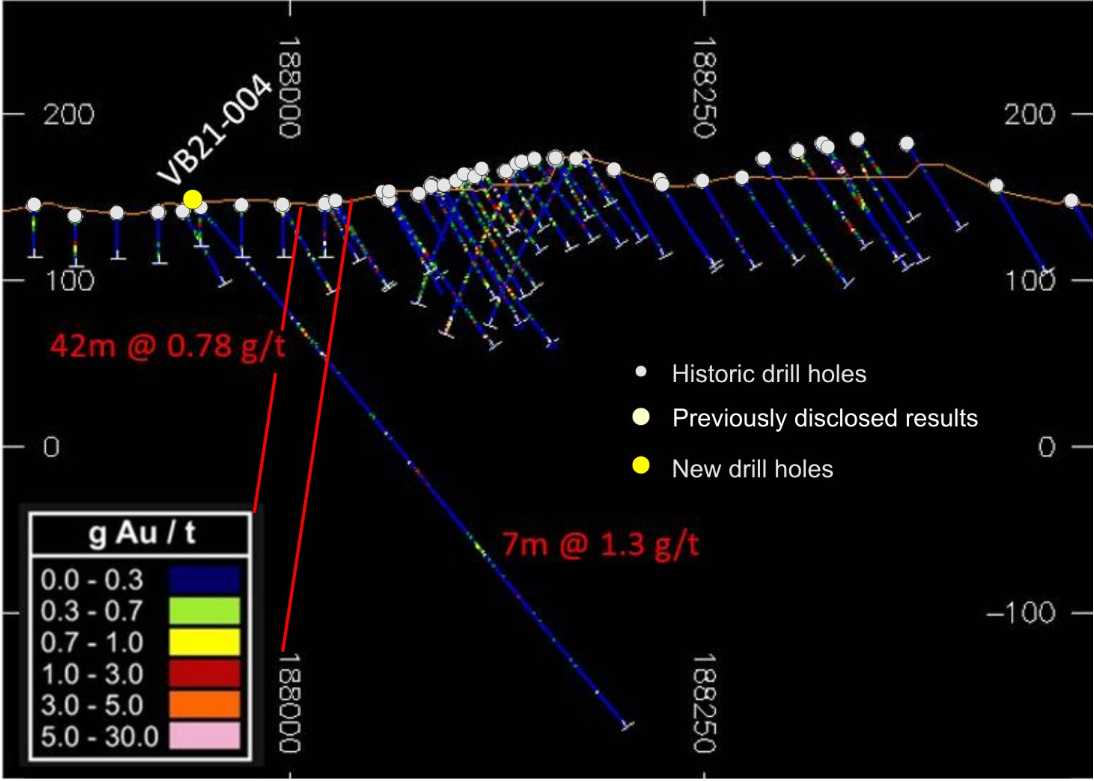

The results from the Phase 2 drilling intersected mineralized intervals both near the surface and at depth, with exceptionally higher grades observed at depths greater than 100 meters downhole. Please refer to Figure 5 for a long section illustrating the results of the SXL drilling. These findings indicate potential for expansion in the northeastern section of the current mineral resource shell, including areas of the block model that were previously unclassified due to low data density. The SXL structure offers opportunity to increase mineral reserves, as we believe it remains open at depth and along strike to the northeast, potentially connecting with other exploration targets identified in our 2020-2022 drilling program.

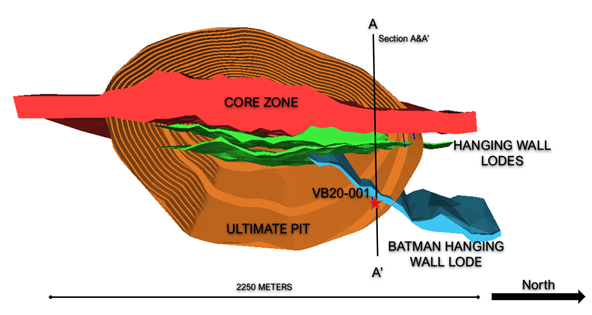

Figure 1. Phase 1 drill holes located within the current mineral resource shell and nearby holes from the 2020-2022 drilling program, showing the extension of the mineralized boundaries of the Batman core zone and relative position to the SXL zone.

1 Resource Shell defining the mineral resource inventory as described in the 2024 Feasibility Study.

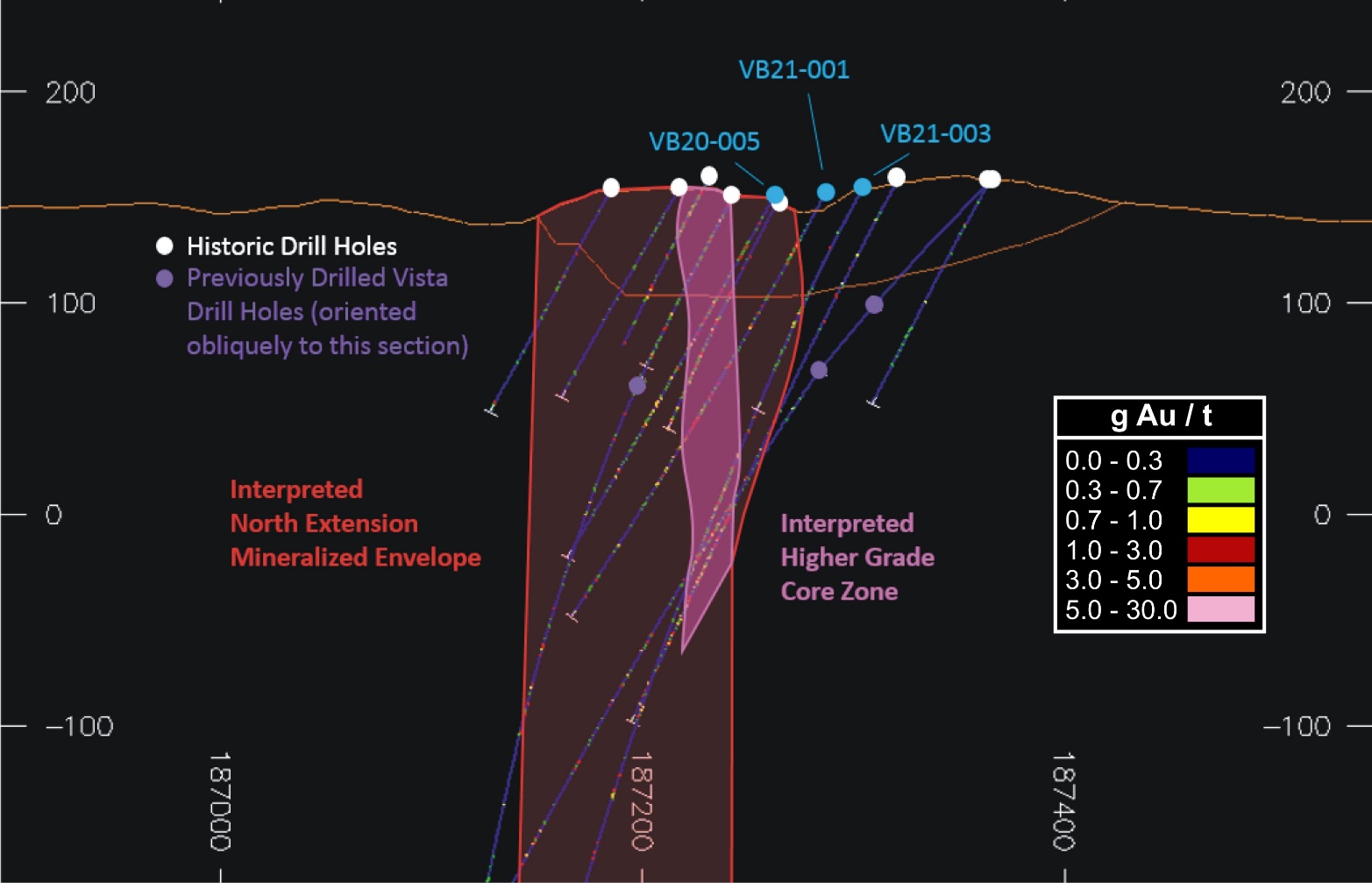

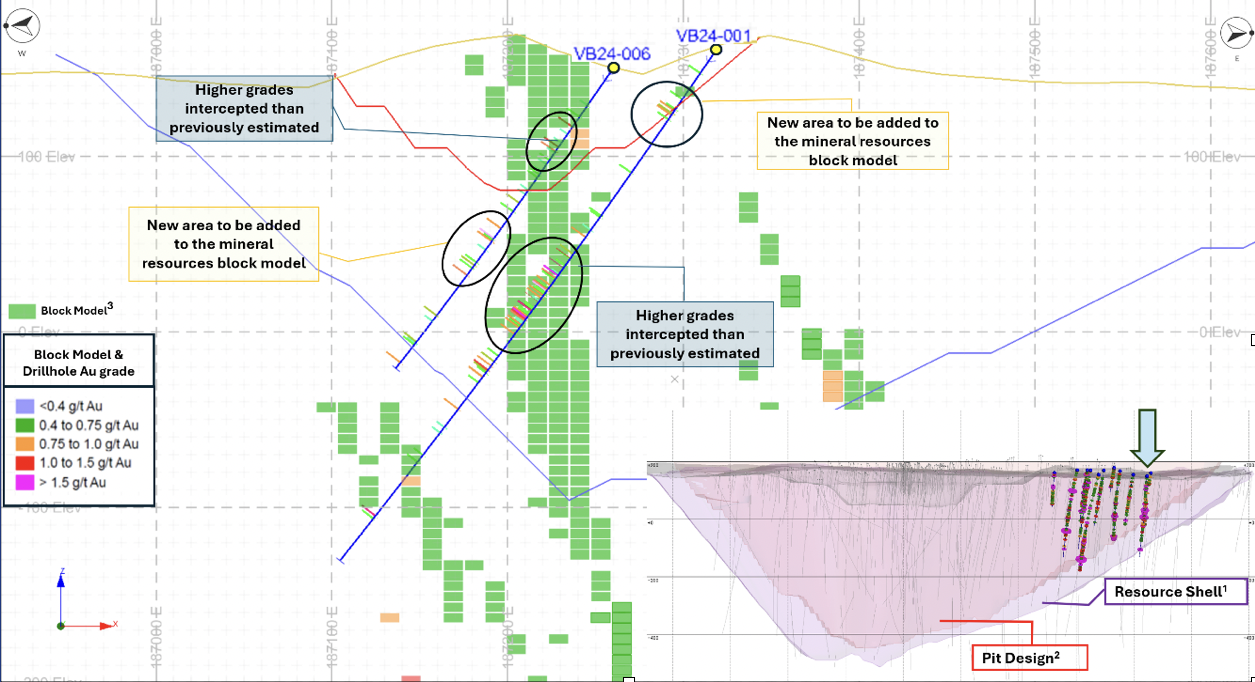

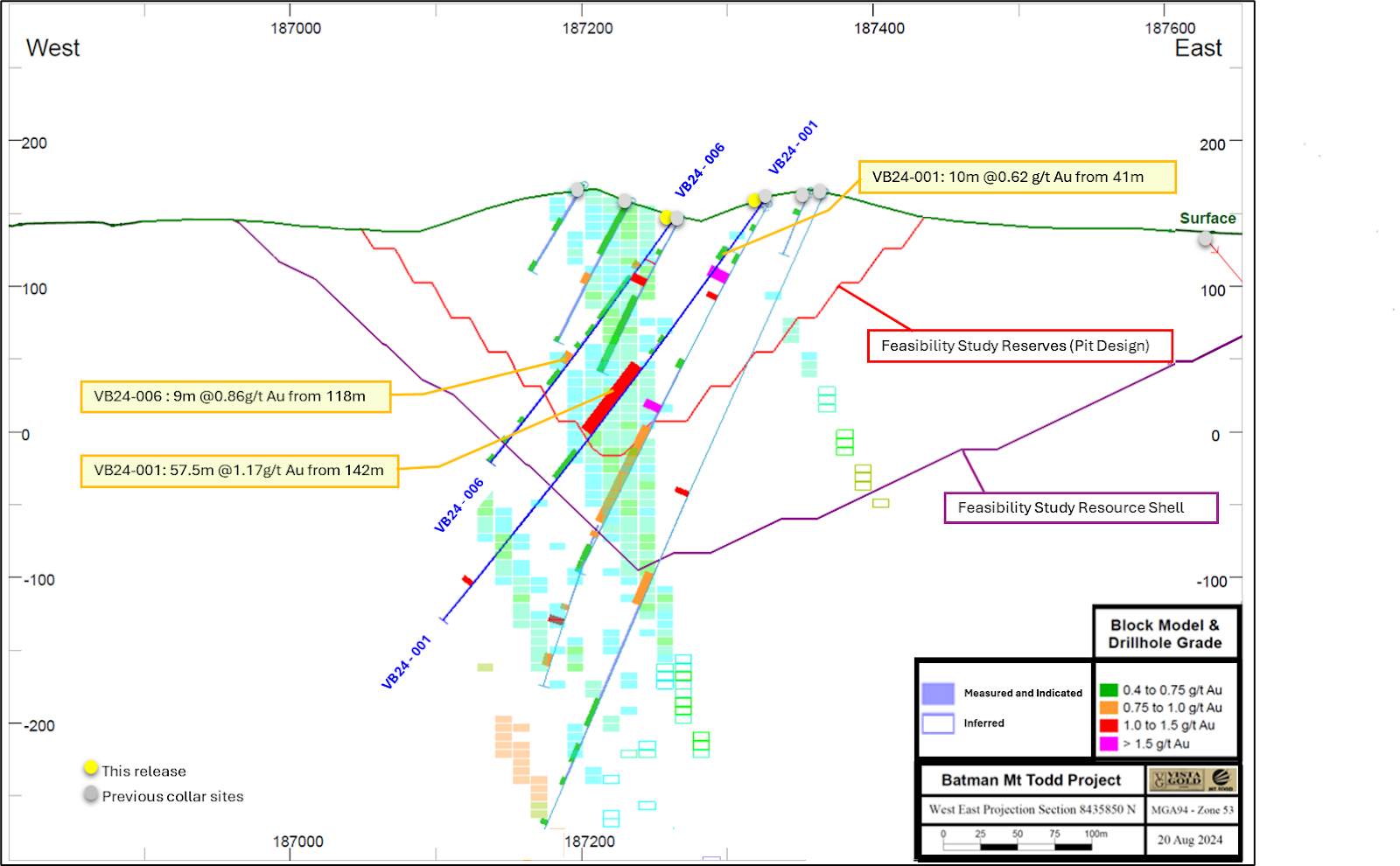

Figure 2. Cross section (8435850N), illustrating drill holes VB24-006 and VB24-001 compared to the current mineral resource shell and pit design featuring blocks with a cut-off grade above 0.40 g Au/t. Intercepted gold grades higher than current estimation and areas to be included in the upcoming mineral resource estimation are circled.

