Vista Gold Corp. Achieves Significant Milestone with Approval of the Final Major Authorization for Mt Todd

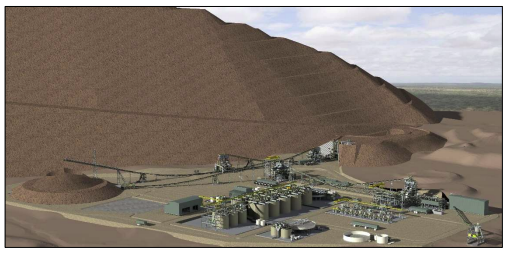

DENVER, June 14, 2021 (GLOBE NEWSWIRE) -- Vista Gold Corp. (NYSE American and TSX: VGZ) (“Vista” or the “Company”) is pleased to announce it has received approval of the Mining Management Plan (“MMP”) by the Northern Territory (“NT”) Government for the Company’s 100% owned Mt Todd gold project (“Mt Todd” or the “Project”) located in Northern Territory, Australia.

The MMP (similar to a mine operating permit in North America) is the final major authorization required for the development of the Mt Todd mine. The receipt of this approval marks the achievement of a significant de-risking milestone that has been the focus of the Company for the last three years. This approval, combined with the previously-approved major environmental permits, recognizes the quality and advanced stage of engineering and project planning, and is a fundamental part of the Company’s strategy for gaining greater recognition of the intrinsic value of Mt Todd.

Frederick H. Earnest, President and Chief Executive Officer of Vista, stated, “The approval of the MMP is a landmark achievement for Vista, its shareholders and the Northern Territory. We believe the approval of the MMP distinguishes Mt Todd as an attractive, de-risked, and partner-ready development-stage gold project highlighted by a large-scale production design, low expected operating costs, mining friendly jurisdiction, substantial existing infrastructure, strong social and government support, and all major authorizations in hand.”

“At a gold price of $1,900 and a foreign exchange rate of US$0.775=A$1.00, the after-tax NPV5% is estimated to be $1.7 billion with an after-tax IRR of more than 38.8%. We are committed to realizing the full value of Mt Todd for our shareholders.” Vista Gold CEO Video.

Mr. Earnest continued, “Following extensive consultation with the Jawoyn people and local environmental, community and business stakeholders, we’re very pleased to be another step closer to delivering a project that is expected to provide significant economic benefit to the Northern Territory. We would like to thank our employees and consultants for their unyielding determination as they worked diligently and cooperatively with the NT Government to advance the permitting process, and express our appreciation to the people in the surrounding communities for the strong support they have demonstrated for Mt Todd and Vista. We will continue to work closely with all stakeholders to ensure the safe and responsible development of Mt Todd.”

Technical Report on Mt Todd

For further information on the Mt Todd Gold Project, see the Technical Report entitled “NI 43-101 Technical Report Mt Todd Gold Project 50,000 tpd Preliminary Feasibility Study Northern Territory, Australia” with an effective date of September 10, 2019 and an issue date of October 7, 2019, amended September 22, 2020, which is available on SEDAR as well as on Vista’s website under the Technical Reports section. John Rozelle, Vista’s Sr. Vice President, a Qualified Person as defined by National Instrument 43-101 – Standards of Disclosure for Mineral Projects, has approved the information in this press release.

About Vista Gold Corp. and Mt Todd

Vista is a gold project developer. The Company’s flagship asset is the Mt Todd gold project located in the Tier 1, mining friendly jurisdiction of Northern Territory, Australia. Situated approximately 250 km southeast of Darwin, Mt Todd is the largest undeveloped gold project in Australia and, if developed as presently designed, would potentially be Australia’s fourth largest gold producer on an annual basis, with lowest tertile in-country and global all-in sustaining costs. Mt Todd’s extensive 1,501 km2 of exploration licenses offer excellent potential to expand gold resources and reserves and increase the life of the mine. All major operating and environmental permits have now been approved.

For further information, please contact Pamela Solly, Vice President of Investor Relations, at (720) 981-1185 or visit the Vista Gold website at www.vistagold.com.

Forward Looking Statements

This press release contains forward-looking statements within the meaning of the U.S. Securities Act of 1933, as amended, and U.S. Securities Exchange Act of 1934, as amended, and forward-looking information within the meaning of Canadian securities laws. All statements, other than statements of historical facts, included in this press release that address activities, events or developments that we expect or anticipate will or may occur in the future, including such things as the belief Mt Todd is an attractive, de-risked, and partner-ready development-stage gold project; the future value of Mt Todd including estimates of after-tax NPV5% and after-tax IRR; that Mt Todd is the largest undeveloped gold project in Australia; our commitment to a strategy that maximizes shareholder value; our expectation that Mt Todd will be Australia’s fourth largest gold producer on an annual basis, with lowest tertile in-country and global all-in sustaining costs; the belief that greater recognition of the intrinsic value of Mt Todd will be gained; the expectation that the Mt Todd mine will achieve large-scale production and low operating costs; the expectation that the Project will provide significant economic benefit to Northern Australia; the belief that Mt Todd’s exploration licenses offer potential to expand gold resources and reserves and increase the life of the mine; and other anticipated mine development and operating costs and results at Mt Todd are forward-looking statements and forward-looking information. The material factors and assumptions used to develop the forward-looking statements and forward-looking information contained in this press release include the following: our approved business plans, exploration and assay results, results of our test work for process area improvements, mineral resource and reserve estimates and results of preliminary economic assessments, prefeasibility studies and feasibility studies on our projects, if any, our experience with regulators, and positive changes to current economic conditions and the price of gold. When used in this press release, the words “optimistic,” “potential,” “indicate,” “expect,” “intend,” “hopes,” “believe,” “may,” “will,” “if,” “anticipate,” and similar expressions are intended to identify forward-looking statements and forward-looking information. These statements involve known and unknown risks, uncertainties and other factors which may cause the actual results, performance or achievements of the Company to be materially different from any future results, performance or achievements expressed or implied by such statements. Such factors include, among others, uncertainty of resource and reserve estimates, uncertainty as to the Company’s future operating costs and ability to raise capital; whether potential partners exist and what views they may have regarding expeditious development of the Mt. Todd project; risks relating to cost increases for capital and operating costs; risks of shortages and fluctuating costs of equipment or supplies; risks relating to fluctuations in the price of gold; the inherently hazardous nature of mining-related activities; whether anticipated gold recoveries and production would be achieved; potential effects on our operations of environmental regulations in the countries in which it operates; risks due to legal proceedings; risks relating to political and economic instability in certain countries in which it operates; uncertainty as to the results of bulk metallurgical test work; and uncertainty as to completion of critical milestones for Mt Todd; as well as those factors discussed under the headings “Note Regarding Forward-Looking Statements” and “Risk Factors” in the Company’s latest Annual Report on Form 10-K and other documents filed with the U.S. Securities and Exchange Commission and Canadian securities regulatory authorities. Although we have attempted to identify important factors that could cause actual results to differ materially from those described in forward-looking statements and forward-looking information, there may be other factors that cause results not to be as anticipated, estimated or intended. Except as required by law, we assume no obligation to publicly update any forward-looking statements or forward-looking information; whether as a result of new information, future events or otherwise.

Cautionary Note to United States Investors

The United States Securities and Exchange Commission (“SEC”) limits disclosure for U.S. reporting purposes to mineral deposits that a company can economically and legally extract or produce. The technical reports referenced in this press release uses the terms defined in Canadian National Instrument 43-101 – Standards of Disclosure for Mineral Projects (“NI 43-101”) and the Canadian Institute of Mining, Metallurgy and Petroleum (the “CIM”) – CIM Definition Standards on Mineral Resources and Mineral Reserves, adopted by the CIM Council, as amended (the “CIM Definition Standards”). These standards are not the same as reserves under the SEC’s Industry Guide 7 and may not constitute reserves or resources under the SEC’s newly adopted disclosure rules to modernize mineral property disclosure requirements (“SEC Modernization Rules”), which became effective February 25, 2019 and will be applicable to the Company in its annual report for the fiscal year ending December 31, 2021. Under the currently applicable SEC Industry Guide 7 standards, a “final” or “bankable” feasibility study is required to report reserves, the three-year historical average price is used in any reserve or cash flow analysis to designate reserves and all necessary permits and government approvals must be filed with the appropriate governmental authority. Additionally, the technical reports uses the terms “measured resources”, “indicated resources”, and “measured & indicated resources”. We advise U.S. investors that while these terms are Canadian mining terms as defined in accordance with NI 43-101, such terms are not recognized under SEC Industry Guide 7 and normally are not permitted to be used in reports and registration statements filed with the SEC. Mineral resources described in the technical reports have a great amount of uncertainty as to their economic and legal feasibility. The SEC normally only permits issuers to report mineralization that does not constitute SEC Industry Guide 7 compliant “reserves” as in-place tonnage and grade, without reference to unit measures. “Inferred resources” have a great amount of uncertainty as to their existence, and great uncertainty as to their economic and legal feasibility. It cannot be assumed that any or all part of an inferred resource will ever be upgraded to a higher category. U.S. Investors are cautioned not to assume that any part or all of mineral deposits in these categories will ever be converted into SEC Industry Guide 7 reserves.

Under the SEC Modernization Rules, the definitions of “proven mineral reserves” and “probable mineral reserves” have been amended to be substantially similar to the corresponding CIM Definition Standards and the SEC has added definitions to recognize “measured mineral resources”, “indicated mineral resources” and “inferred mineral resources” which are also substantially similar to the corresponding CIM Definition Standard. However there are differences between the definitions and standards under the SEC Modernization Rules and those under the CIM Definition Standards and therefore once the Company begins reporting under the SEC Modernization Rules there is no assurance that the Company’s mineral reserve and mineral resource estimates will be the same as those reported under CIM Definition Standards as contained in the technical reports prepared under CIM Definition Standards or that the economics for the Mt Todd project estimated in such technical reports will be the same as those estimated in any technical report prepared by the Company under the SEC Modernization Rules in the future.

Vista Gold Corp. Receives Key Aboriginal and Water Authorizations for the Mt Todd Gold Project

DENVER, June 17, 2021 (GLOBE NEWSWIRE) -- Vista Gold Corp. (NYSE American and TSX: VGZ) (“Vista” or the “Company”) is pleased to announce it has received the Aboriginal Areas Protection Authority (“AAPA”) Certificate and Surface Water Extraction License from the Northern Territory Government for the Company’s 100% owned Mt Todd gold project (“Mt Todd” or the “Project”) located in Northern Territory, Australia.