1 Mineral Resource Shell defining the mineral resource estimate as described in the 2024 Feasibility Study.

2 Pit design defining the mineral reserves as described in the 2024 Feasibility Study.

3 Resource block model as described in the 2024 Feasibility Study.

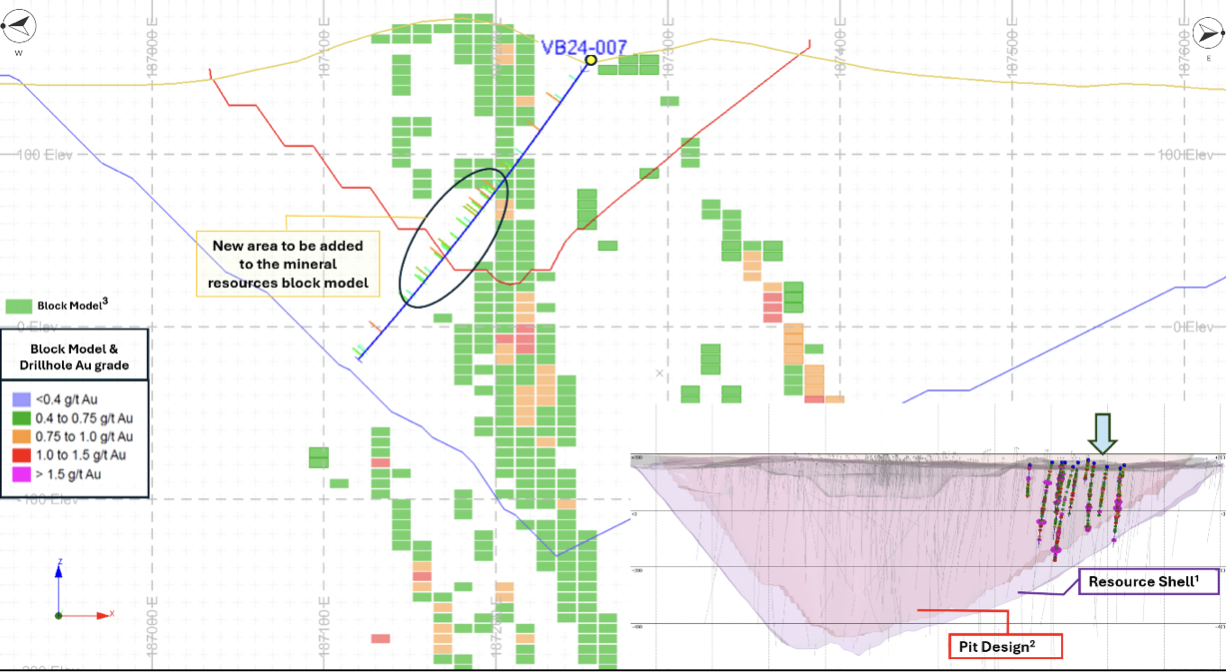

Figure 3. Cross section (8435800N), illustrating drill holes VB24-007 compared to the current mineral resource shell and pit design featuring blocks with a cut-off grade above 0.40 g Au/t. Intercepted gold grades and areas to be included in the upcoming mineral resource estimation are circled.

1 Mineral Resource Shell defining the mineral resource estimate as described in the 2024 Feasibility Study.

2 Pit design defining the mineral reserves as described in the 2024 Feasibility Study.

3 Resource block model as described in the 2024 Feasibility Study.

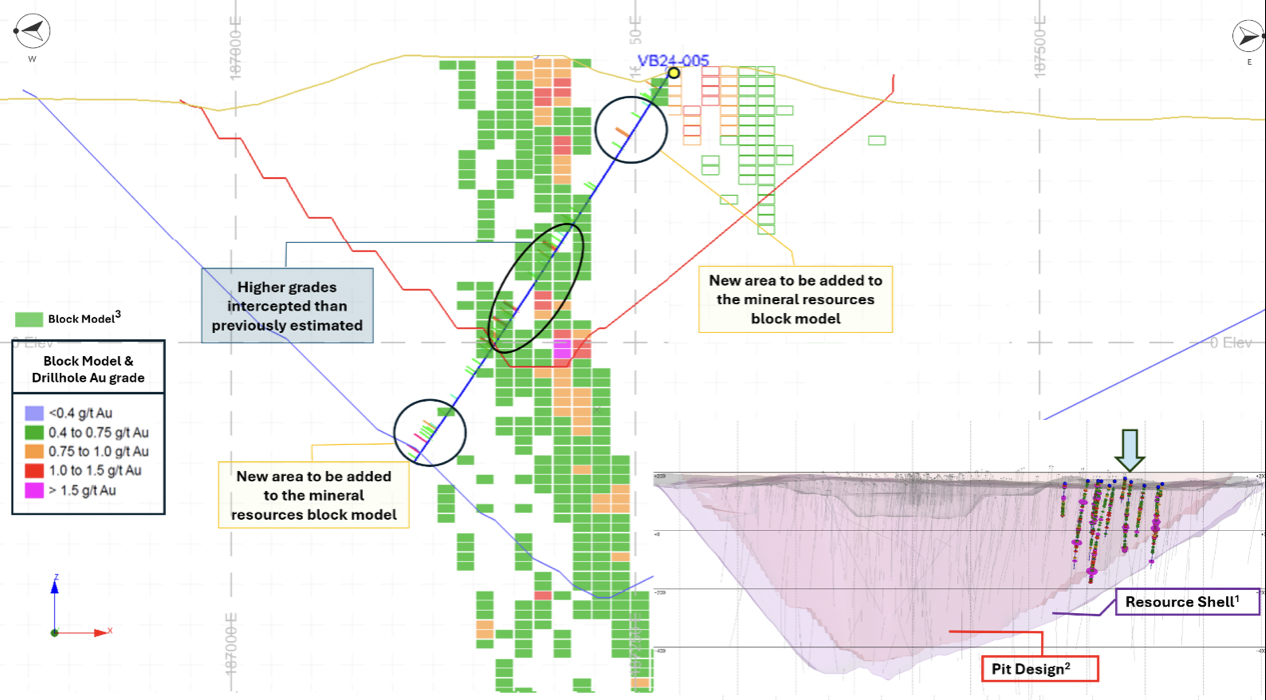

Figure 4. Cross section (8435750N), illustrating drill hole VB24-005 compared to the current mineral resource shell and pit design featuring blocks with a cut-off grade above 0.40 g Au/t. Intercepted gold grades higher than current estimation and areas to be included in the upcoming mineral resource estimation are circled.

1 Mineral Resource Shell defining the mineral resource estimate as described in the 2024 Feasibility Study.

2 Pit design defining the mineral reserves as described in the 2024 Feasibility Study.

3 Resource block model as described in the 2024 Feasibility Study.

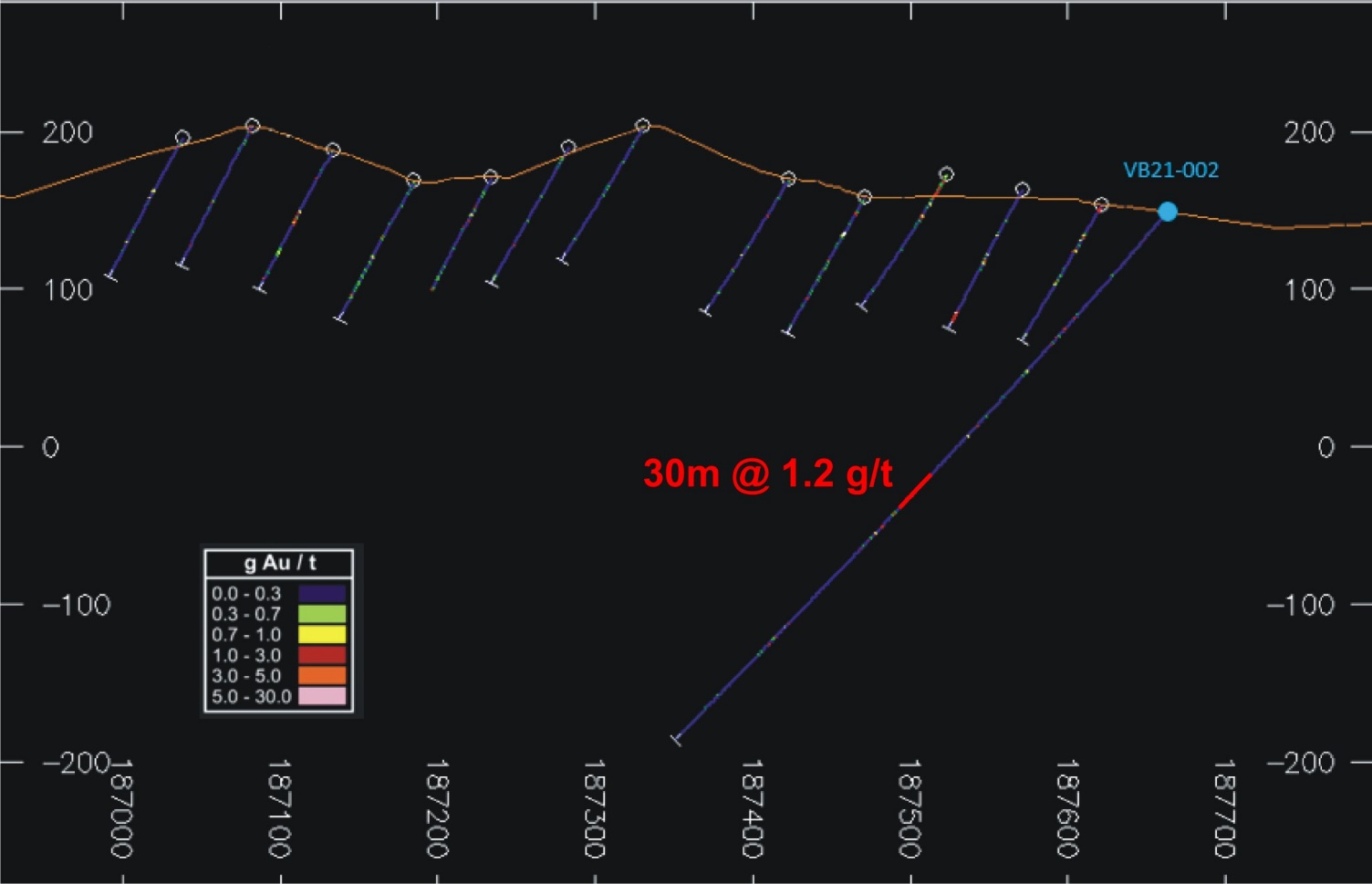

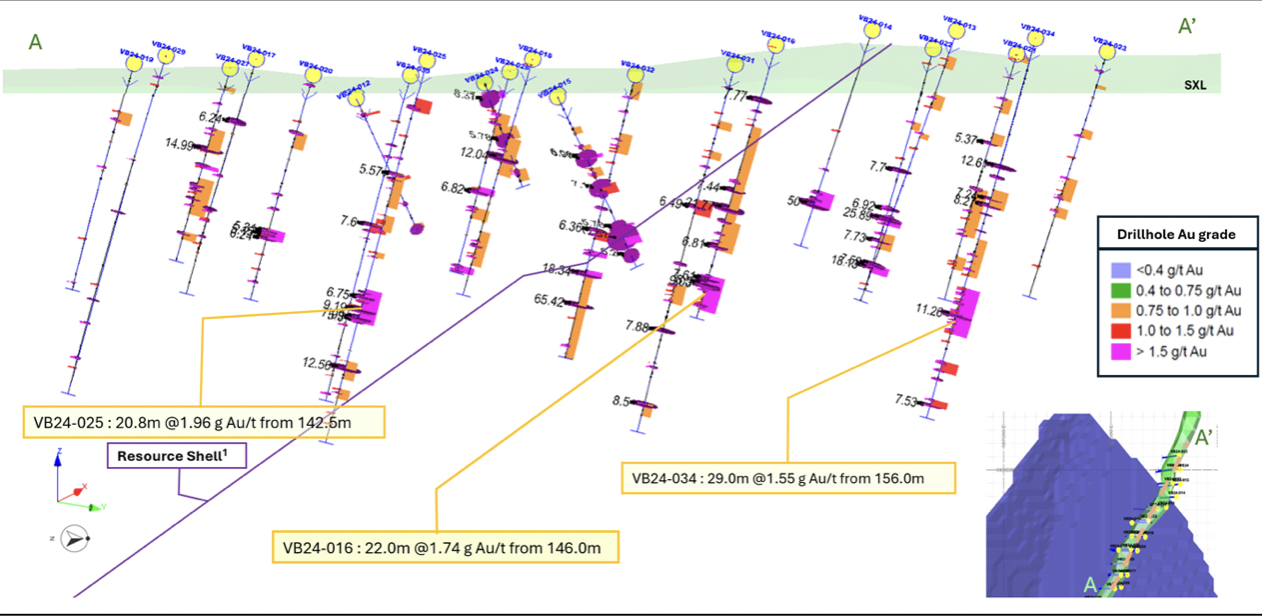

Figure 5. Long section of the SXL mineralized structure, displaying Phase 2 drill holes with intercepts over 5.0 g Au/t. Intervals with over 20 meters and grades greater than 1.0 g Au/t are called out.

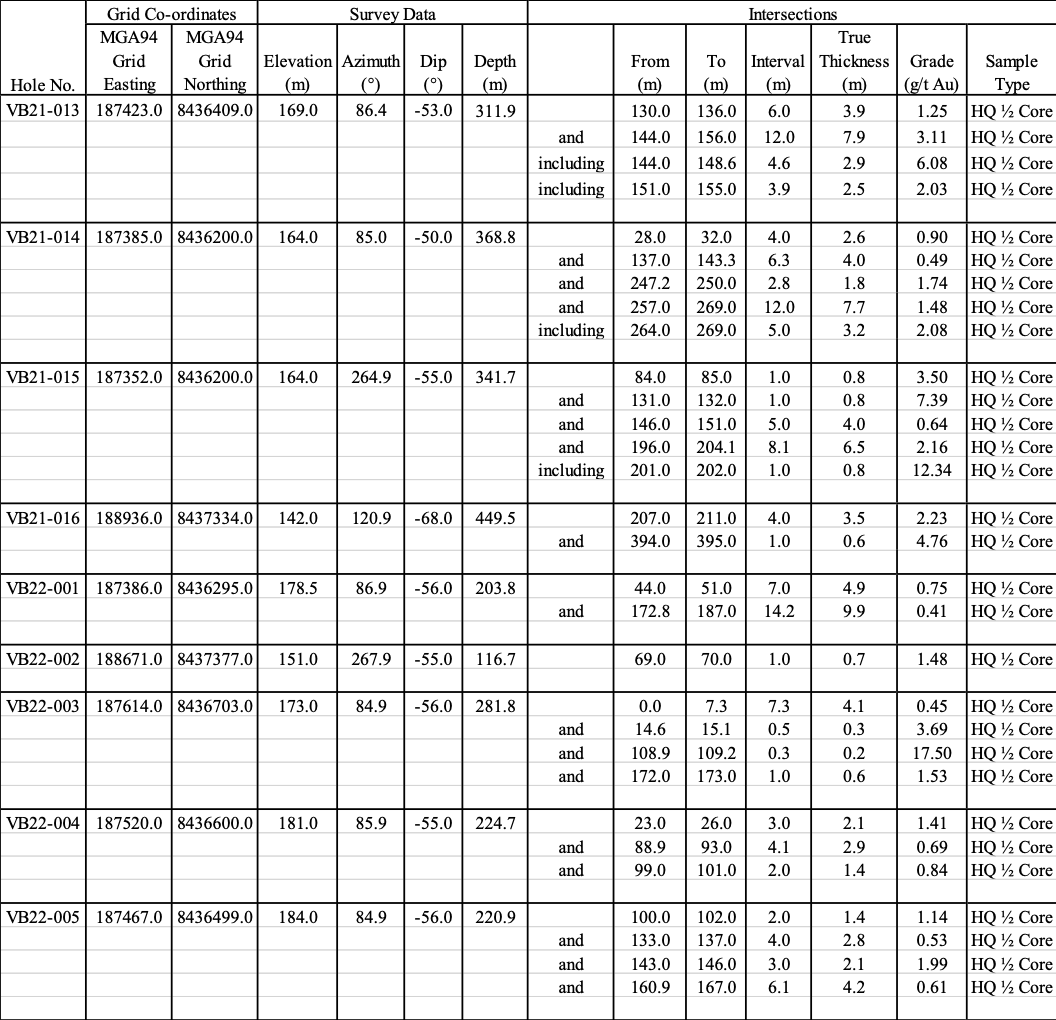

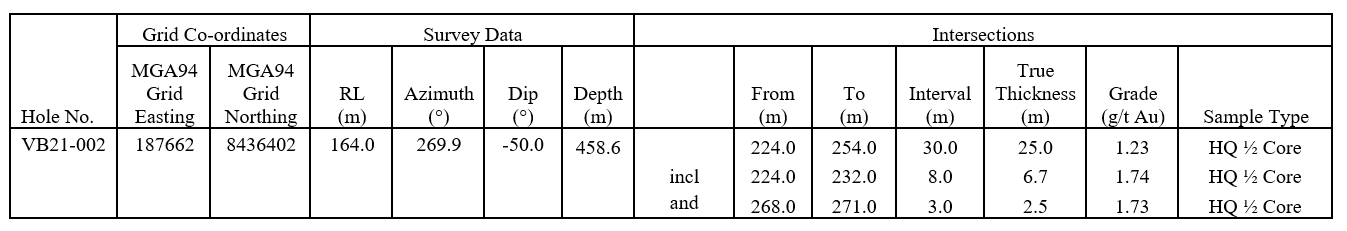

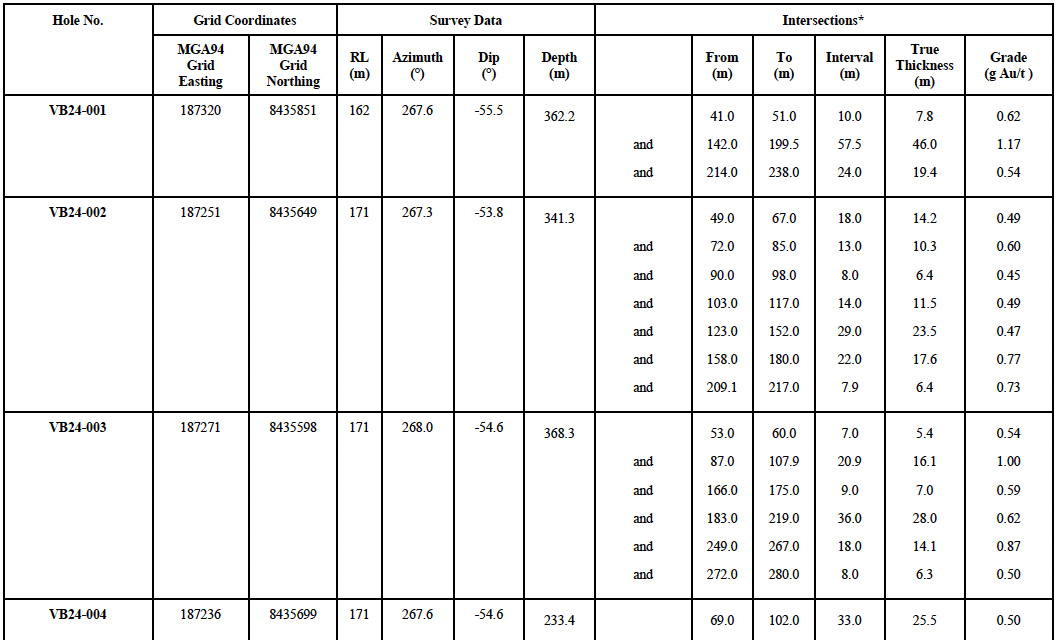

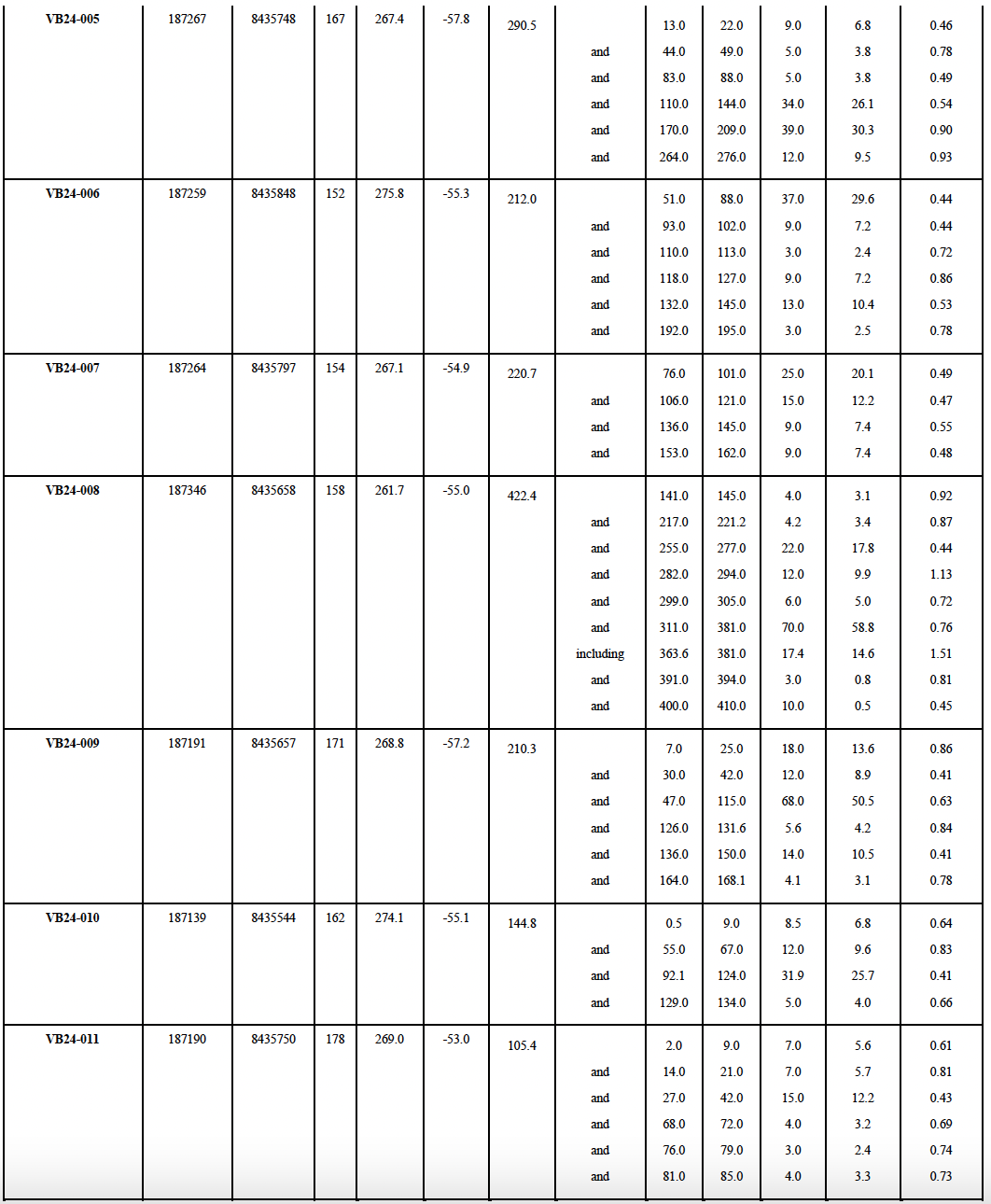

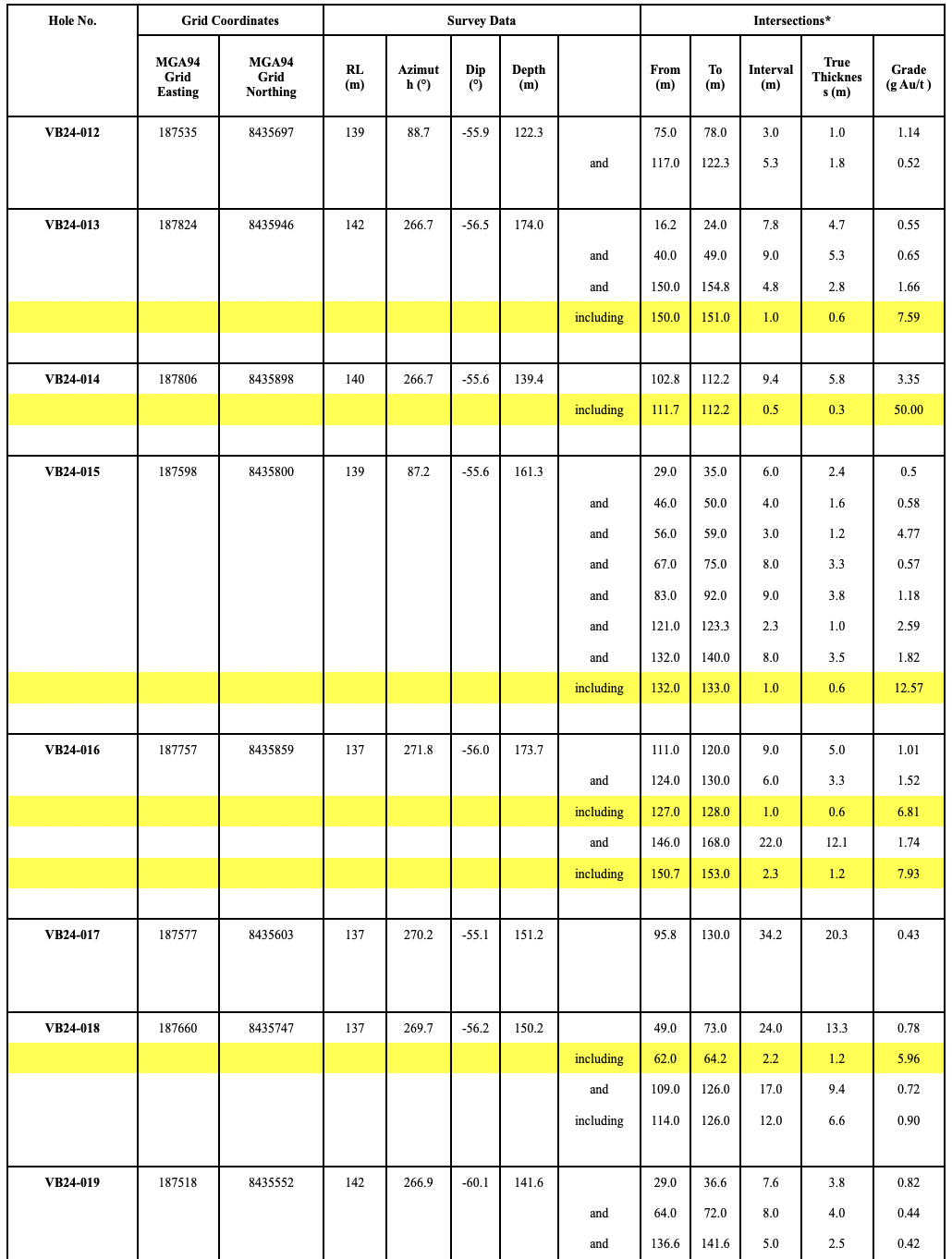