Aboriginal Areas Protection Authority Certificate

An AAPA Certificate is required as a legal means to identify and protect sacred sites from damage by setting out the conditions for using or carrying out works on an area of land. It is a legal document issued under the Northern Territory Aboriginal Sacred Sites Act.

Following extensive review, the AAPA determined that the use of, or work on, certain areas can proceed without a risk of damage to, or interference with, the sacred sites identified at Mt Todd. The AAPA Authority Certificate for Mt Todd covers the 1,501 km² of exploration licenses contiguous with the mining leases.

Surface Water Extraction License

Following the approval of the Mining Management Plan, the Mt Todd Surface Water Extraction License has been approved. This provides Vista with the right to harvest 3.4 Gigalitres of surface run-off each year to facilitate processing and mining activities associated with Mt Todd and is expected to adequately supply all of the Project’s water requirements as presently designed. The license is valid for 10 years with the right to renew.

Frederick H. Earnest, President and Chief Executive Officer of Vista, stated, “These two supporting authorizations underscore our strong commitment to the protection of sites of sacred or cultural significance to the aboriginal people and the wise use of water resources at the Mt Todd gold project. The AAPA Certificate for the area of the exploration licenses complements the existing AAPA certificate for the areas within the mining licenses and affirms our present practice of working closely with Jawoyn people to ensure constant communication and coordination in identifying and protecting sacred and culturally significant sites.”

Mr. Earnest continued, “Every mining project needs water and with the approval of the Surface Water Extraction License, we are assured the right to capture surface run-off during the wet season and store it for use during the balance of the year. This permit approval assures the Project with the water needed for our planned operations, recognizes our commitment to responsible water use, and allows us to capture water during the portion of the year when there is abundant surface run-off, rather than competing with other water users for ground water resources.”

About Vista Gold Corp. and Mt Todd

Vista is a gold project developer. The Company’s flagship asset is the Mt Todd gold project located in the Tier 1, mining friendly jurisdiction of Northern Territory, Australia. Situated approximately 250 km southeast of Darwin, Mt Todd is the largest undeveloped gold project in Australia and, if developed as presently designed, would potentially be Australia’s fourth largest gold producer on an annual basis, with lowest tertile in-country and global all-in sustaining costs. All major operating and environmental permits have now been approved.

For further information, please contact Pamela Solly, Vice President of Investor Relations, at (720) 981-1185 or visit the Vista Gold website at www.vistagold.com.

Forward Looking Statements

This press release contains forward-looking statements within the meaning of the U.S. Securities Act of 1933, as amended, and U.S. Securities Exchange Act of 1934, as amended, and forward-looking information within the meaning of Canadian securities laws. All statements, other than statements of historical facts, included in this press release that address activities, events or developments that we expect or anticipate will or may occur in the future, including such things as our belief that the use of, or works on, certain designated areas can proceed without a risk of damage to, or interference with, the sacred sites identified at Mt Todd; our belief that harvesting 3.4 Gigalitres of surface run-off water each year to facilitate the processing and mining activities associated with Mt Todd is expected to adequately supply all of the Project’s water requirements as presently designed; our belief that the authorization underscores our strong commitment to the protection of sites of sacred or cultural significance to the aboriginal people and the wise use of water resources at the Mt Todd gold project; our belief that the AAPA Certificate for the area of the exploration licenses complements the existing AAPA certificate for the areas of the mining licenses and affirms our present practice of working closely with the Jawoyn people to ensure constant communications and coordination in identifying and protecting sacred and culturally significant sites; our belief that the Water Extraction License assures us the right to capture surface run-off during the wet season and store it for use during the balance of the year and recognizes our commitment to responsible water use; our belief that Mt Todd is the largest undeveloped gold project in Australia; our expectation that Mt Todd will be Australia’s fourth largest gold producer on an annual basis, with lowest tertile in-country and global all-in sustaining costs; the belief that greater recognition of the intrinsic value of Mt Todd will be gained; and other anticipated mine development and operating costs and results at Mt Todd are forward-looking statements and forward-looking information. The material factors and assumptions used to develop the forward-looking statements and forward-looking information contained in this press release include the following: our approved business plans, exploration and assay results, results of our test work for process area improvements, mineral resource and reserve estimates and results of preliminary economic assessments, prefeasibility studies and feasibility studies on our projects, if any, our experience with regulators, and positive changes to current economic conditions and the price of gold. When used in this press release, the words “optimistic,” “potential,” “indicate,” “expect,” “intend,” “hopes,” “believe,” “may,” “will,” “if,” “anticipate,” and similar expressions are intended to identify forward-looking statements and forward-looking information. These statements involve known and unknown risks, uncertainties and other factors which may cause the actual results, performance or achievements of the Company to be materially different from any future results, performance or achievements expressed or implied by such statements. Such factors include, among others, uncertainty of resource and reserve estimates, uncertainty as to the Company’s future operating costs and ability to raise capital; whether potential partners exist and what views they may have regarding expeditious development of the Mt. Todd project; risks relating to cost increases for capital and operating costs; risks of shortages and fluctuating costs of equipment or supplies; risks relating to fluctuations in the price of gold; the inherently hazardous nature of mining-related activities; whether anticipated gold recoveries and production would be achieved; potential effects on our operations of environmental regulations in the countries in which it operates; risks due to legal proceedings; risks relating to political and economic instability in certain countries in which it operates; uncertainty as to the results of bulk metallurgical test work; and uncertainty as to completion of critical milestones for Mt Todd; as well as those factors discussed under the headings “Note Regarding Forward-Looking Statements” and “Risk Factors” in the Company’s latest Annual Report on Form 10-K and other documents filed with the U.S. Securities and Exchange Commission and Canadian securities regulatory authorities. Although we have attempted to identify important factors that could cause actual results to differ materially from those described in forward-looking statements and forward-looking information, there may be other factors that cause results not to be as anticipated, estimated or intended. Except as required by law, we assume no obligation to publicly update any forward-looking statements or forward-looking information; whether as a result of new information, future events or otherwise.

Vista Gold Corp. Receives $1.0 Million Guadalupe de los Reyes Payment

DENVER, June 28, 2021 (GLOBE NEWSWIRE) -- Vista Gold Corp. (NYSE American and TSX: VGZ) (“Vista” or the “Company”) today announced receipt of the final $1.0 million payment from Prime Mining Corp. (“Prime Mining”).

As announced on June 15, 2020 (see news release), Prime Mining was required to pay Vista $2.1 million in lieu of Vista being granted certain royalties and back-in rights relating to the Guadalupe de los Reyes gold / silver project in Mexico. The first payment of $1.1 million was paid in January 2021. With this $1.0 million payment, Vista has no remaining right to be granted the royalties and back-in rights.

Frederick H. Earnest, President and Chief Executive Officer of Vista, commented, “We are pleased to receive this final payment and successfully complete this agreement with Prime Mining.”

All dollar amounts in this press release are in U.S. dollars.

About Vista Gold Corp.

The Company is a gold project developer. The Company’s flagship asset is the Mt Todd gold project in the Tier-1 mining jurisdiction of Northern Territory, Australia. Mt Todd is the largest undeveloped gold project in Australia and if developed as presently designed, would potentially be Australia’s fourth largest gold producer on an annual basis.

For further information about Vista or the Mt Todd gold project, please contact Pamela Solly, Vice President of Investor Relations, at (720) 981-1185 or visit the Company’s website at www.vistagold.com to access important information, including the current Technical Report.

Forward Looking Statements

This press release contains forward-looking statements within the meaning of the U.S. Securities Act of 1933, as amended, and U.S. Securities Exchange Act of 1934, as amended, and forward-looking information within the meaning of Canadian securities laws. All statements, other than statements of historical facts, included in this press release that address activities, events or developments that we expect or anticipate will or may occur in the future, including such things as our ongoing efforts to advance development of Mt Todd to potentially be Australia’s fourth largest gold producer are forward-looking statements and forward-looking information. The material factors and assumptions used to develop the forward-looking statements and forward-looking information contained in this press release include the following: our discussions and contractual arrangements with Prime Mining; our reliance that Prime Mining will deem the exploration results at the Guadalupe de los Reyes gold / silver project sufficiently positive to continue its business plans for this project and its ability to raise funds to meet obligations when due; our approved business plans, exploration and assay results, results of our test work for process area improvements, mineral resource and reserve estimates and results of preliminary economic assessments, prefeasibility studies and feasibility studies on our projects, if any, our experience with regulators, and positive changes to current economic conditions and the price of gold. When used in this press release, the words “optimistic,” “potential,” “indicate,” “expect,” “intend,” “hopes,” “believe,” “may,” “will,” “if,” “anticipate,” and similar expressions are intended to identify forward-looking statements and forward-looking information. These statements involve known and unknown risks, uncertainties and other factors which may cause the actual results, performance or achievements of the Company to be materially different from any future results, performance or achievements expressed or implied by such statements. Such factors include, among others, uncertainty of resource and reserve estimates, uncertainty as to the Company’s future operating costs and ability to raise capital; risks relating to cost increases for capital and operating costs; risks of shortages and fluctuating costs of equipment or supplies; risks relating to fluctuations in the price of gold; the inherently hazardous nature of mining-related activities; potential effects on our operations of environmental regulations in the countries in which it operates; risks due to legal proceedings; risks relating to political and economic instability in certain countries in which it operates; uncertainty as to the results of bulk metallurgical test work; and uncertainty as to completion of critical milestones for Mt Todd; as well as those factors discussed under the headings “Note Regarding Forward-Looking Statements” and “Risk Factors” in the Company’s latest Annual Report on Form 10-K as filed February 26, 2021 and other documents filed with the U.S. Securities and Exchange Commission and Canadian securities regulatory authorities. Although we have attempted to identify important factors that could cause actual results to differ materially from those described in forward-looking statements and forward-looking information, there may be other factors that cause results not to be as anticipated, estimated or intended. Except as required by law, we assume no obligation to publicly update any forward-looking statements or forward-looking information; whether as a result of new information, future events or otherwise.

Vista Gold Corp. Announces US$8 Million Bought Deal Offering

DENVER, July 07, 2021 (GLOBE NEWSWIRE) -- Vista Gold Corp. (NYSE American and TSX: VGZ) (“Vista” or the “Company”) is pleased to announce that it has entered into an underwriting agreement with a syndicate of underwriters with H.C. Wainwright & Co. acting as sole book-running manager and representative of the underwriters, under which the underwriters have agreed to purchase in a public offering on a firm commitment basis 7,272,728 units of the Company (the “Units”) at a public offering price of US$1.10 per Unit, less underwriting discounts and commissions, for aggregate gross proceeds of approximately US$8,000,000 (the “Offering”). Each Unit consists of one common share in the capital of the Company (each, a “Common Share”) and one-half of one Common Share purchase warrant (each whole warrant, a “Warrant”). Each Warrant will be exercisable immediately upon issuance for thirty six months and entitle the holder thereof to purchase one Common Share upon exercise at an exercise price of US$1.25 per Common Share.

H.C. Wainwright & Co. is acting as sole book-running manager for the Offering. Haywood Securities Inc. is acting as co-manager for the Offering.

In addition, the Company has granted the underwriters an option, exercisable at any time and from time to time for up to 30 days, to purchase up to an additional 1,090,908 Units, and/or 1,090,908 Common Shares and/or Warrants to purchase up to 545,454 Common Shares at the public offering price per Unit, per Common Share and/or per Warrant, respectively, less underwriting discounts and commissions, in any combination thereof so long as the aggregate number of additional Common Shares and additional Warrants that may be issued under the option does not exceed 1,090,908 additional Common Shares and 545,454 additional Warrants.

The Offering is expected to close on or about July 12, 2021, subject to the satisfaction of customary closing conditions, including TSX and NYSE American approvals. For the purposes of the TSX approval, the Company intends to rely on the exemption set forth in Section 602.1 of the TSX Company Manual, which provides that the TSX will not apply its standards to certain transactions involving eligible interlisted issuers on a recognized exchange, such as NYSE American.

The Company intends to allocate the net proceeds from the Offering to advance programs at Mt Todd by further refining technical aspects of the project, enhancing economic returns, and supporting the Company’s objective of securing a development partner. These programs may include additional drilling and technical reports supported by engineering/design work and other technical studies. Remaining proceeds will be used for working capital requirements and/or for other general corporate purposes, which include ongoing regulatory, legal and accounting expenses, management and administrative expenses, and other corporate initiatives.

A shelf registration statement on Form S-3 (File No. 333-239139) relating to the securities described above was filed with the U.S. Securities and Exchange Commission (the “SEC”) on June 12, 2020, and became effective on June 24, 2020 and an additional registration statement on Form S-3 filed pursuant to Rule 462(b) (File No. 333-257746), which became automatically effective on July 7, 2021. The offering will be made only by means of a prospectus supplement and accompanying prospectus that form a part of the effective shelf registration statement. A preliminary prospectus supplement and accompanying prospectus relating to the Offering have been filed with the SEC and will be available on the SEC's website, located at www.sec.gov. Electronic copies of the preliminary prospectus supplement and accompanying prospectus, and the final prospectus supplement and accompanying prospectus relating to the Offering, when filed, may also be obtained from H.C. Wainwright & Co., LLC, 430 Park Avenue, New York, NY 10022, by email at

The Company will file a prospectus supplement with the securities regulatory authorities in each province of Canada (other than Quebec) to supplement the Company’s Canadian short form base shelf prospectus dated October 5, 2020. Before you invest, you should read the offering documents and other documents that the Company has filed with the Canadian securities regulatory authorities for more complete information about the Company and the Offering. A copy of the underwriting agreement will be available for free by visiting the Company’s profiles on SEDAR at www.sedar.com.

Alternatively, a copy of the offering documents can be obtained by contacting the Company, attention: Pamela Solly, Vice President of Investor Relations, at (720) 981-1185, 7961 Shaffer Parkway, Suite 5, Littleton, Colorado 80127.

This press release shall not constitute an offer to sell or the solicitation of an offer to buy these securities, nor shall there be any sale of these securities in any state or jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such state or jurisdiction.

About Vista Gold Corp.

Vista is a gold project developer. The Company’s flagship asset is the Mt Todd gold project located in the Tier 1, mining friendly jurisdiction of Northern Territory, Australia. Situated approximately 250 km southeast of Darwin, Mt Todd is the largest undeveloped gold project in Australia and, if developed as presently designed, would potentially be Australia’s fourth largest gold producer on an annual basis, with lowest tertile in-country and global all-in sustaining costs. All major operating and environmental permits have now been approved.

For further information, please contact Pamela Solly, Vice President of Investor Relations, at (720) 981-1185.

Forward Looking Statements

This press release contains forward-looking statements within the meaning of the U.S. Securities Act of 1933, as amended, and U.S. Securities Exchange Act of 1934, as amended, and forward-looking information within the meaning of Canadian securities laws. All statements, other than statements of historical facts, included in this press release that address activities, events or developments that we expect or anticipate will or may occur in the future, including such things as statements with respect to the expected closing date of the Offering, the use of proceeds from the Offering and our intent to file the Offering Documents; our belief that Mt Todd is the largest undeveloped gold project in Australia; our expectation that Mt Todd will be Australia’s fourth largest gold producer on an annual basis, with lowest tertile in-country and global all-in sustaining costs; other anticipated mine development and operating costs and results at Mt Todd, and other such matters are forward-looking statements and forward-looking information. The material factors and assumptions used to develop the forward-looking statements and forward-looking information contained in this press release include the following: our understanding and belief of the current market conditions, approved business plans, exploration and assay results, results of our test work for process area improvements, mineral resource and reserve estimates and results of preliminary economic assessments, prefeasibility studies and feasibility studies on our projects, if any, our experience with regulators, and positive changes to current economic conditions and the price of gold. When used in this press release or otherwise, the words “optimistic,” “potential,” “indicate,” “expect,” “intend,” “hopes,” “believe,” “may,” “will,” “if,” “anticipate,” and similar expressions are intended to identify forward-looking statements and forward-looking information. These statements involve known and unknown risks, uncertainties and other factors which may cause the actual results, performance or achievements of the Company to be materially different from any future results, performance or achievements expressed or implied by such statements. Such factors include, among others, our ability to satisfy the conditions to closing of the Offering and to use the proceeds from the Offering as expected, uncertainty of mineral resource and reserve estimates, uncertainty as to the Company’s future operating costs and ability to raise capital; whether potential partners exist and what views they may have regarding any transaction terms and expeditious development of the Mt. Todd project; risks relating to cost increases for capital and operating costs; risks of shortages and fluctuating costs of equipment or supplies; risks relating to fluctuations in the price of gold; the inherently hazardous nature of mining-related activities; whether anticipated gold recoveries and production would be achieved; potential effects on our operations of environmental regulations in the countries in which we operate; risks due to legal proceedings; risks relating to political and economic instability in certain countries in which we operate; uncertainty as to the results of bulk metallurgical test work; and uncertainty as to completion of critical milestones for Mt Todd; as well as those factors discussed under the headings “Note Regarding Forward-Looking Statements” and “Risk Factors” in the Company’s latest Annual Report on Form 10-K and other documents filed with the U.S. Securities and Exchange Commission and Canadian securities regulatory authorities. Although we have attempted to identify important factors that could cause actual results to differ materially from those described in forward-looking statements and forward-looking information, there may be other factors that cause results not to be as anticipated, estimated or intended. Except as required by law, we assume no obligation to publicly update any forward-looking statements or forward-looking information; whether as a result of new information, future events or otherwise.

Vista Gold Provides Corporate Update

Denver, Colorado, November 30, 2021 - Vista Gold Corp. (“Vista” or the “Company”) (NYSE American and TSX: VGZ) provided an update on the definitive feasibility study (“DFS”) for its 100% owned Mt Todd gold project (“Mt Todd” or the “Project”) in Northern Territory, Australia and other key programs.

Frederick H. Earnest, President and CEO of Vista, commented, “We are approaching the achievement of a very important milestone in increasing shareholder value. The Mt Todd DFS is nearly complete and we expect to announce the results early next year. We believe the DFS results, reflective of more detailed engineering and the higher level of precision in cost estimating required for this study, will generate significant interest in the Project from investors and potential partners. In addition to a new mine plan using a higher gold price, which we expect to result in an increase in reserves and a longer mine life, we are completing trade-off studies that have the potential to lower related capital costs. We continue to execute on our strategy to seek a partner and believe the DFS will provide the catalyst for accelerating the process. Our exploration drilling program is ongoing and expected to continue through the first quarter of 2022. As part of the Company’s normal course of business, we recently filed a Registration Statement on Form S-3 to maintain maximum financial flexibility as we advance toward our goal of a joint venture to develop Mt Todd.”

Definitive Feasibility Study

The DFS is on schedule and on budget, with completion expected in early 2022. As previously reported, Vista is:

- completing the remaining feasibility-level engineering in the process plant (piping, electrical, and instrumentation);

- updating Project designs to be consistent with the approved Mine Management Plan;

- revising the mine plan using a higher gold price, which is expected to reflect increased gold reserves, improve the production profile, and extend the life of the mine;

- completing the Project economic evaluation using a gold price and cost inputs more reflective of current market conditions;

- undertaking trade-off studies to evaluate opportunities to reduce related capital costs by using a third-party power generating facility and contract mining; and

- evaluating autonomous truck haulage as part of the operating cost optimization work.

Development Strategy

The DFS is a major milestone which is expected to raise the profile of and expedite our ongoing partnering process, leading to a joint venture or other transaction that will recognize the intrinsic value of Mt Todd for Vista shareholders.

Vista has completed extensive technical work at Mt Todd and has the approval of all major permits required to undertake project development. The completion of the DFS is expected to provide a solid foundation and catalyst to move forward expeditiously with prospective partners to establish a mutually beneficial pathway for development of the Project.