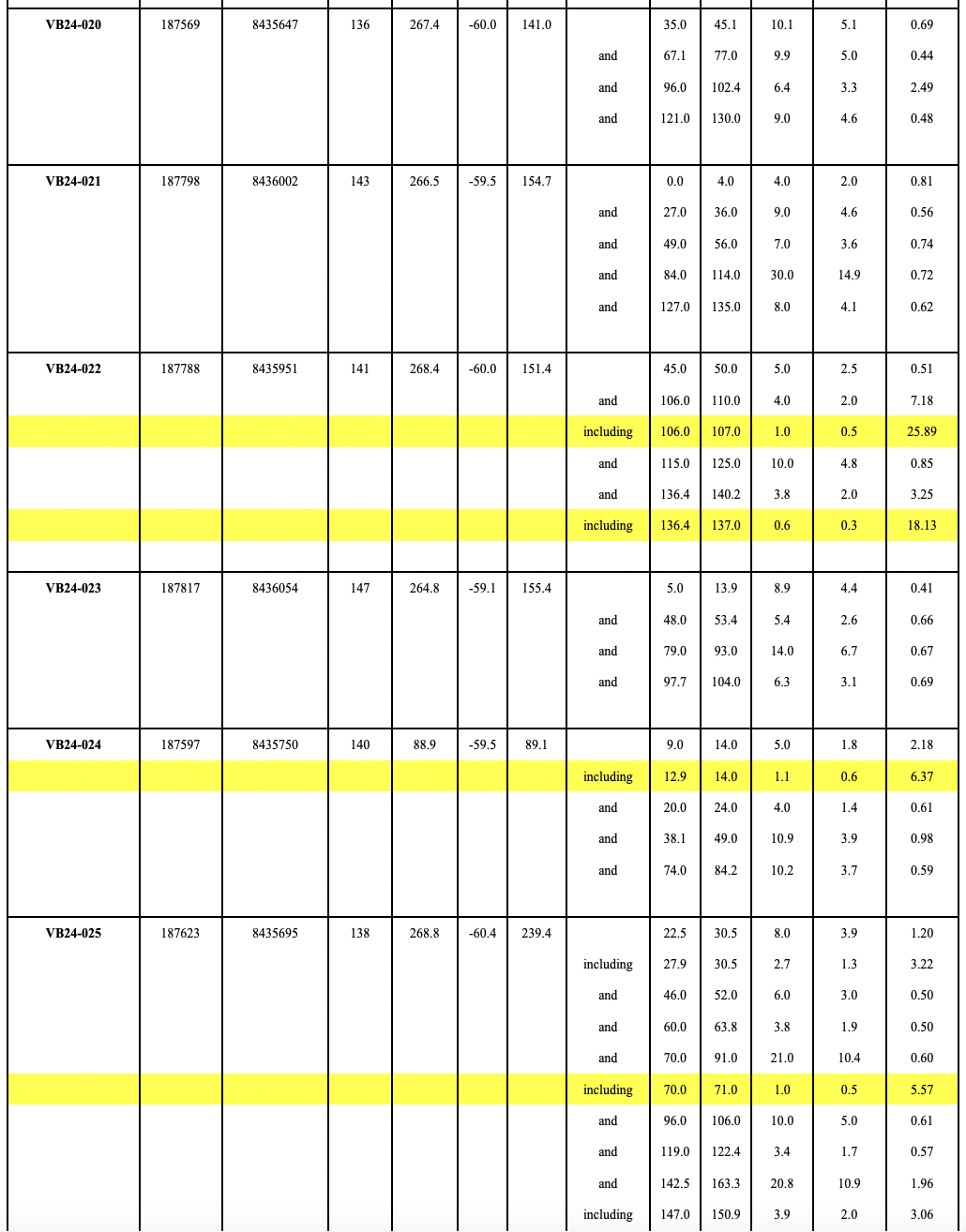

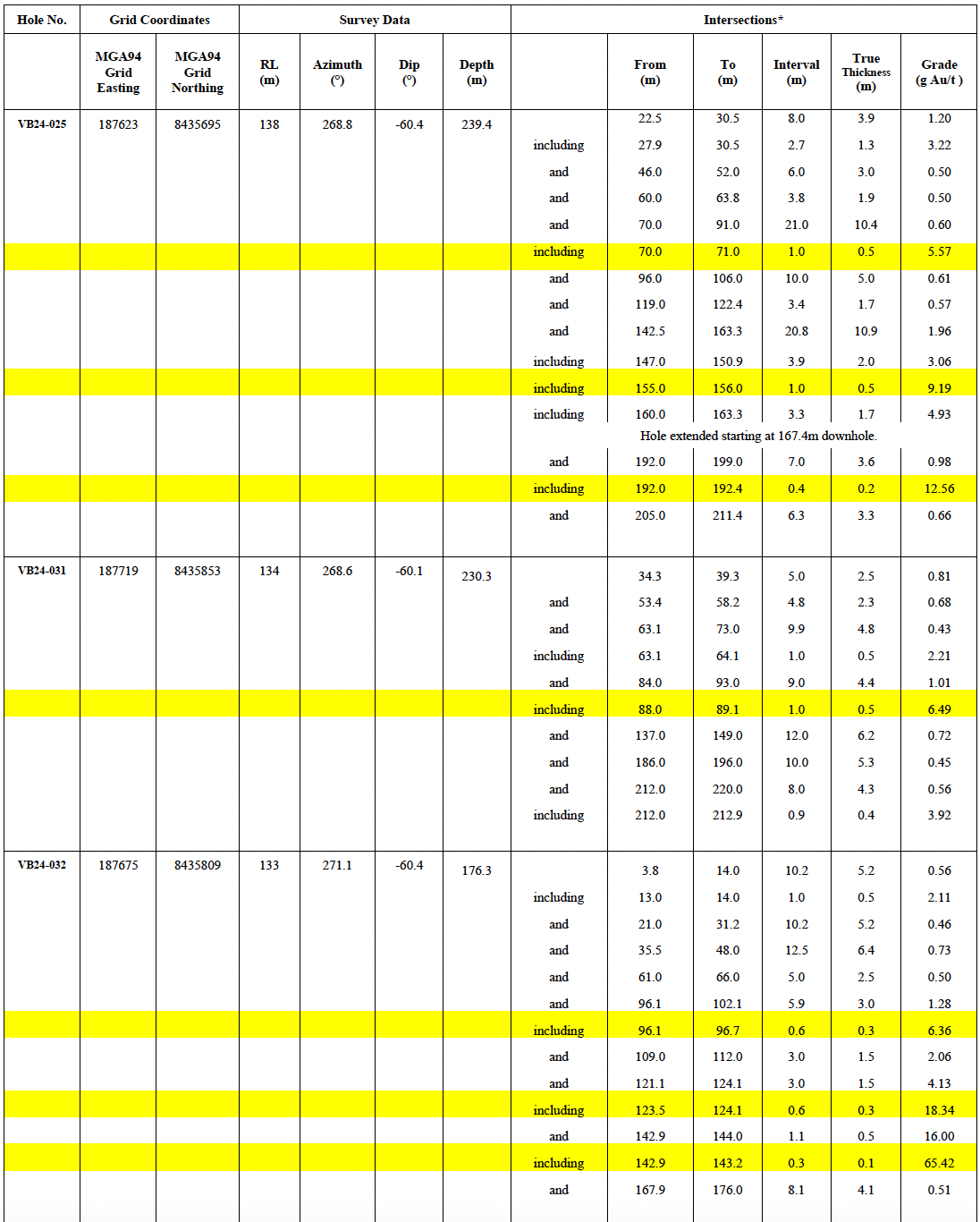

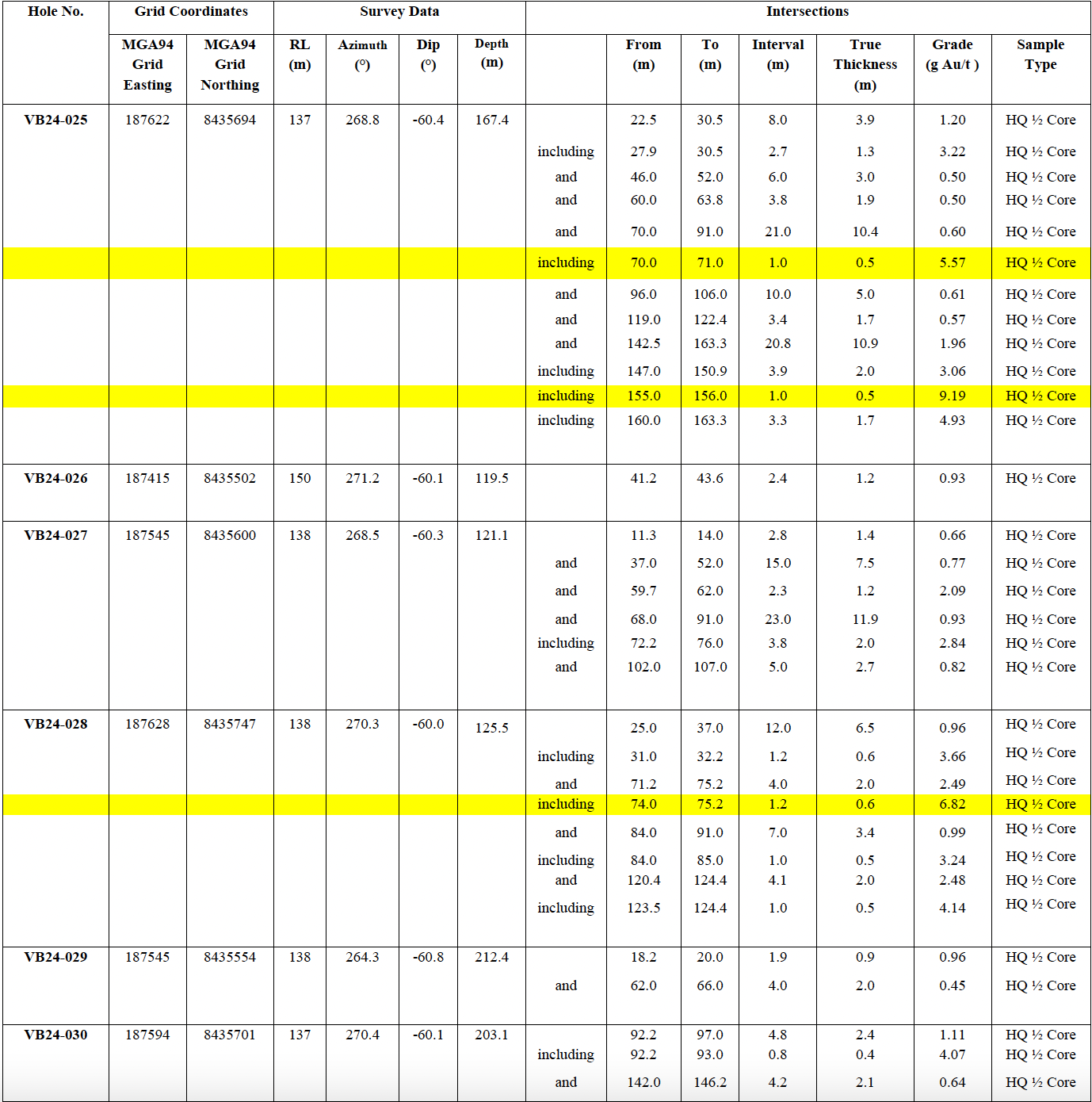

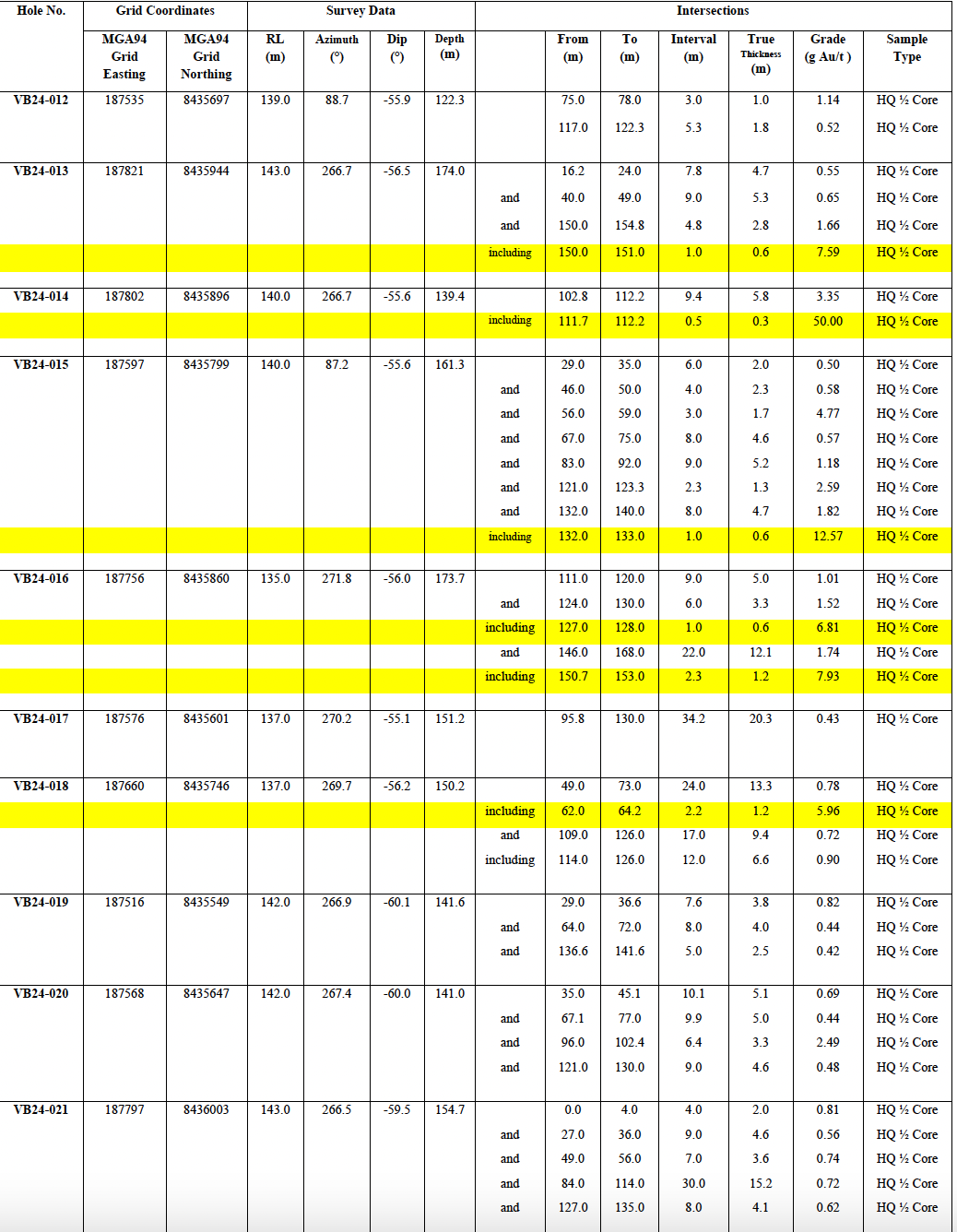

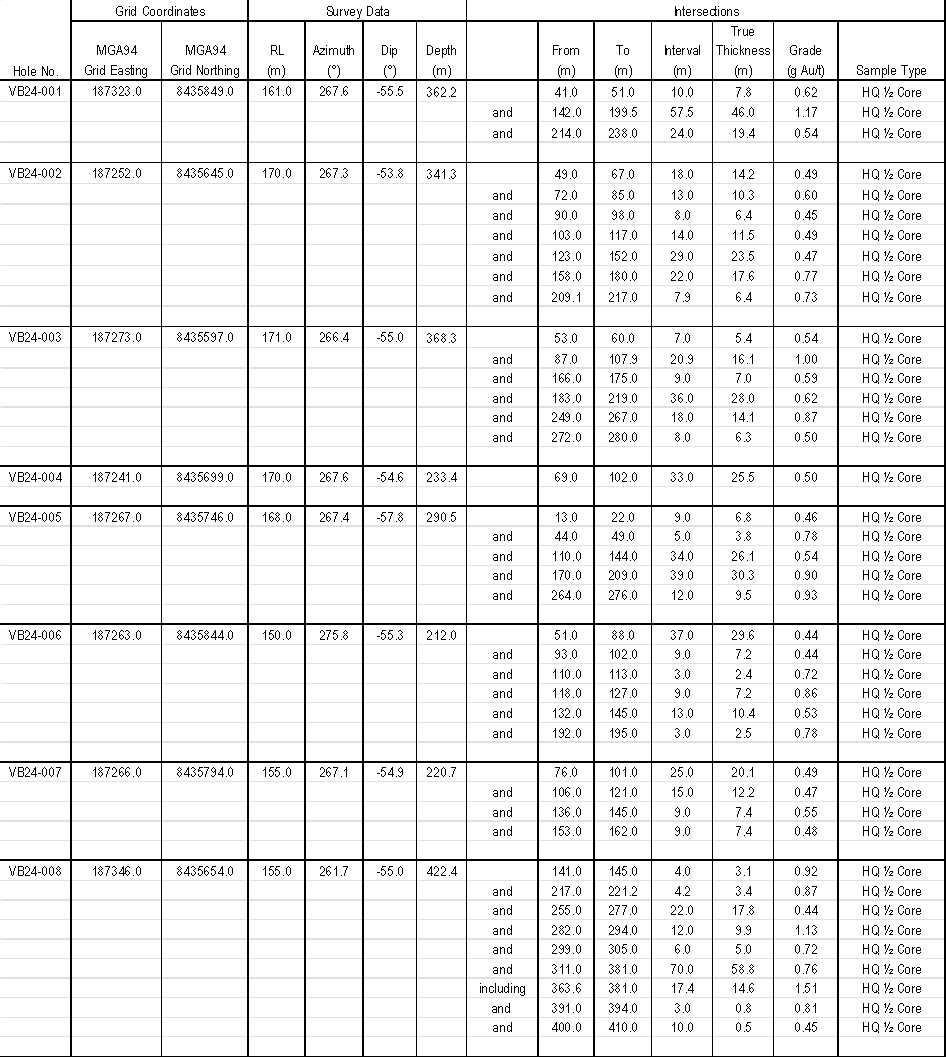