Exploration Drilling Program

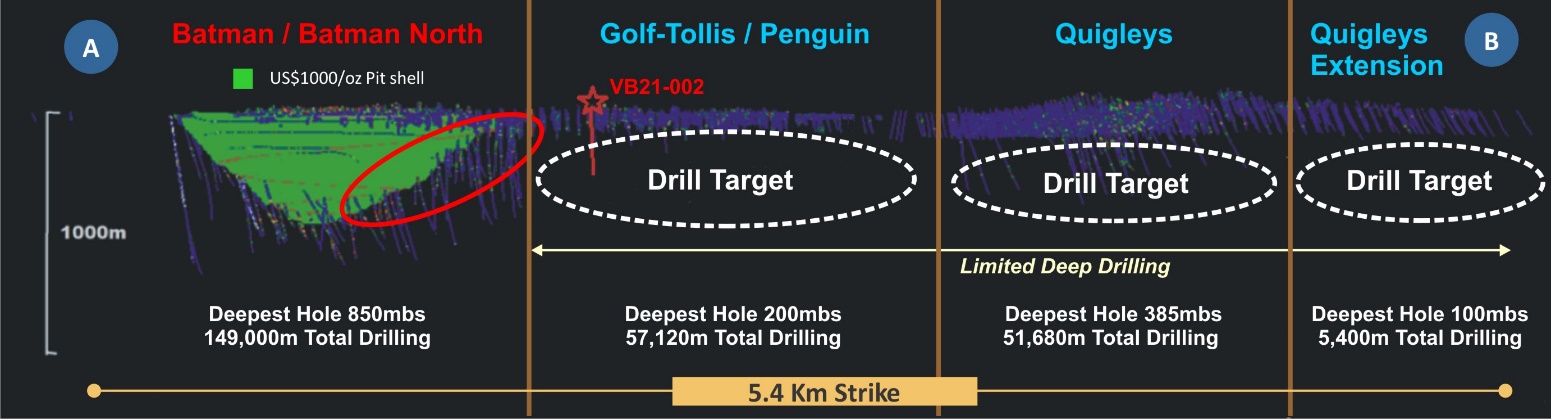

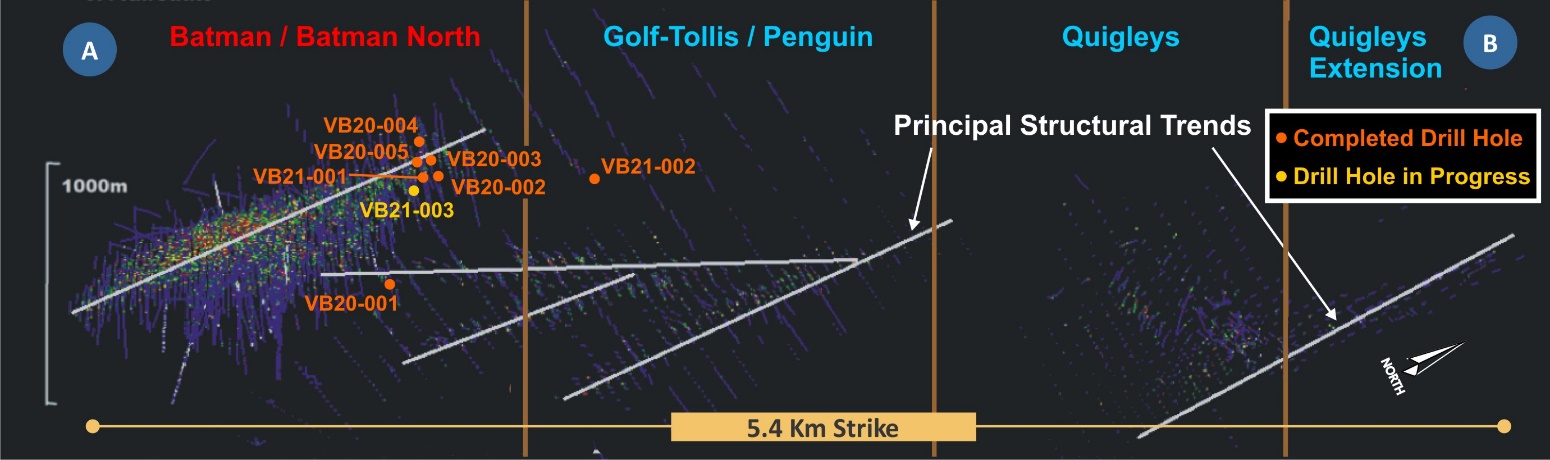

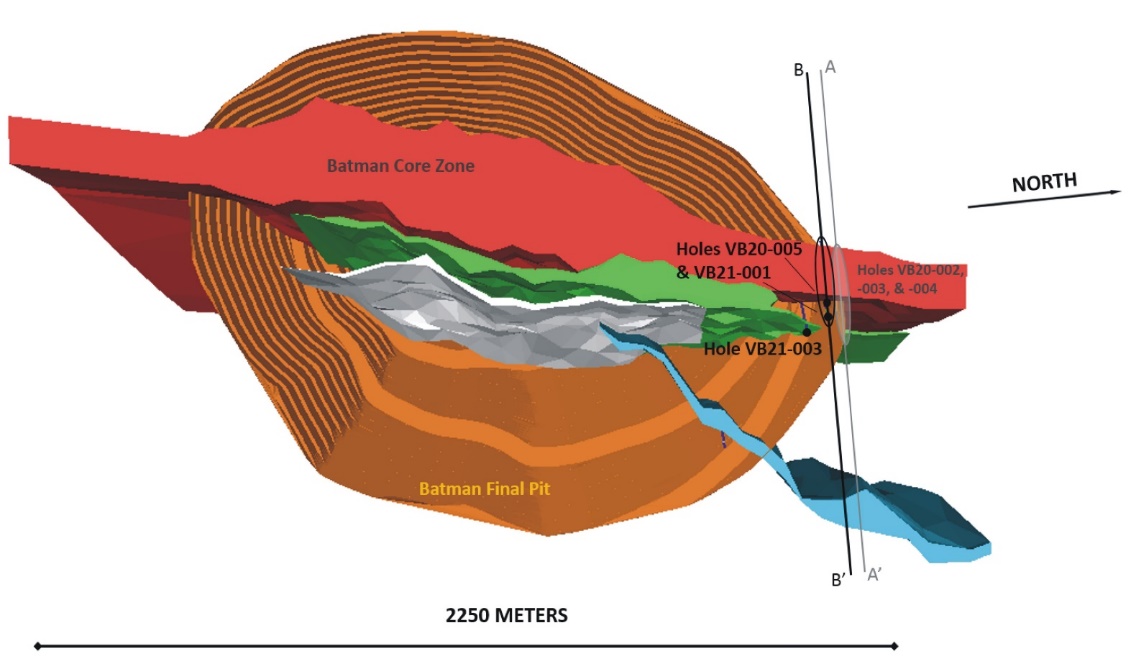

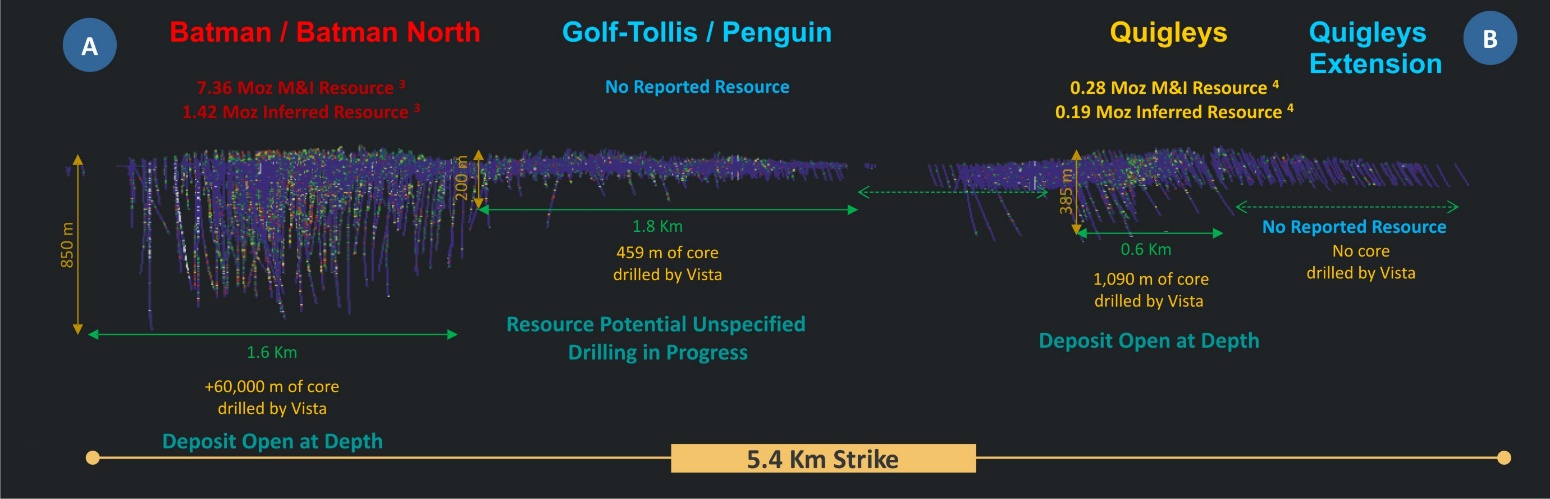

The Company’s exploration program is expected to continue through the first quarter of 2022. Vista is continuing its approach to demonstrate district-scale mineralization and structural continuity between the Batman and Quigleys deposits, where future in-fill drilling may be undertaken to define additional gold resources.

Shelf Registration Statement

On November 19, 2021, the Company filed a $100 million Shelf Registration Statement on Form S-3 (“Shelf Registration Statement”) with the U.S. Securities and Exchange Commission (“SEC”) (SEC File No. 333-239139). The Company has no present plans to use the Shelf Registration, nor is it under any obligation to do so, and has filed the Shelf Registration Statement in the normal course of business.

Management believes the Company’s current liquidity is sufficient to fund the Company’s value enhancing programs, continue to fund working capital, and strengthen its position in discussions with potential partners.

About Vista Gold Corp.

Vista is a gold project developer. The Company’s flagship asset is the Mt Todd gold project located in the Tier 1, mining friendly jurisdiction of Northern Territory, Australia. Situated approximately 250 km southeast of Darwin, Mt Todd is the largest undeveloped gold project in Australia and, if developed as presently designed, would potentially be Australia’s fourth largest gold producer on an annual basis, with lowest tertile in-country and global all-in sustaining costs. All major operating and environmental permits have now been approved.

For further information, please contact Pamela Solly, Vice President of Investor Relations, at (720) 981-1185.