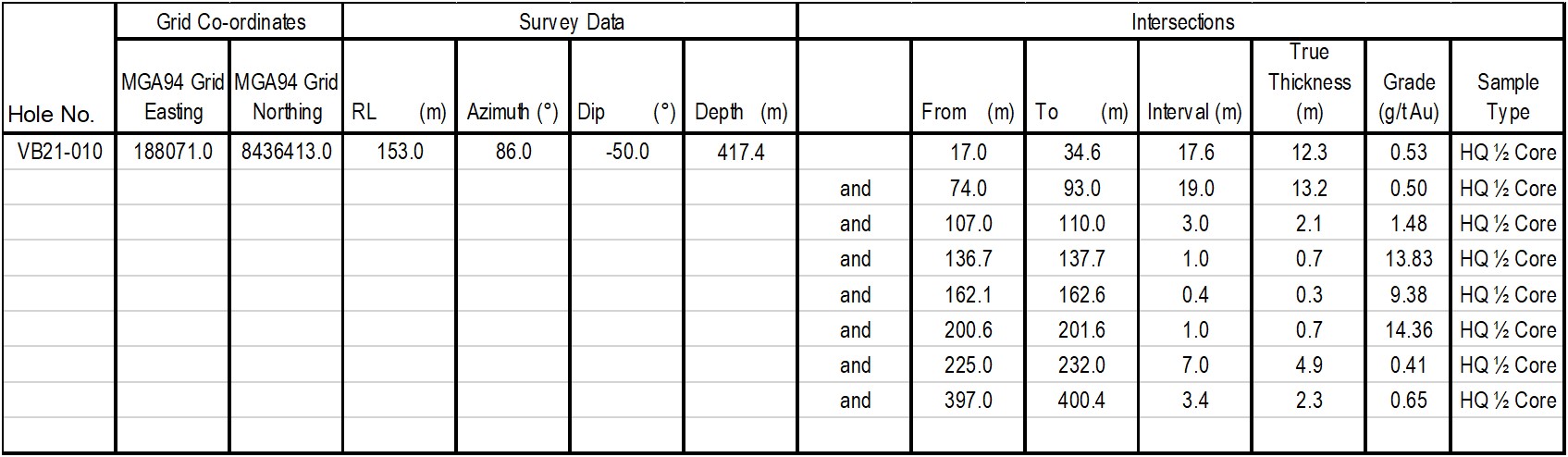

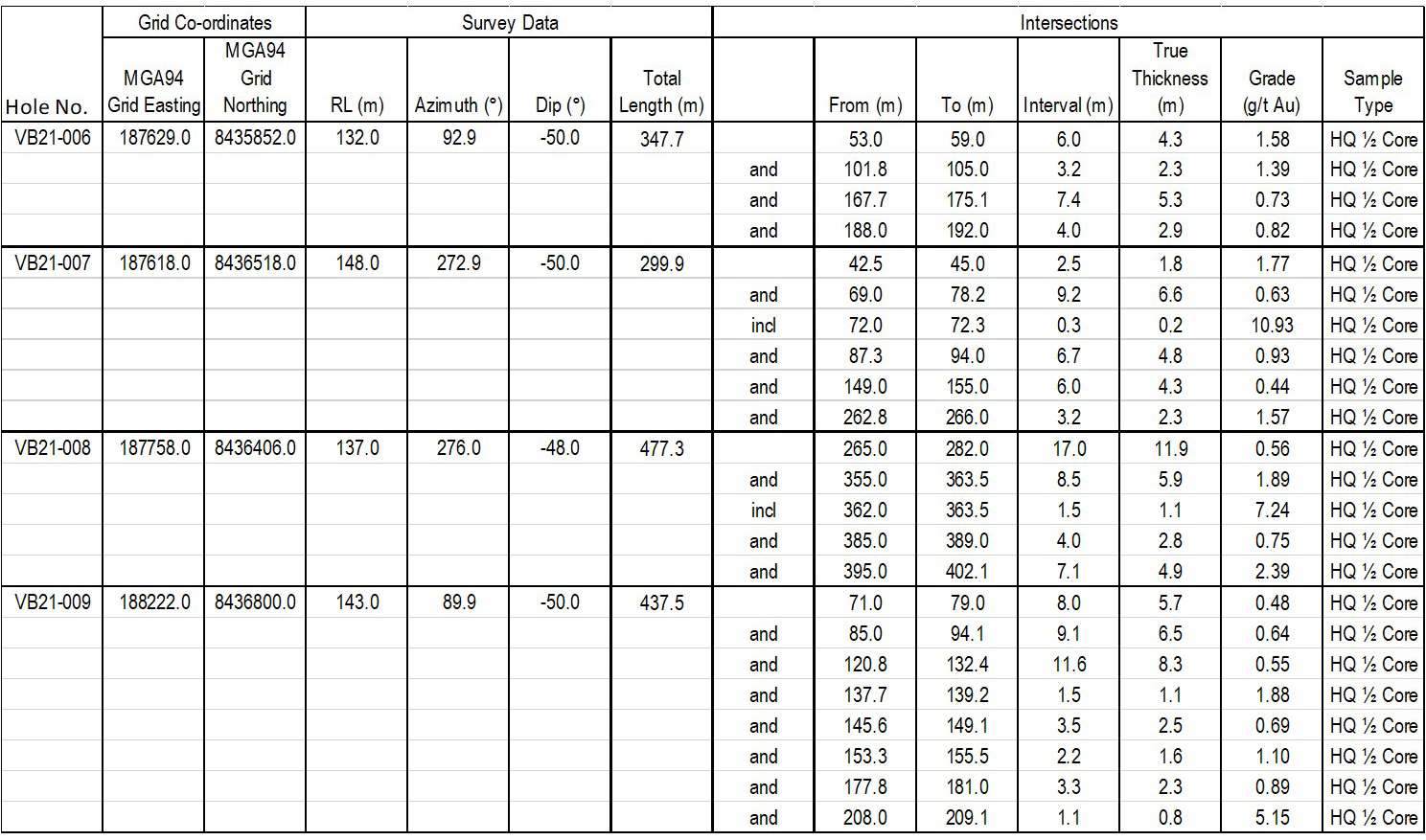

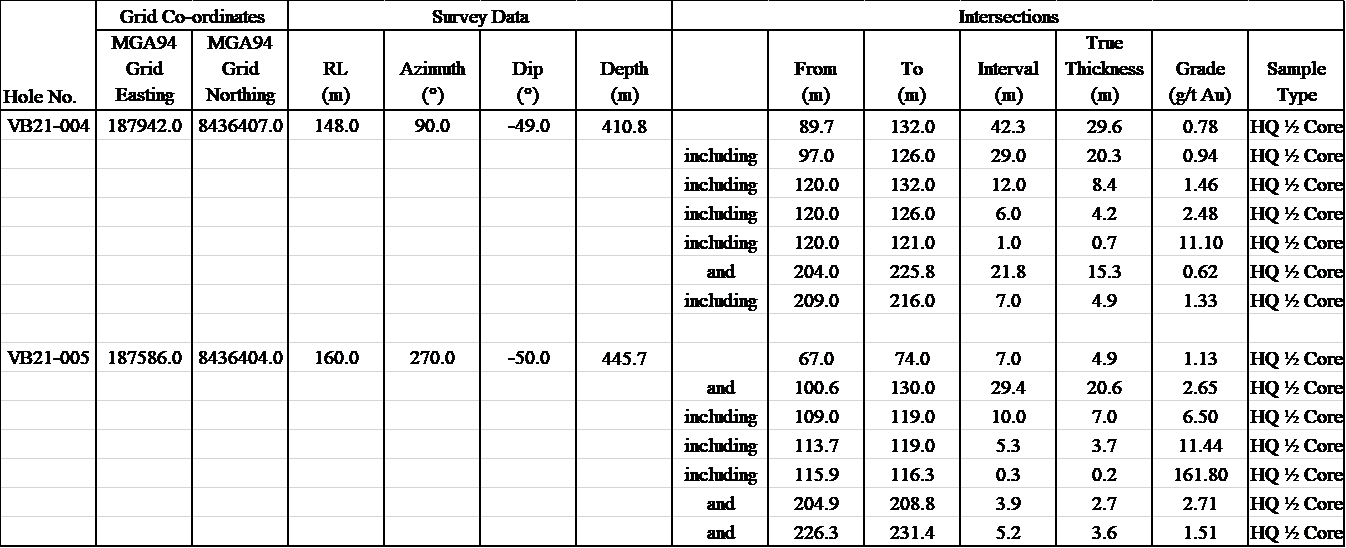

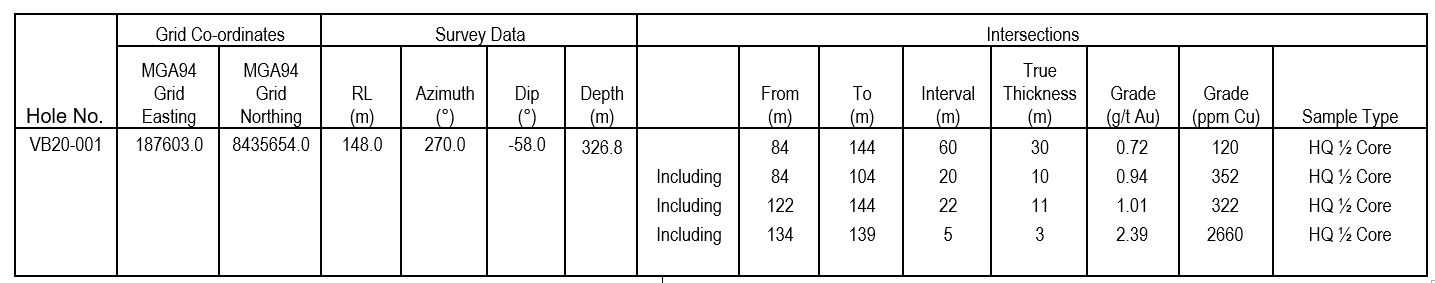

Table 1. Summary of Phase 1 drill holes.