Forward Looking Statements

This press release contains forward-looking statements within the meaning of the U.S. Securities Act of 1933, as amended, and U.S. Securities Exchange Act of 1934, as amended, and forward-looking information within the meaning of Canadian securities laws. All statements, other than statements of historical facts, included in this press release that address activities, events or developments that Vista expects or anticipates will or may occur in the future, including such things as, the Company’s belief that the completion of the definitive feasibility study (“DFS”) is a very important step toward increasing shareholder value; the DFS is nearly complete; the DFS results will be announced early next year; the DFS results, reflective of more detailed engineering and the higher level of precision in cost estimating required for the study, will generate significant interest in the Project from investors and potential partners; a new mine plan using a higher gold price is expected to result in an increase in reserves and a longer mine life; trade-off studies have potential to lower related initial capital costs of the Project; the completion of the DFS will provide a catalyst for accelerating the process to seek a strategic partner; the drilling program is expected to continue through the first quarter of 2022; the recently filed Registration Statement on Form S-3 will provide the Company with maximum flexibility as we advance toward our goal of a joint venture to develop Mt Todd; the DFS is on schedule and on budget, with completion expected early 2022; completion of the DFS is a major milestone expected to raise the profile and expedite our ongoing partnering process leading to a joint venture or other transaction that will recognize the intrinsic value of Mt Todd for Vista shareholders; Vista’s extensive technical work at Mt Todd the approval of all major permits and the completion of a definitive feasibility study are expected to provide a solid foundation and catalyst to move forward expeditiously with prospective partners to establish a mutually beneficial pathway for the development of the Project; there are no present plans to use the Shelf Registration; and the Company’s liquidity is sufficient to fund the Company’s value enhancing programs, continue to fund working capital, and strengthen its position with potential partners and other such matters are forward-looking statements and forward-looking information. The material factors and assumptions used to develop the forward-looking statements and forward-looking information contained in this press release include the following: the accuracy of the results of the PFS, mineral resource and reserve estimates, and exploration and assay results; the terms and conditions of our agreements with contractors and our approved business plan; the anticipated timing and completion of a feasibility study on the Project; the anticipated receipt of required permits; no change in laws that materially impact mining development or operations of a mining business; the potential occurrence and timing of a production decision; the anticipated gold production at the Project; the life of any mine at the Project; all economic projections relating to the Project, including estimated cash cost, NPV, IRR, and initial capital requirements; and Vista’s goal of becoming a gold producer. When used in this press release, the words “optimistic,” “potential,” “indicate,” “expect,” “intend,” “plans,” “hopes,” “believe,” “may,” “will,” “if,” “anticipate,” and similar expressions are intended to identify forward-looking statements and forward-looking information. These statements involve known and unknown risks, uncertainties and other factors which may cause the actual results, performance or achievements of Vista to be materially different from any future results, performance or achievements expressed or implied by such statements. Such factors include, among others, uncertainty of mineral resource estimates, estimates of results based on such mineral resource estimates; risks relating to cost increases for capital and operating costs; risks related to the timing and the ability to obtain the necessary permits, risks of shortages and fluctuating costs of equipment or supplies; risks relating to fluctuations in the price of gold; the inherently hazardous nature of mining-related activities; potential effects on Vista’s operations of environmental regulations in the countries in which it operates; risks due to legal proceedings; risks relating to political and economic instability in certain countries in which it operates; as well as those factors discussed under the headings “Note Regarding Forward-Looking Statements” and “Risk Factors” in Vista’s Annual Report Form 10-K as filed February 25, 2021 and other documents filed with the U.S. Securities and Exchange Commission and Canadian securities regulatory authorities. Although Vista has attempted to identify important factors that could cause actual results to differ materially from those described in forward-looking statements and forward-looking information, there may be other factors that cause results not to be as anticipated, estimated or intended. Except as required by law, Vista assumes no obligation to publicly update any forward-looking statements or forward-looking information; whether as a result of new information, future events or otherwise.

Cautionary Note to United States Investors

The United States Securities and Exchange Commission (“SEC”) limits disclosure for U.S. reporting purposes to mineral deposits that a company can economically and legally extract or produce. This press release and the technical reports referenced in this press release use the terms defined in Canadian National Instrument 43-101 – Standards of Disclosure for Mineral Projects (“NI 43-101”) and the Canadian Institute of Mining, Metallurgy and Petroleum (the “CIM”) – CIM Definition Standards on Mineral Resources and Mineral Reserves, adopted by the CIM Council, as amended (the “CIM Definition Standards”). These standards are not the same as reserves under the SEC’s Industry Guide 7 and may not constitute reserves or resources under the SEC’s newly adopted disclosure rules to modernize mineral property disclosure requirements (“SEC Modernization Rules”), which became effective February 25, 2019 and will be applicable to the Company in its annual report for the fiscal year ending December 31, 2021. Under the currently applicable SEC Industry Guide 7 standards, a “final” or “bankable” feasibility study is required to report reserves, the three-year historical average price is used in any reserve or cash flow analysis to designate reserves and all necessary permits and government approvals must be filed with the appropriate governmental authority. Additionally, the technical reports uses the terms “measured resources”, “indicated resources”, and “measured & indicated resources”. We advise U.S. investors that while these terms are Canadian mining terms as defined in accordance with NI 43-101, such terms are not recognized under SEC Industry Guide 7 and normally are not permitted to be used in reports and registration statements filed with the SEC. Mineral resources described in the technical reports have a great amount of uncertainty as to their economic and legal feasibility. The SEC normally only permits issuers to report mineralization that does not constitute SEC Industry Guide 7 compliant “reserves” as in-place tonnage and grade, without reference to unit measures. “Inferred resources” have a great amount of uncertainty as to their existence, and great uncertainty as to their economic and legal feasibility. It cannot be assumed that any or all part of an inferred resource will ever be upgraded to a higher category. U.S. Investors are cautioned not to assume that any part or all of mineral deposits in these categories will ever be converted into SEC Industry Guide 7 reserves.

Under the SEC Modernization Rules, the definitions of “proven mineral reserves” and “probable mineral reserves” have been amended to be substantially similar to the corresponding CIM Definition Standards and the SEC has added definitions to recognize “measured mineral resources”, “indicated mineral resources” and “inferred mineral resources” which are also substantially similar to the corresponding CIM Definition Standard. However there are differences between the definitions and standards under the SEC Modernization Rules and those under the CIM Definition Standards and therefore once the Company begins reporting under the SEC Modernization Rules there is no assurance that the Company’s mineral reserve and mineral estimates will be the same as those reported under CIM Definition Standards as contained in the technical reports prepared under CIM Definition Standards or that the economics for the Mt Todd project estimated in such technical reports will be the same as those estimated in any technical report prepared by the Company under the SEC Modernization Rules in the future.

Vista Gold Corp. Reports Third Quarter Cash of $16.0 Million and Definitive Feasibility Study Progress

Denver, Colorado, October 27, 2021 – Vista Gold Corp. (NYSE American and TSX: VGZ) (“Vista” or the “Company”) today announced its unaudited financial results for the quarter ended September 30, 2021, which were highlighted by reported cash of $16.0 million and substantial progress toward completion of the Definitive Feasibility Study (“DFS”) for Vista’s 100% owned Mt Todd gold project (“Mt Todd” or the “Project”). All dollar amounts in this press release are in U.S. dollars.

Frederick H. Earnest, President and Chief Executive Officer of Vista, commented, “Our activities during the third quarter focused on increasing shareholder value. The DFS is nearing completion and remains on budget. Mine planning using a higher gold price is expected to increase reserves and extend the life of mine. We started Phase 3 drilling of our exploration program and plan to drill an additional 2,650 meters, for approximately 9,000 meters of total drilling. Results of the drilling program have been very positive. Every drill hole has intersected mineralization, consistent with our geologic model.”

Mr. Earnest continued, “We significantly strengthened our balance sheet, with quarter-end cash of approximately $16.0 million. We believe our existing cash will fund the Company’s value enhancing programs, continue to fund working capital, and strengthen our position in discussions with potential partners.”

Important Recent Developments

- The Mt Todd DFS engineering and design are 80% complete, on track and on budget;

- Completed Phase 2 of the ongoing exploration drilling program and started Phase 3 drilling; and

- Ended Q3 2021 with cash and cash equivalents of $16.0 million and zero debt.

Definitive Feasibility Study

Engineering and design for the Mt Todd DFS are 80% complete. With new mine plans at higher gold prices, the DFS is expected to result in a larger reserve and longer mine life. This DFS will address recommendations from the 2019 pre-feasibility study, reflect minor updates of the Project design to be consistent with the approved Mine Management Plan, and advance the level of engineering and detailed costing in all areas of the Project. We are also evaluating several trade-off opportunities (e.g., contract power generation, contract mining and autonomous truck haulage).

Accretive Development Strategy

The process to seek a strategic partner is advancing, despite COVID-related travel restrictions. In particular, mining companies outside Australia have been hindered in their ability to complete site visits and perform other in-country due diligence activities. Nonetheless, we continued to see strong interest in Mt Todd. The Australian government recently announced it will begin to ease international travel restrictions for its fully vaccinated citizens and permanent residents beginning in November. The Australian government is working to define a plan to allow international travel by foreigners, but this will likely not occur until sometime in early 2022. Once Australia’s borders re-open, we expect opportunities for on-site due diligence to increase.