*Sample Type - HQ 1/2 Core

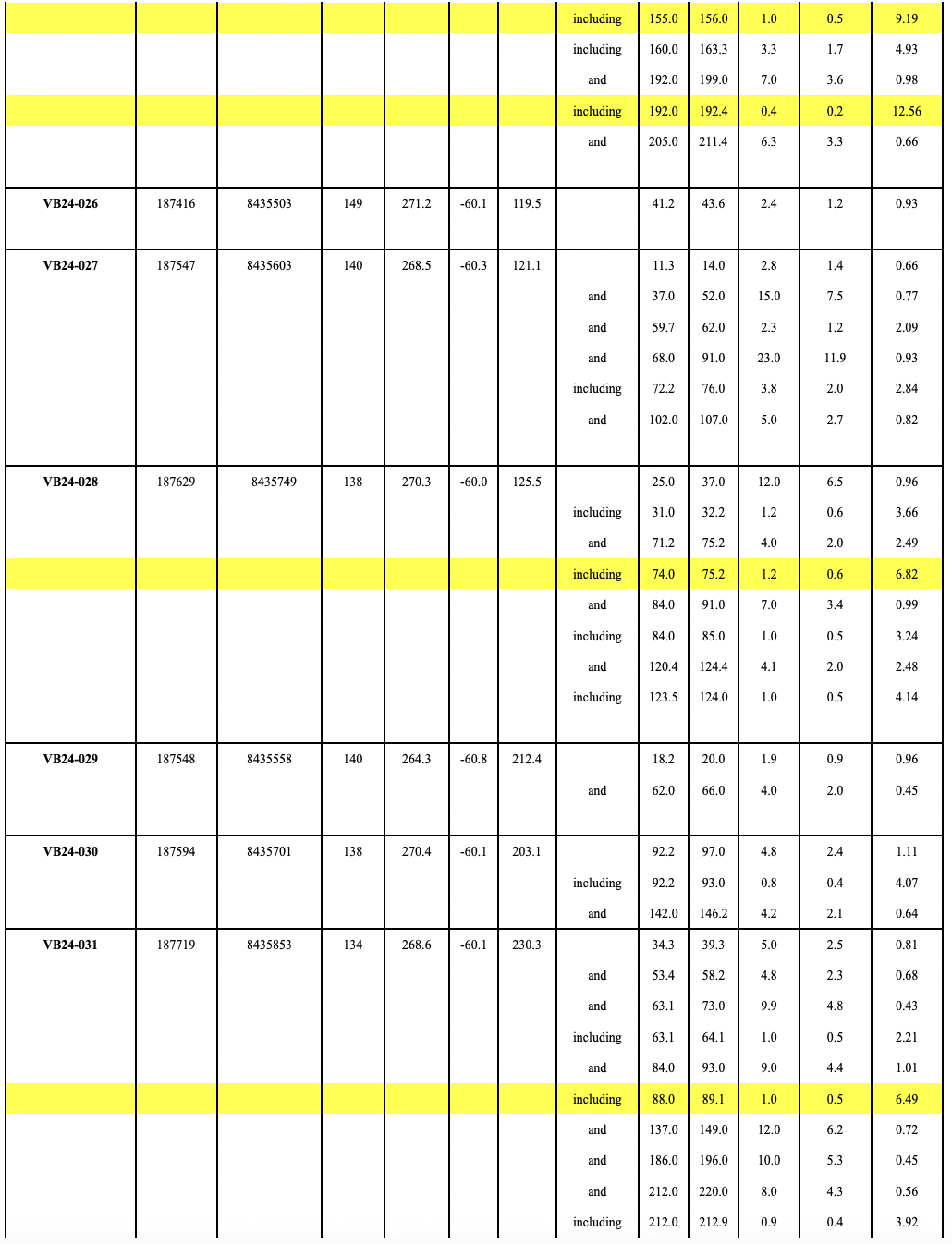

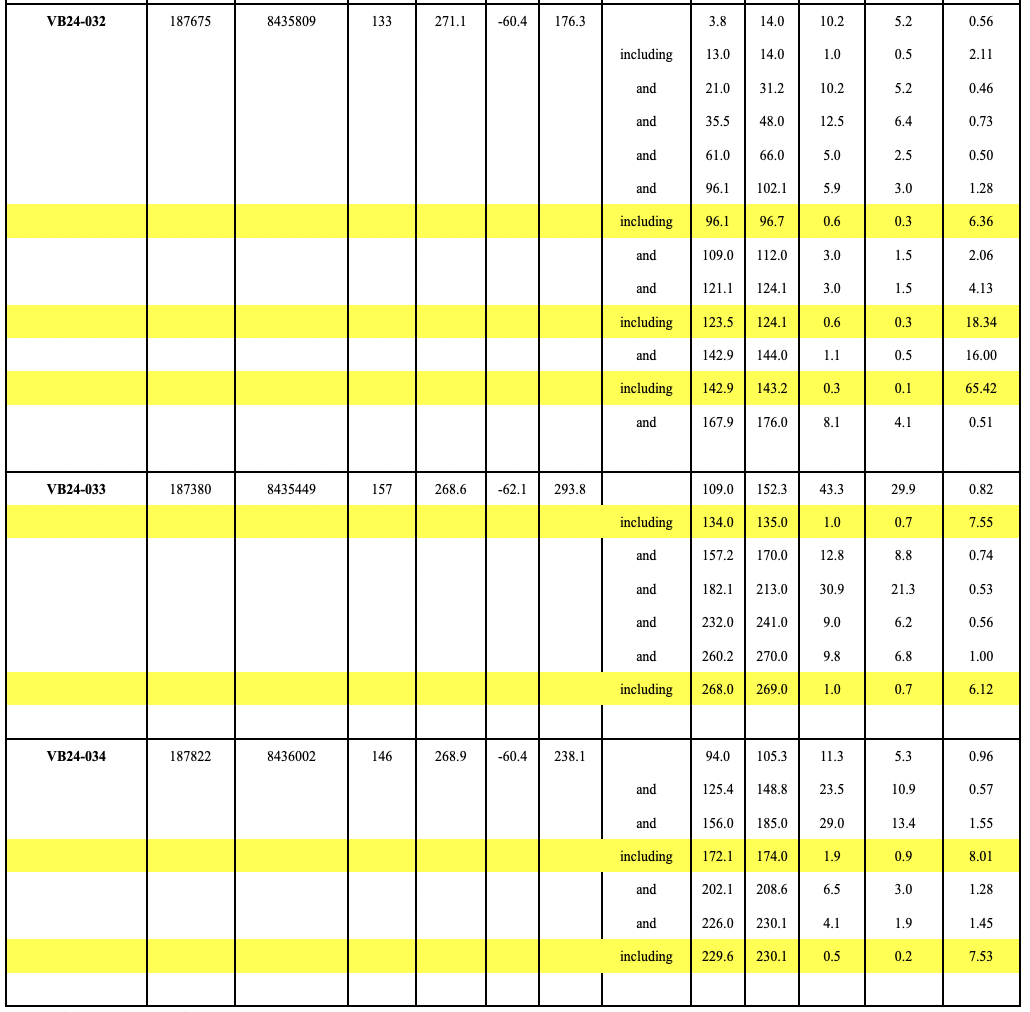

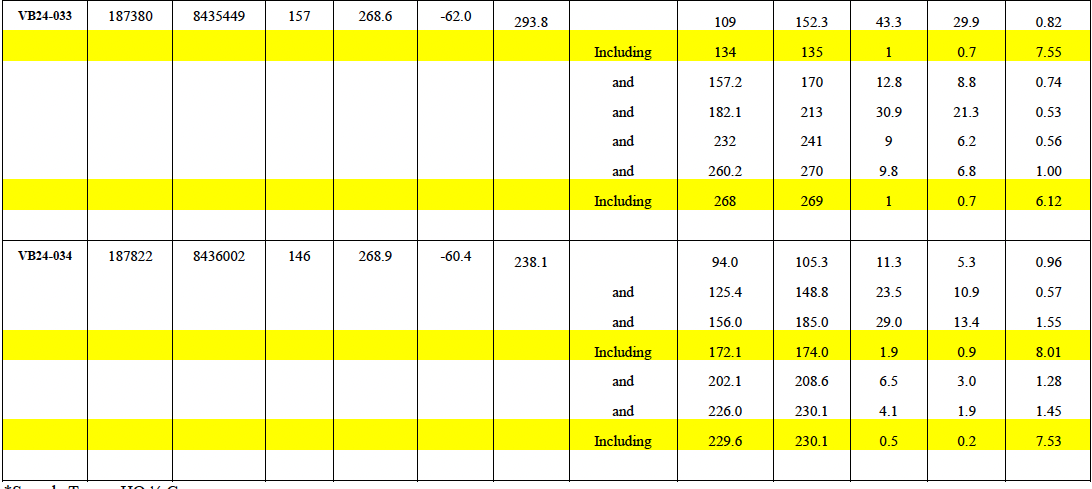

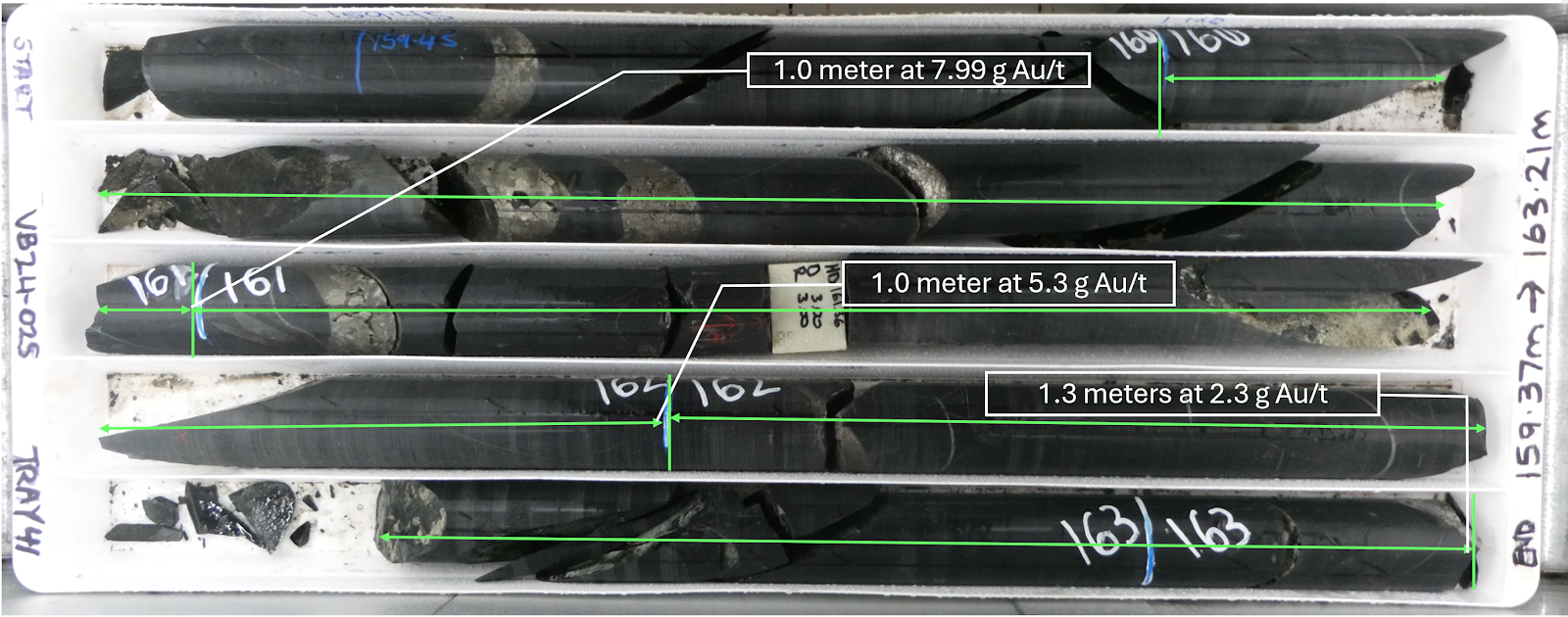

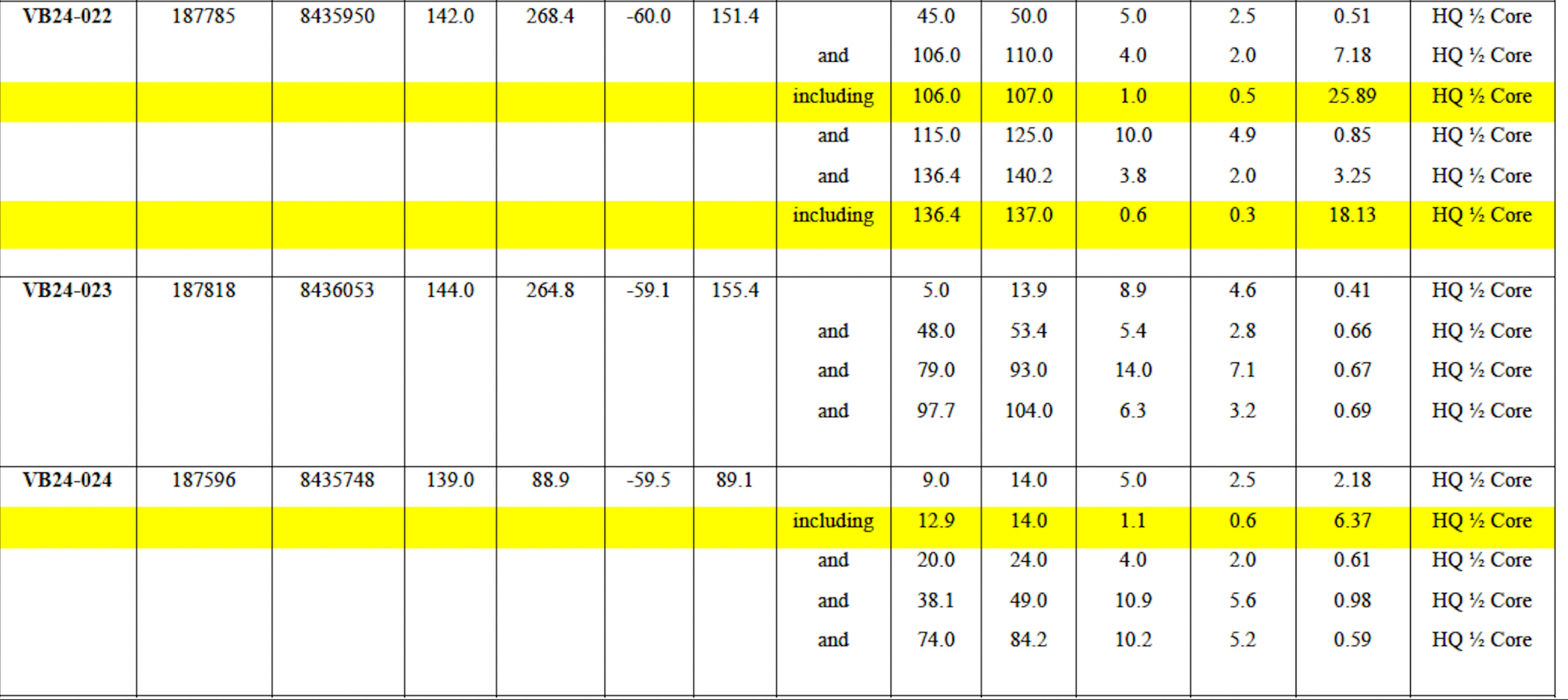

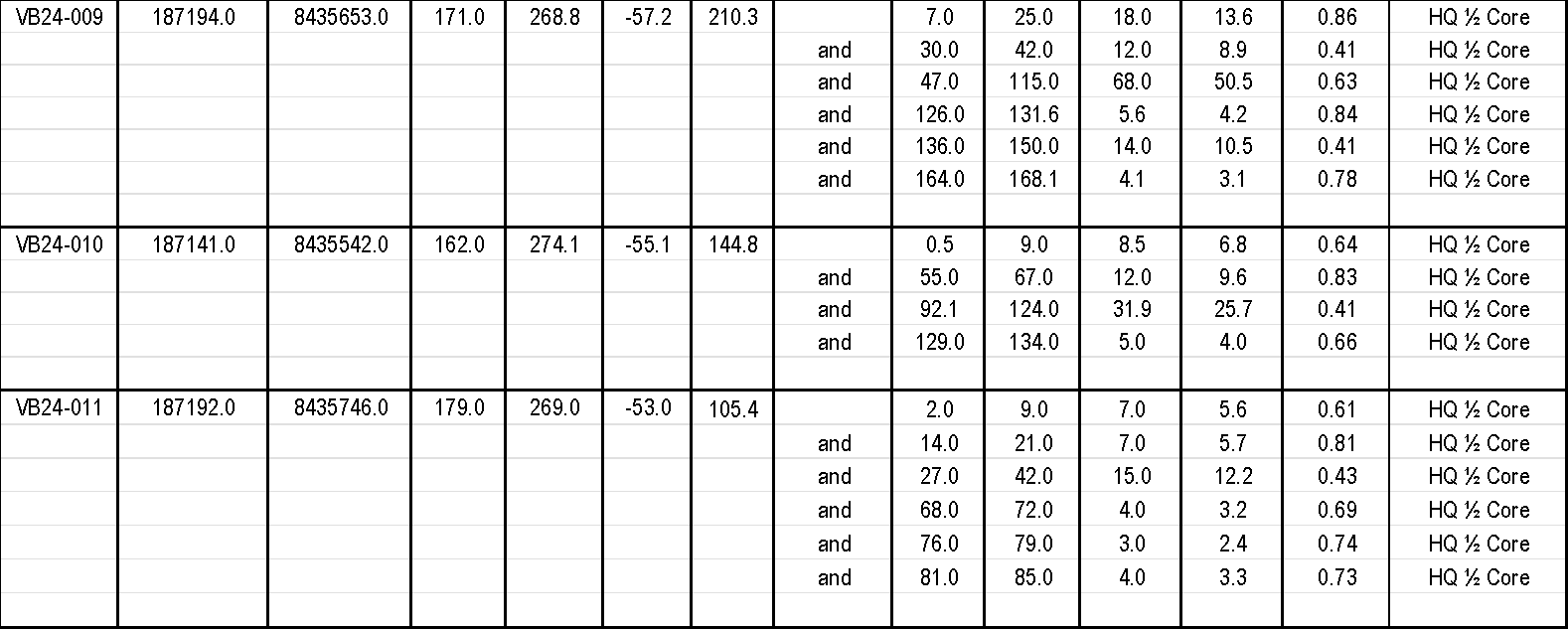

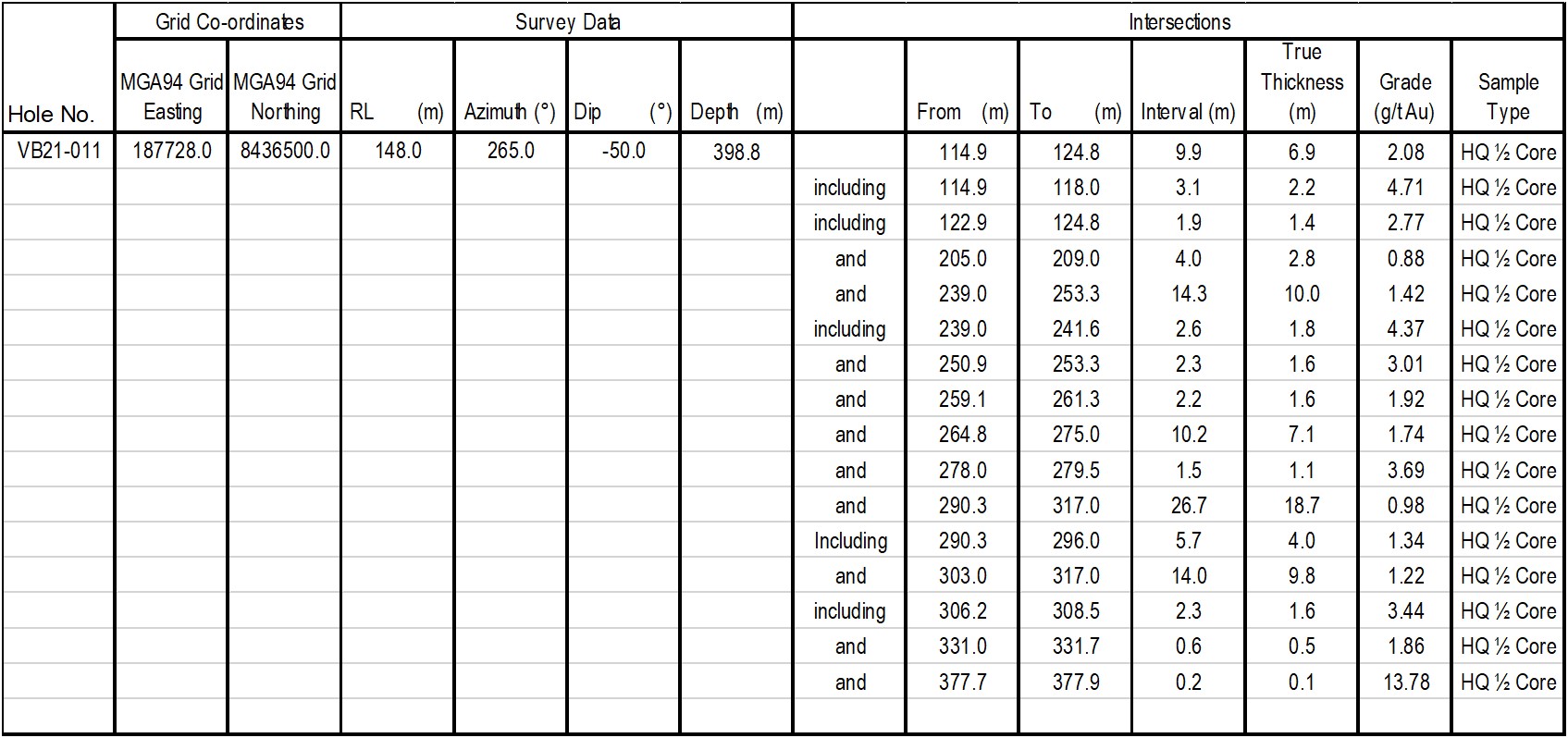

Table 2. Summary of Phase 2 drill holes – highlighting intercepts greater than 5.0 g Au/t.

*Sample Type - HQ 1/2 Core.

Highlighting intercepts greater than 5.0 g Au/t.

Notes:

- Results are based on ore grade 50 g fire assay for Au.