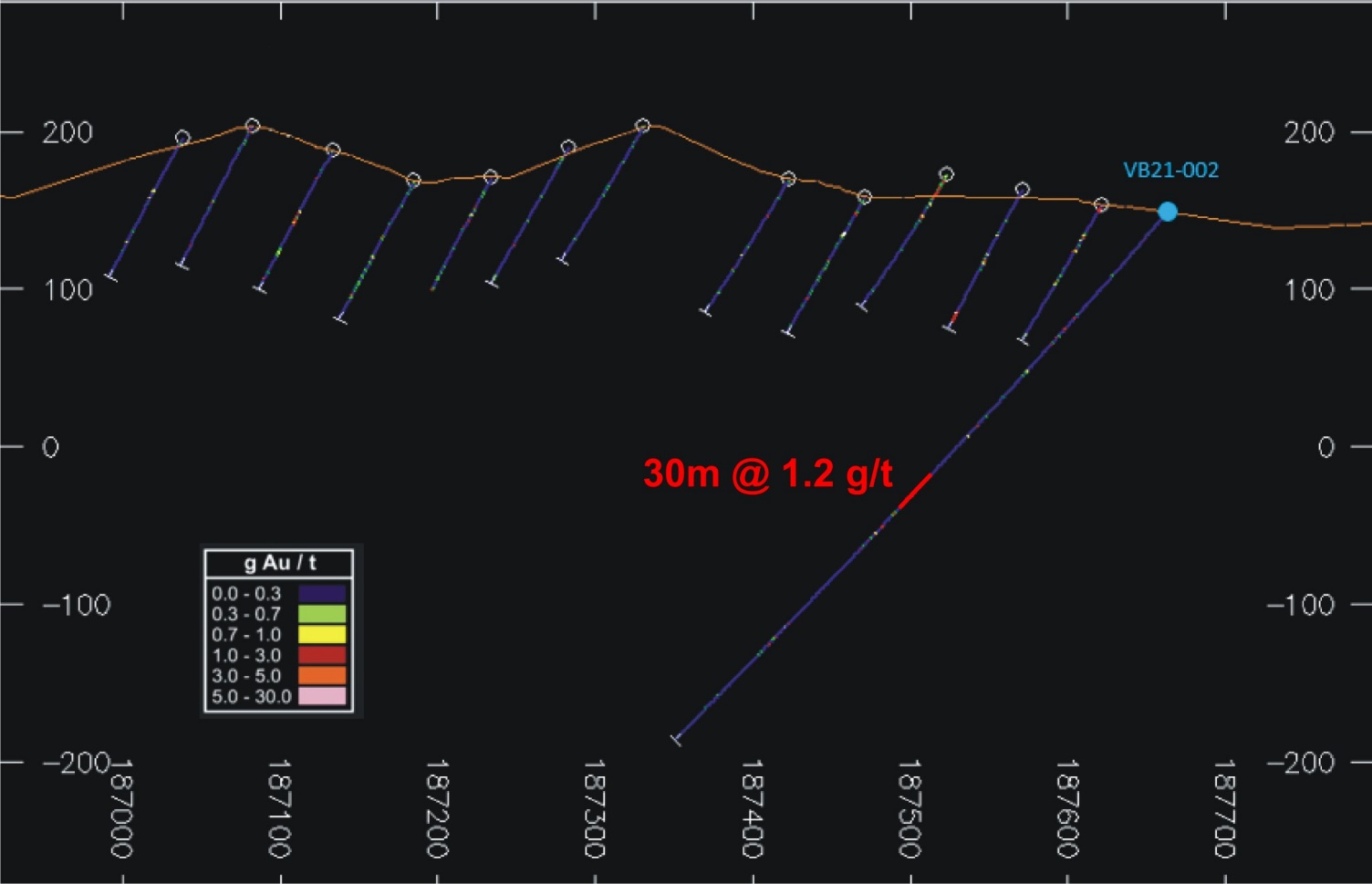

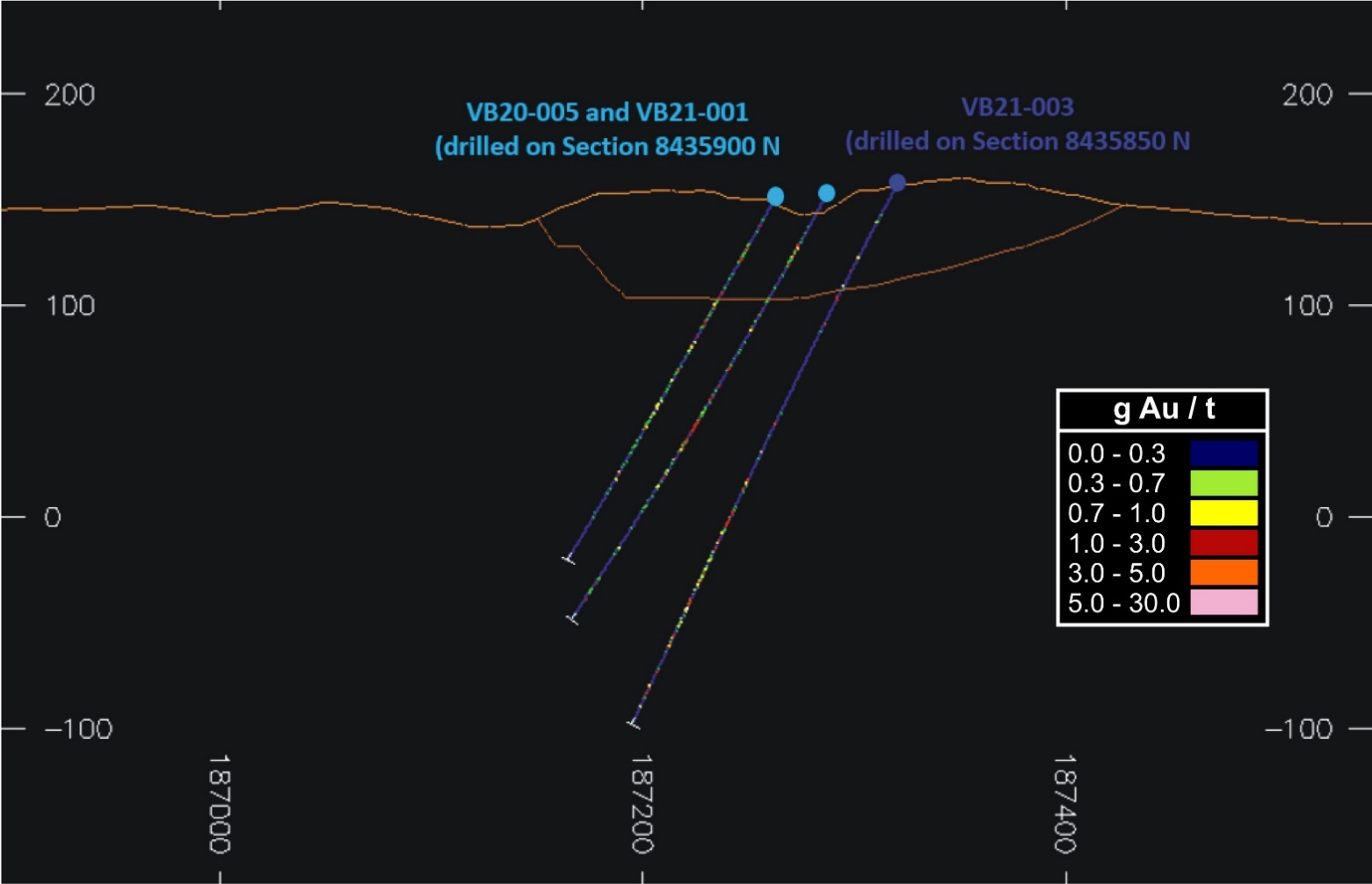

Positive Drilling Results

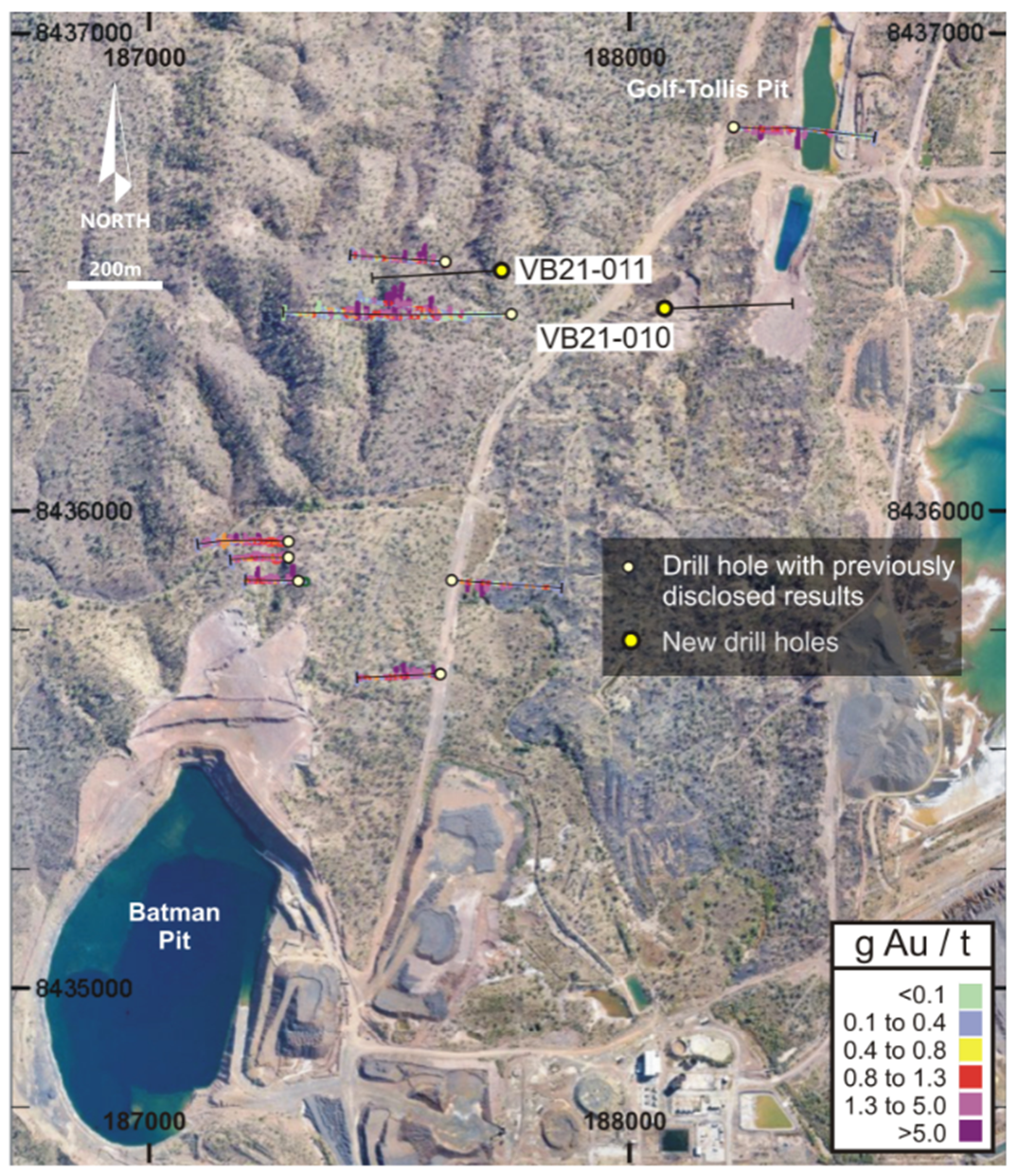