- Intersections are from diamond core drilling with half-core samples.

- Core sample intervals were constrained by geology, alteration or structural boundaries, intervals varied between a minimum of 0.2 meters to a maximum of 1.2 meters.

- Weighted mean grades have been calculated on a 0.4 g Au/t lower cut-off grade with no upper cut-off grade applied, and maximum internal waste of 4.0 meters.

- All mineralized interval lengths reported are downhole intervals.

- True Thicknesses are estimated based on the orientation of veining as measured relative to the core axis.

- All downhole deviations have been verified by downhole gyro equipment.

- The Company maintains a Quality Assurance and Quality Control (QA/QC) procedures program in accordance with the requirements and guidelines of CIM Standards of Disclosure for Mineral Projects.

- The independent laboratory responsible for the assays was North Australian Laboratories Pty Ltd, Pine Creek, NT.

QA/QC Protocols and Sampling Procedure

All sampling was conducted under the supervision of the Company's geologists and the chain of custody from Mt Todd facilities to the independent sample preparation facility at North Australian Laboratories Pty Ltd (“NAL”) in Pine Creek, NT was continuously monitored.

- The core is marked, geologically logged, geotechnically logged, photographed, and sawn into halves using diamond saws. One-half is placed into pre-numbered sample bags as per industry standards with sample lengths between a minimum of 0.2 meters to a maximum of 1.2 meters. The other half of the core is retained for future reference by the Company. The only exception to this is when a portion of the remaining core has been flagged for use in metallurgical testwork.

- Following common industry practices, blanks and standards are also placed in plastic bags for inclusion in the shipment. A reference blank or a standard is inserted at a minimum ratio of 1 in 10 and additional blank samples are added at suspected high-grade intervals to monitor assay accuracy. Standard reference material is sourced from Ore Research & Exploration Pty Ltd and provided in 60-gram sealed packets. When a sequence of four samples is completed, they are placed in a shipping bag and tied closed. All of these samples are kept in a secure area on-site until sealed crated for shipping. This ensures a clear chain of custody from collection to analysis, minimizing the risk of sample errors.

- Vista employees ship and transport the sealed crates to the NAL. At the lab, the samples are pulverized and split down to 50-gram assay samples prior to assaying. The industry-standard 3 assay-ton fire assay is followed by an atomic absorption (AA) finish.

- Vista conducts regular internal reviews of drilling data, where geologists validate the results against QA/QC findings before finalizing reports.

- For the purposes of this release, mineralized intervals are defined as runs of mineralization with a maximum internal waste of 4.0 meters.

- NAL is independent of Vista.

It is the opinion of the QP (as defined below) that the sample preparation methods and quality control measures employed before the dispatch of samples to an analytical or testing laboratory ensured the validity and integrity of samples taken.

About Vista Gold Corp.

Vista holds the Mt Todd gold project, a ready-to-build development-stage gold deposit located in the Tier-1 mining jurisdiction of Northern Territory, Australia. Vista is positioning Mt Todd as a leading development opportunity within the gold sector. Mt Todd offers significant scale, development optionality, growth opportunities, advanced local infrastructure, community support, and demonstrated economic feasibility. All major environmental and operating permits necessary to initiate development of Mt Todd are in place.

Vista’s strategy is to advance Mt Todd in ways that efficiently position the project for development while exercising the discipline necessary to best realize value at the right time. Vista believes its strategy of advancing Mt Todd in this manner will deliver a more fully valued project to its shareholders.

For further information about Vista or Mt Todd, please contact Pamela Solly, Vice President of Investor Relations, at (720) 981-1185 or visit the Company’s website at www.vistagold.com.

Qualified Person

Maria Vallejo, Vista’s Director of Projects and Technical Services, a Qualified Person (“QP”) as defined by Item 1300 of Regulation S-K under the Securities Exchange Act of 1934, as amended, and Canadian National Instrument 43-101 – Standards of Disclosure for Mineral Projects, has verified the data underlying the information contained herein and has approved this press release. The information contained in this press release is provided as a summary of the 2024 drilling program for the Mt Todd project.

Technical Studies

For more information on the Company’s March 2024 Feasibility Study (the “2024 Feasibility Study”), including with respect to mineral resource and mineral reserve estimates, please refer to the technical report summary entitled “SK 1300 Technical Report Summary – Mt Todd Gold Project – 50,000 tpd Feasibility Study – Northern Territory, Australia” with an effective date of March 12, 2024 and an issue date of March 14, 2024 available at www.sec.gov and, for Canadian purposes, the technical report entitled “National Instrument 43-101 Technical Report – Mt Todd Gold Project – 50,000 tpd Feasibility Study – Northern Territory, Australia” with an effective date of March 12, 2024 and an issue date of April 16, 2024 under Vista’s profile at www.sedarplus.ca. For more information on the Company’s 2024 drilling results, please refer to the Company’s previous 2024 and 2025 drilling news releases available under the Company’s profile at www.sedarplus.ca.

Forward Looking Statements

This news release contains forward-looking statements within the meaning of the U.S. Securities Act of 1933, as amended, and U.S. Securities Exchange Act of 1934, as amended, and forward-looking information within the meaning of Canadian securities laws. All statements, other than statements of historical facts, included in this news release that address activities, events or developments that the Company expects or anticipate will or may occur in the future, including such things as the Company’s belief that the 2024 Mt Todd drilling program is expected to increase gold mineral reserves in the Batman deposit; the Company’s belief that the Phase 1 and Phase 2 drill results and the drill results from the 2020–2022 drilling program will be included in the updated Mt Todd mineral resources estimate and new feasibility study; statements regarding expectations that Vista will, on the basis of 2024 drilling results, increase its mineral resource and mineral reserve estimates, convert mineral resources to mineral reserves and expand the mineral resource shell, all with respect to the Batman deposit; the Company’s choice to announce the new mineral resource estimate as part of the Mt Todd feasibility study, scheduled for completion mid-2025; the Company’s belief that the intercepts that returned gold grades that exceeded block model values in the current mineral resource model further demonstrate potential to increase gold mineral reserves; Vista’s belief that the metallurgical characteristics of the material in the north extension will be very similar to the rest of the Batman deposit; the Company’s belief that shallower areas of the SXL may be included in mineral reserves for the 2025 feasibility study; the Company’s belief that the SXL material will be amenable to processing using the same flowsheet as the ore from the Batman deposit; the Company’s belief that the findings from Phase 2 drilling indicate promising potential for expansion in the northeastern section of the current resource shell, including areas of the block model that were previously unclassified due to low data density; the Company’s belief that the SXL structure remains open at depth and along the strike to the northeast, potentially connecting with other exploration targets identified in our 2020-2022 drilling program; the Company’s belief that Northern Territory, Australia is a Tier 1 mining friendly jurisdiction; the Company’s belief that it is positioning Mt Todd as a leading development opportunity within the gold sector; the Company’s belief that Mt Todd offers significant scale, development optionality, growth opportunities, advanced local infrastructure, community support, and demonstrated economic feasibility; the Company’s belief that all major environmental and operating permits necessary to initiate development of Mt Todd are in place; the Company’s belief that Mt Todd is a ready-to-build development stage gold deposit; the Company’s strategy to advance Mt Todd in ways that efficiently position the Project for development while exercising the discipline necessary will best realize value at the right time; and the Company’s belief that advancing Mt Todd in this manner will deliver a more fully valued project to its shareholders are forward-looking statements and forward-looking information. The material factors and assumptions used to develop the forward-looking statements and forward-looking information contained in this news release include the following: the Company’s forecasts and expected cash flows; the Company’s projected capital and operating costs; the Company’s expectations regarding mining and metallurgical recoveries; mine life and production rates; that laws or regulations impacting mine development or mining activities will remain consistent; the Company’s approved business plans, mineral resource and reserve estimates and results of preliminary economic assessments; preliminary feasibility studies and feasibility studies on the Company’s projects, if any; the Company’s experience with regulators; political and social support of the mining industry in Australia; the Company’s experience and knowledge of the Australian mining industry and expectations of economic conditions and the price of gold. When used in this news release, the words “optimistic,” “potential,” “indicate,” “expect,” “intend,” “hopes,” “believe,” “may,” “will,” “if,” “anticipate” and similar expressions are intended to identify forward-looking statements and forward-looking information. These statements involve known and unknown risks, uncertainties and other factors which may cause the actual results, performance, or achievements of the Company to be materially different from any future results, performance or achievements expressed or implied by such statements. Such factors include, among others, uncertainty of resource and reserve estimates, uncertainty as to the Company’s future operating costs and ability to raise capital; risks relating to cost increases for capital and operating costs; risks of shortages and fluctuating costs of equipment or supplies; risks relating to fluctuations in the price of gold; the inherently hazardous nature of mining-related activities; potential effects on our operations of environmental regulations in the countries in which it operates; risks due to legal proceedings; risks relating to political and economic instability in certain countries in which it operates; uncertainty as to the results of bulk metallurgical test work; and uncertainty as to completion of critical milestones for Mt Todd; as well as those factors discussed under the headings “Note Regarding Forward-Looking Statements” and “Risk Factors” in the Company’s latest Annual Report on Form 10-K as filed in March 2024, subsequent Quarterly Reports on Form 10-Q, and other documents filed with the U.S. Securities and Exchange Commission and Canadian securities regulatory authorities. Although Vista has attempted to identify important factors that could cause actual results to differ materially from those described in forward-looking statements and forward-looking information, there may be other factors that cause results not to be as anticipated, estimated or intended. Except as required by law, Vista assumes no obligation to publicly update any forward-looking statements or forward-looking information, whether as a result of new information, future events or otherwise.

Vista Gold Continues to Encounter High Grade Gold Intercepts in Final Holes of 2024 Drilling Program

Denver, Colorado, January 13, 2025 – Vista Gold Corp. (NYSE American and TSX: VGZ) today announced the final drill results for its 2024 drilling program at the Mt Todd gold project. These results further delineate the wider veins with high gold grade intercepts that are consistent with previous drill results in the South Cross Lode (the “SXL”).

Drilling Highlights

VB24-032 – Drilled in the SXL and returned multiple mineralized intervals, including

- 3.0 meters at 4.13 grams of gold per tonne (“g Au/t”) from 121.1 meters downhole, including

- 0.6 meters at 18.34 g Au/t from 123.5 meters downhole

- 1.1 meters at 16.00 g Au/t from 142.9 meters downhole, including

- 0.3 meters at 65.42 g Au/t from 142.9 meters downhole

VB24-033 – Drilled in hanging wall structures adjacent to the Batman deposit and returned multiple mineralized intervals, including

- 43.3 meters at 0.82 g Au/t from 109.0 meters downhole, including

- 1.0 meters at 7.55 g Au/t from 134.0 meters downhole

VB24-034 – Drilled in the SXL and returned multiple mineralized intervals, including

- 29.0 meters at 1.55 g Au/t from 156.0 meters downhole, including

- 1.9 meters at 8.01 g Au/t from 172.1 meters downhole

Frederick H. Earnest, President and CEO, commented, “The holes announced today were an excellent way to finish our drilling in the South Cross Lode. We are most excited about the wider and higher-grade vein intercepts that we continued to encounter at depths beginning just 100 meters below surface. The Company plans to provide an overview of the 2024 drilling program in the coming weeks.

These and prior drill holes in the South Cross Lode demonstrate the continuity of the mineralization along strike at relatively shallow depths. We expect this to benefit the update to our resource model and the reserve estimates that will be completed in conjunction with the in-progress Mt Todd feasibility study.”

Drilling Assessment

The holes reported today concluded Phase 2 of the Company’s 2024 drilling program at the Company’s Mt Todd gold project located in Northern Territory, Australia. These last holes were located to provide specific information to support updating the mineral resource model and to delineate the limits of mineralization in the SXL. Based on 2

these results, we believe that mineralization in the SXL remains open at depth and to the northeast. Hole VB24-033 was drilled to confirm the limits of hanging wall structures adjacent to the Batman deposit.

Holes VB24-031 and VB24-032 demonstrated consistent mineralization from near-surface depths through the end of the holes. Hole VB24-033 was positioned to intercept hanging wall structures to the Batman deposit at greater depths. These three holes were strategically positioned within the 2024 Feasibility Study (as defined below) mineral resources shell. Data from these holes provide a better understanding of the mineralization, structure, and the geological characteristics of the targeted mineralized zones.

Hole VB24-034 is located at the northeast extent of our drilling in the SXL. This hole showed encouraging high grades and featured multiple mineralized intervals, including 29.0 meters at 1.55 g Au/t from 156.0 meters downhole. Along with other nearby holes in the 2024 drilling program, this hole indicates that mineralization remains open at depth and to the northeast, trending towards other identified targets announced for the 2020-2022 drilling program.

Hole VB24-025 was extended to confirm the presence of veins intercepted by deeper holes in the vicinity. This extension successfully identified two additional mineralized intervals, with a notable 7.0 meters at 0.98 g Au/t from 192 meters downhole, including 0.4 meters at 12.56 g Au/t.