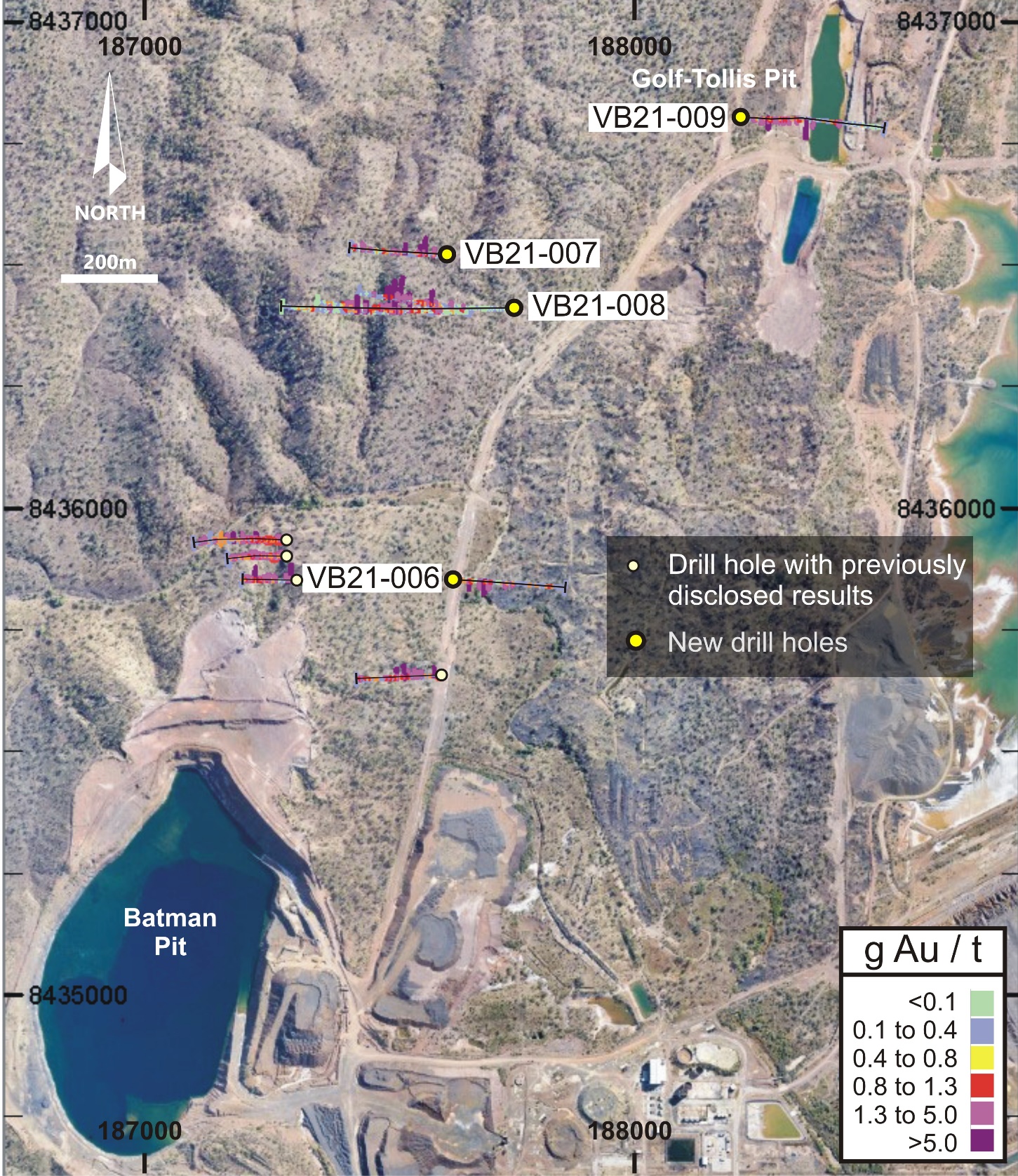

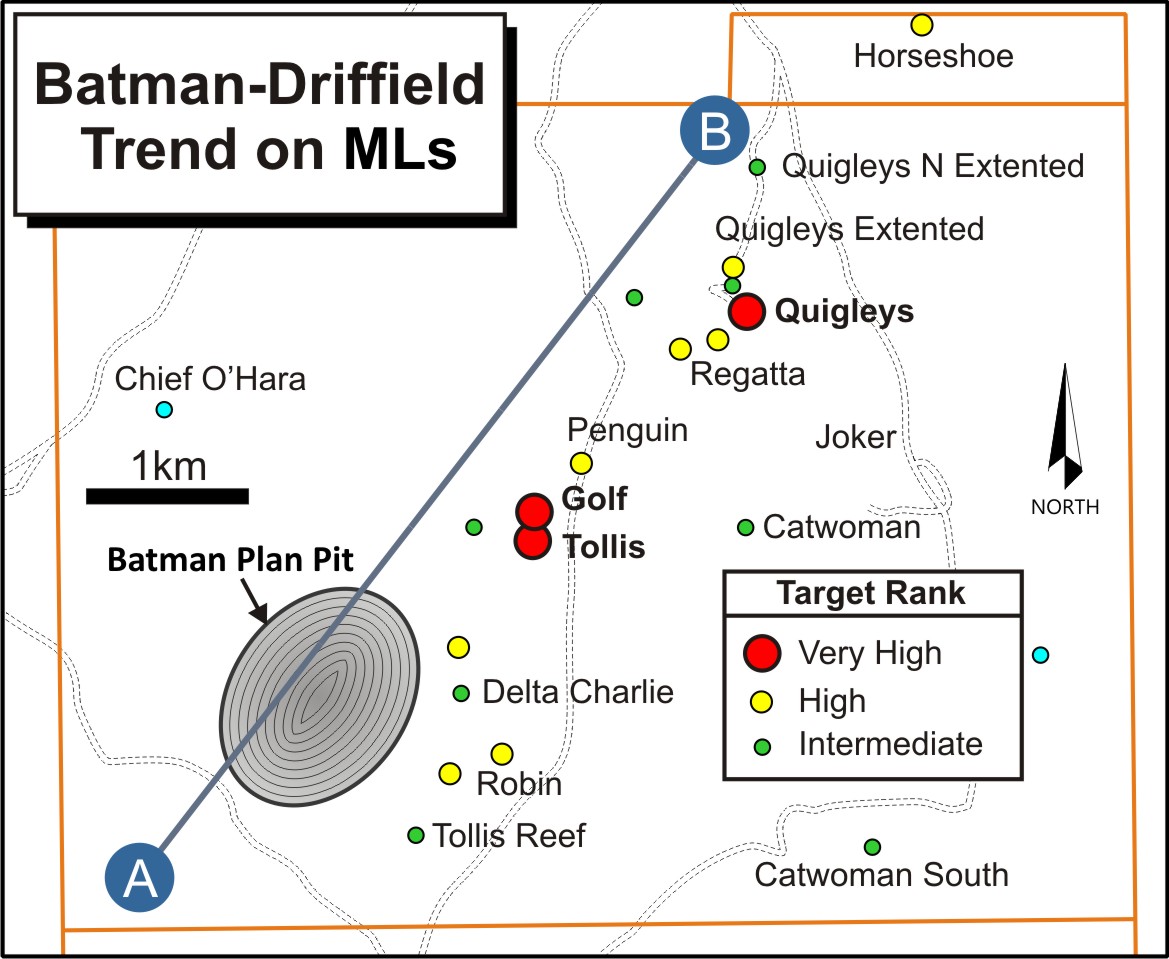

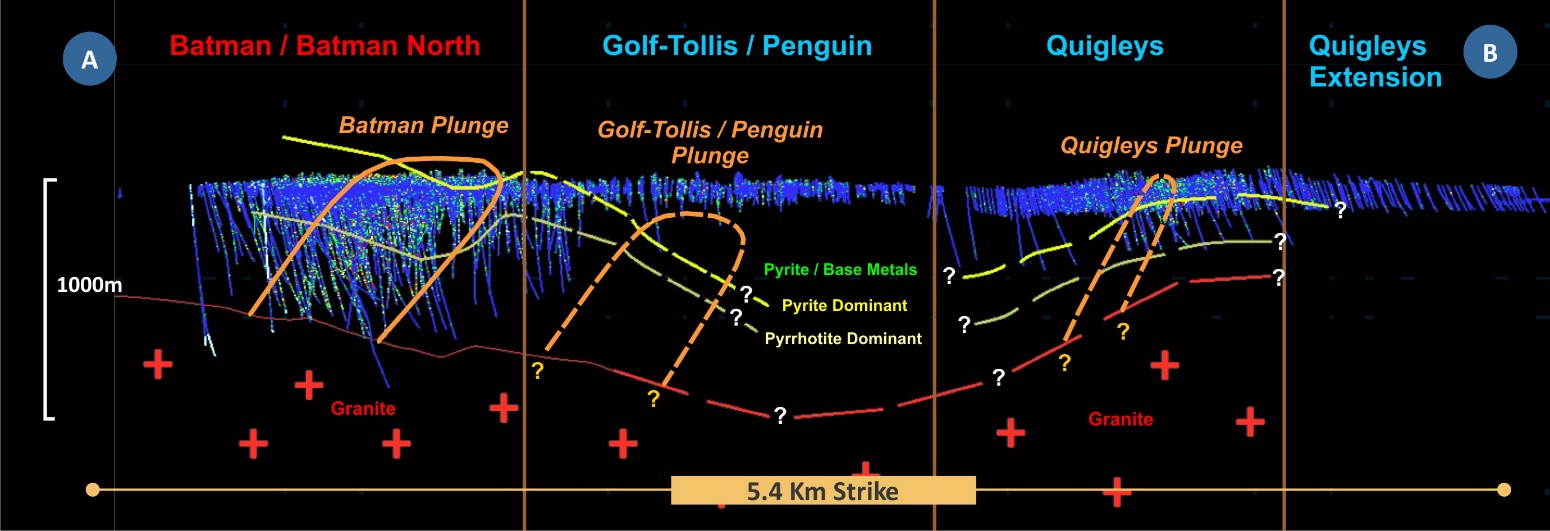

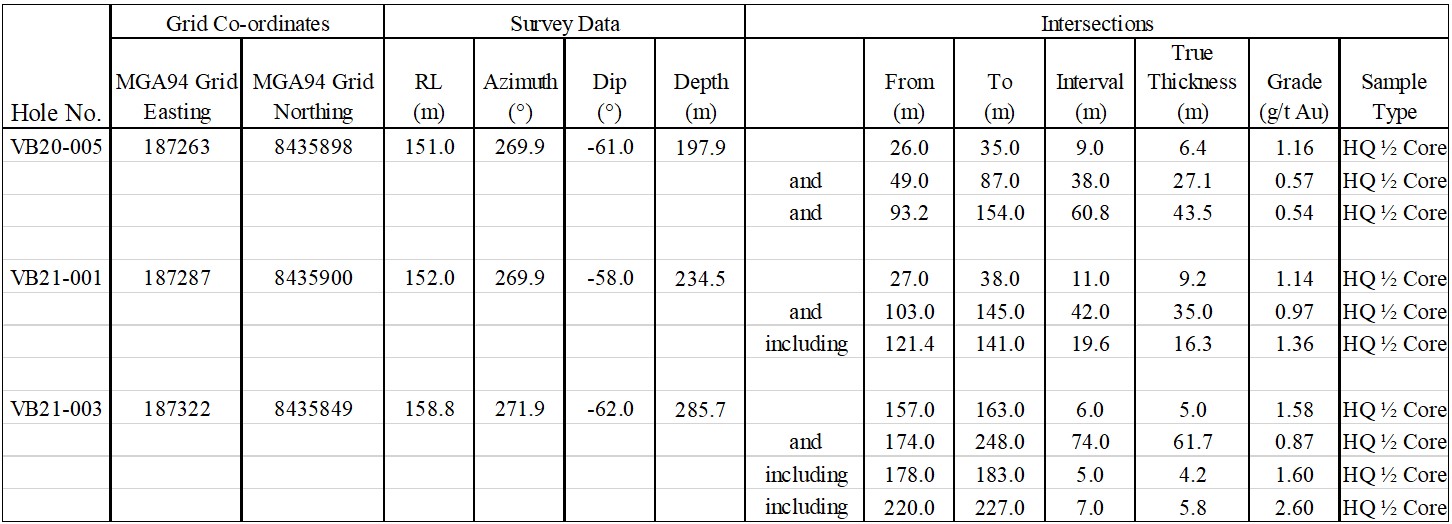