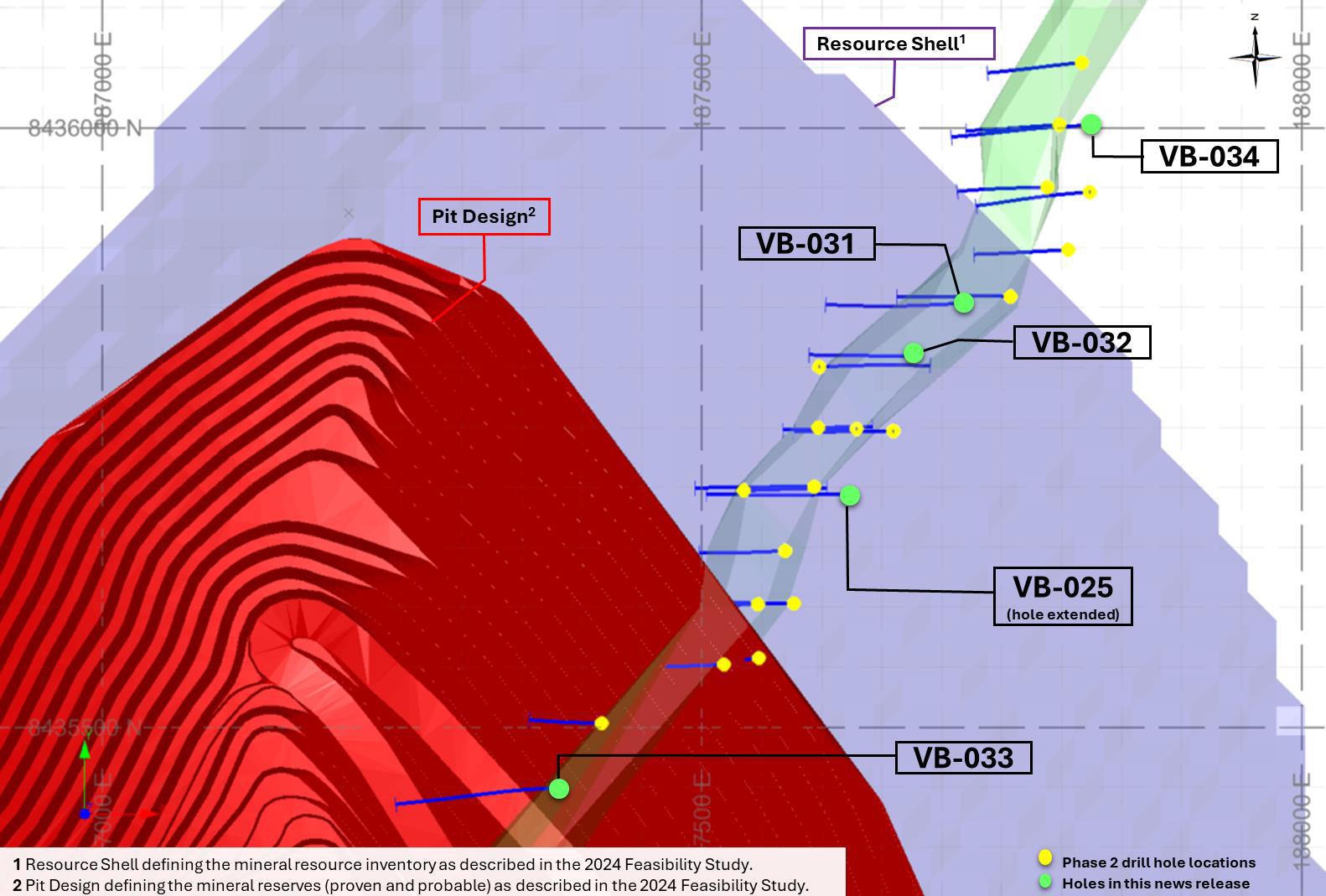

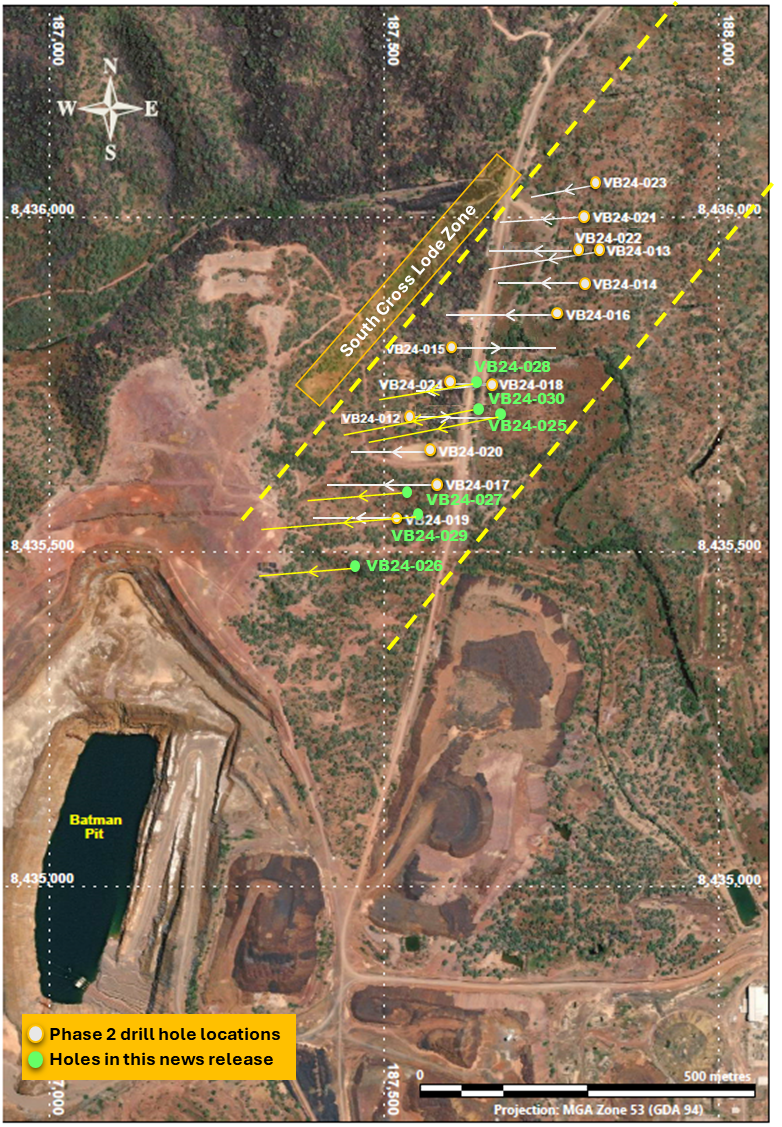

Figure 1: Plan view of the Mt Todd terrain showing Phase 2 drill hole locations with respective orientation, highlighting the holes announced in this release. 4

Figure 2: Plan view of the Phase 2 drill holes, including holes in this release, in relation to the current reserves pit design, resource shell, and the wireframe representing the SXL. 5

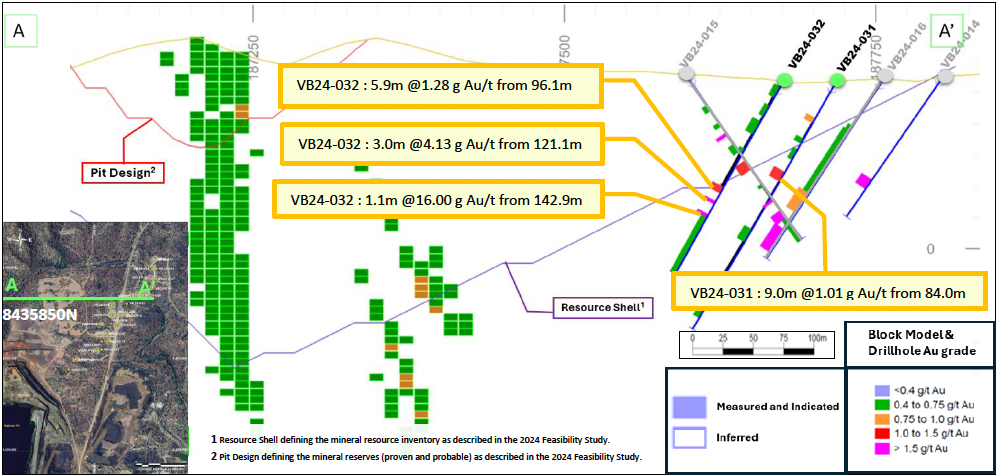

Figure 3: Cross section (8435850N) of the center portion of the SXL, illustrating drill holes VB24-031 and VB24-032 within the current mineral resource shell from the 2024 Feasibility Study featuring blocks with a cut-off grade above 0.40 g Au/t.

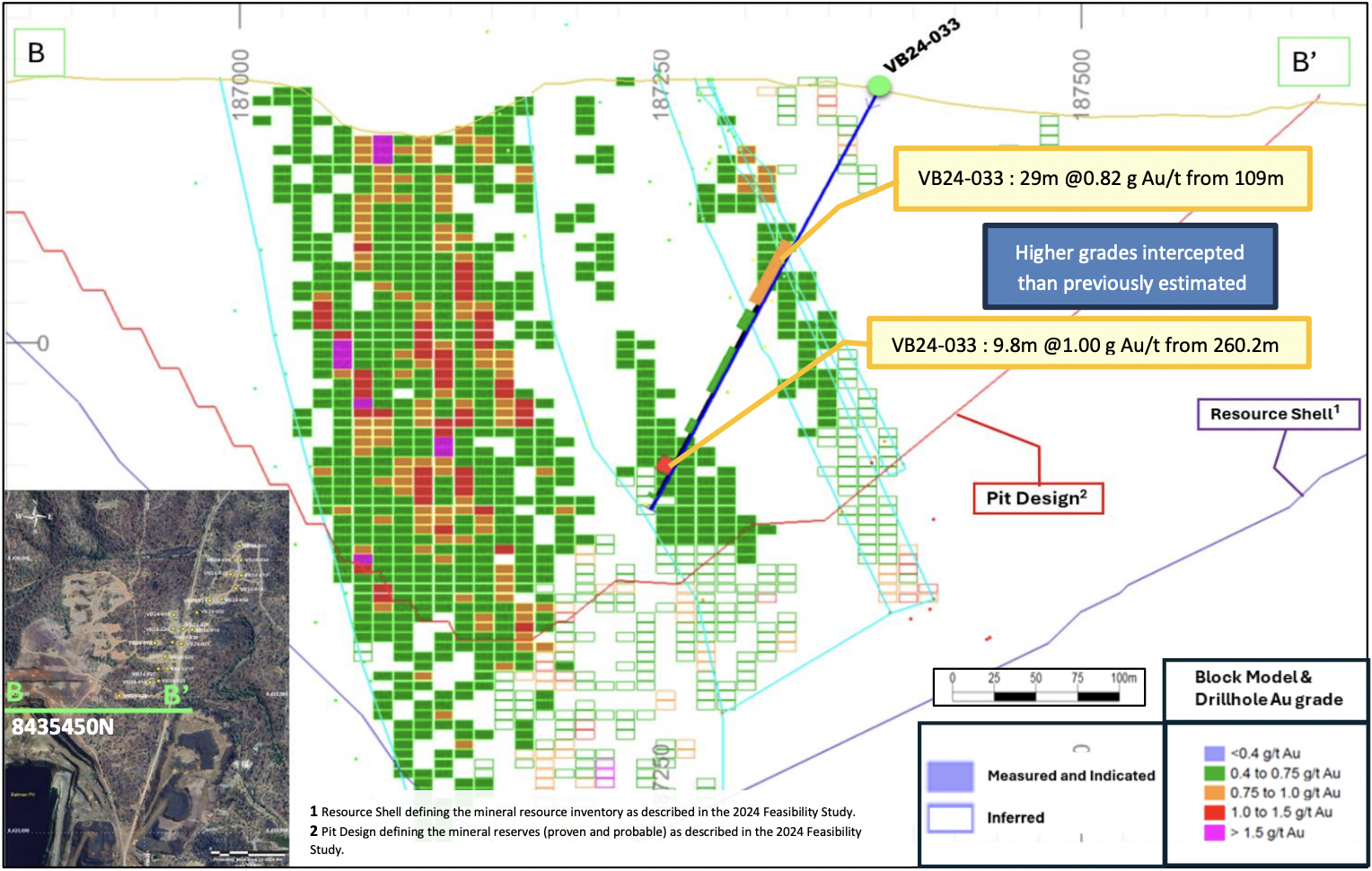

Figure 4: Cross section (8435450N) of the Batman core zone, illustrating drill holes VB24-033 within the current mineral resource shell from the 2024 Feasibility Study featuring blocks with a cut-off grade above 0.40 g Au/t.

Table 1: Summary of Phase 2 drill holes VB24-031 through VB24-034 and extension of VB24-025 – highlighting intercepts greater than 5.0 g Au/t.

*Sample Type – HQ ½ Core

Notes:

- Results are based on ore grade 50 g fire assay for Au.

- Intersections are from diamond core drilling with half-core samples.

- Core sample intervals were constrained by geology, alteration or structural boundaries, intervals varied between a minimum of 0.2 meters to a maximum of 1.2 meters.

- Weighted mean grades have been calculated on a 0.4 g Au/t lower cut-off grade with no upper cut-off grade applied, and maximum internal waste of 4.0 meters.

- All mineralized interval lengths reported are downhole intervals.

- True Thicknesses are estimated based on the orientation of veining as measured relative to the core axis.

- All downhole deviations have been verified by downhole gyro equipment.

- Collar coordinates surveyed by Cross Solutions Pty Ltd using survey-grade GNSS RTK equipment.

- The Company maintains a Quality Assurance and Quality Control (QA/QC) procedures program in accordance with the requirements and guidelines of CIM Standards of Disclosure for Mineral Projects.

- The independent laboratory responsible for the assays was North Australian Laboratories Pty Ltd, Pine Creek, NT.

QA/QC Protocols and Sampling Procedure

All sampling was conducted under the supervision of the Company's geologists and the chain of custody from Mt Todd facilities to the independent sample preparation facility at North Australian Laboratories Pty Ltd (“NAL”) in Pine Creek, NT was continuously monitored.

- The core is marked, geologically logged, geotechnically logged, photographed, and sawn into halves using diamond saws. One-half is placed into pre-numbered sample bags as per industry standards with sample lengths between a minimum of 0.2 meters to a maximum of 1.2 meters. The other half of the core is retained for future reference by the Company. The only exception to this is when a portion of the remaining core has been flagged for use in metallurgical testwork.

- Following common industry practices, blanks and standards are also placed in plastic bags for inclusion in the shipment. A reference blank or a standard is inserted at a minimum ratio of 1 in 10 and additional blank samples are added at suspected high-grade intervals. Standard reference material is sourced from Ore Research & Exploration Pty Ltd and provided in 60-gram sealed packets. When a sequence of four samples is completed, they are placed in a shipping bag and tied closed. All of these samples are kept in a secure area on-site until crated for shipping.

- Vista employees ship and transport the samples to the NAL. At the lab, the samples are pulverized and split down to 50-gram assay samples prior to assaying. The industry-standard 3 assay-ton fire assay is followed by an atomic absorption (AA) finish.

- For the purposes of this release, mineralized intervals are defined as runs of mineralization with a maximum internal waste of 4.0 meters.

- NAL is independent of Vista.

It is the opinion of the QP (as defined below) that the sample preparation methods and quality control measures employed before the dispatch of samples to an analytical or testing laboratory ensured the validity and integrity of samples taken.

About Vista Gold Corp.

Vista holds the Mt Todd gold project, ready-to-build development-stage gold deposit located in the Tier-1 mining jurisdiction of Northern Territory, Australia. Vista is positioning Mt Todd as a leading development opportunity within the gold sector. Mt Todd offers significant scale, development optionality, growth opportunities, advanced local infrastructure, community support, and demonstrated economic feasibility. All major environmental and operating permits necessary to initiate development of Mt Todd are in place.

Vista’s strategy is to advance Mt Todd in ways that efficiently position the project for development while exercising the discipline necessary to best realize value at the right time. Vista believes its strategy of advancing Mt Todd in this manner will deliver a more fully valued project to its shareholders.

For further information about Vista or Mt Todd, please contact Pamela Solly, Vice President of Investor Relations, at (720) 981-1185 or visit the Company’s website at www.vistagold.com.

Qualified Person

Maria Vallejo, Vista’s Director of Projects and Technical Services, a Qualified Person (“QP”) as defined by Item 1300 of Regulation S-K under the Securities Exchange Act of 1934, as amended, and Canadian National Instrument 43-101 – Standards of Disclosure for Mineral Projects, has verified the data underlying the information contained herein and has approved this press release. The information contained in this press release is provided to inform the reader of the advancement of the 2024 drilling program for the Mt Todd project.

Maria Vallejo, Vista’s Director of Projects and Technical Services, a Qualified Person (“QP”) as defined by Item 1300 of Regulation S-K under the Securities Exchange Act of 1934, as amended, and Canadian National Instrument 43-101 – Standards of Disclosure for Mineral Projects, has verified the data underlying the information contained herein and has approved this press release. The information contained in this press release is provided to inform the reader of the advancement of the 2024 drilling program for the Mt Todd project.

Technical Studies

For more information on the Company’s March 2024 feasibility study (the “2024 Feasibility Study”), including with respect to mineral resource and mineral reserve estimates, please refer to the technical report summary entitled “S-K 1300 Technical Report Summary – Mt Todd Gold Project – 50,000 tpd Feasibility Study – Northern Territory, Australia” with an effective date of March 12, 2024 and an issue date of March 14, 2024 available at www.sec.gov and, for Canadian purposes, the technical report entitled “National Instrument 43-101 Technical Report – Mt Todd Gold Project – 50,000 tpd Feasibility Study – Northern Territory, Australia” with an effective date of March 12, 2024 and an issue date of April 16, 2024 under Vista’s profile at www.sedarplus.ca. For more information on the Company’s 2024 drilling results, please refer to the Company’s previous 2024 drilling news releases available under the Company’s profile at www.sedarplus.ca.

Forward Looking Statements