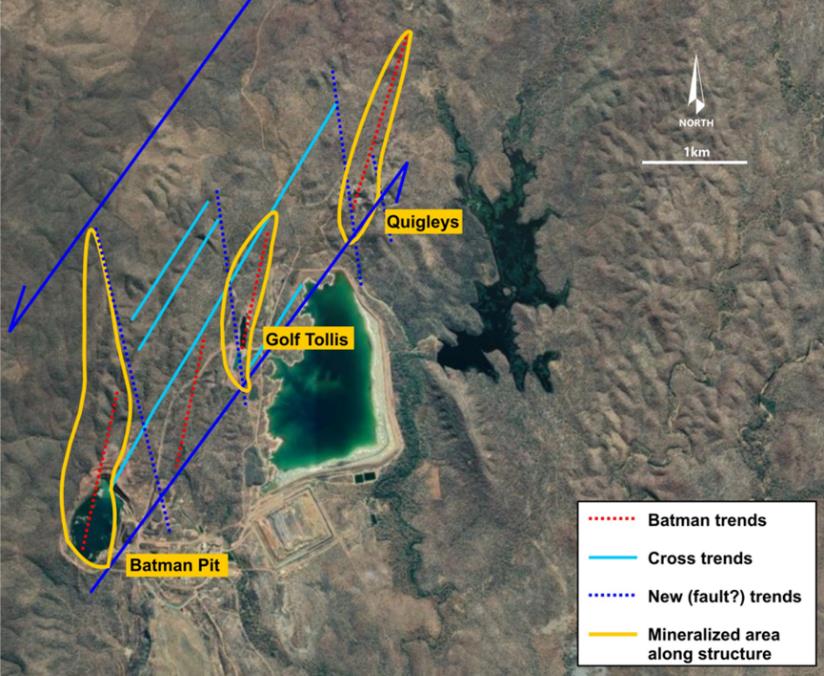

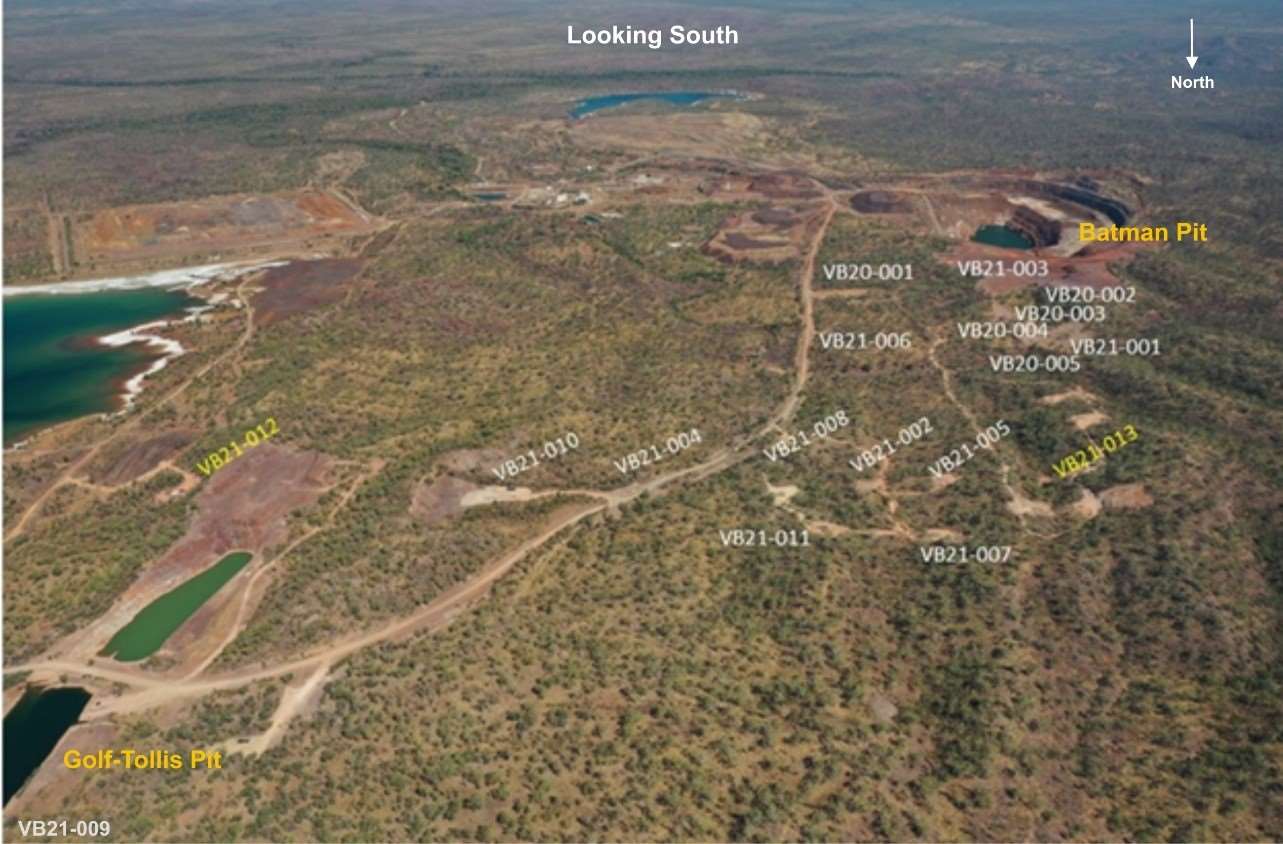

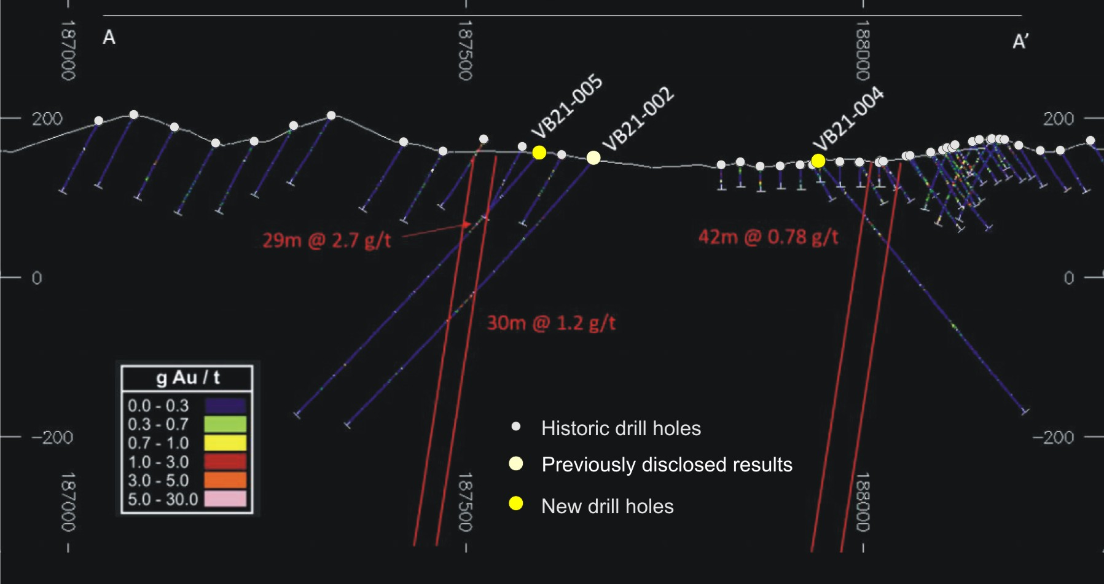

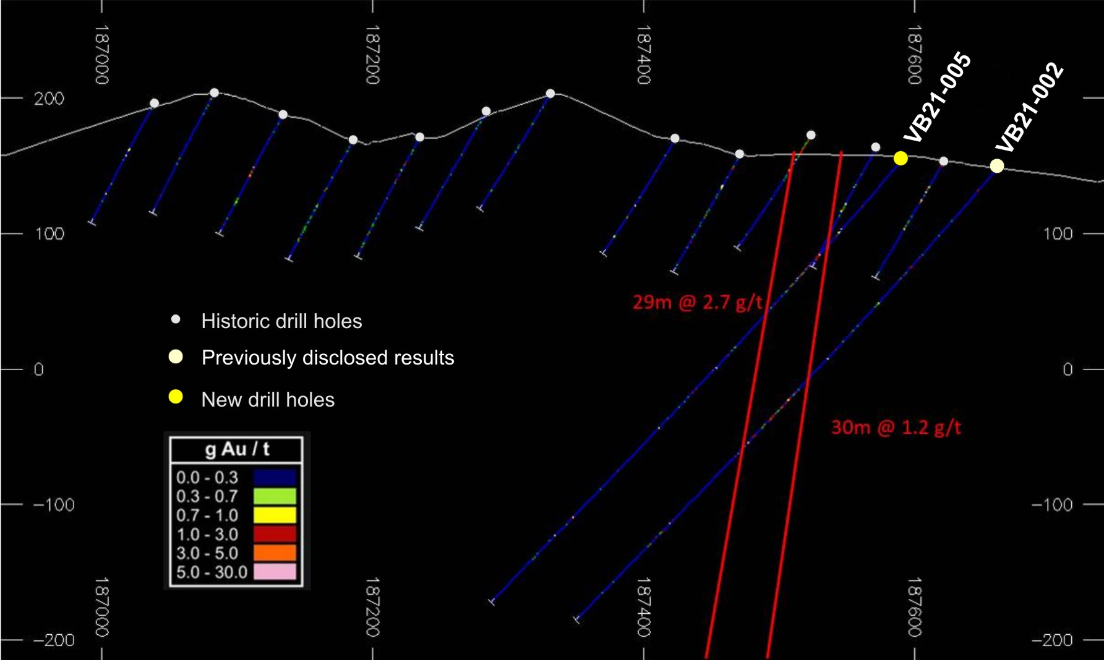

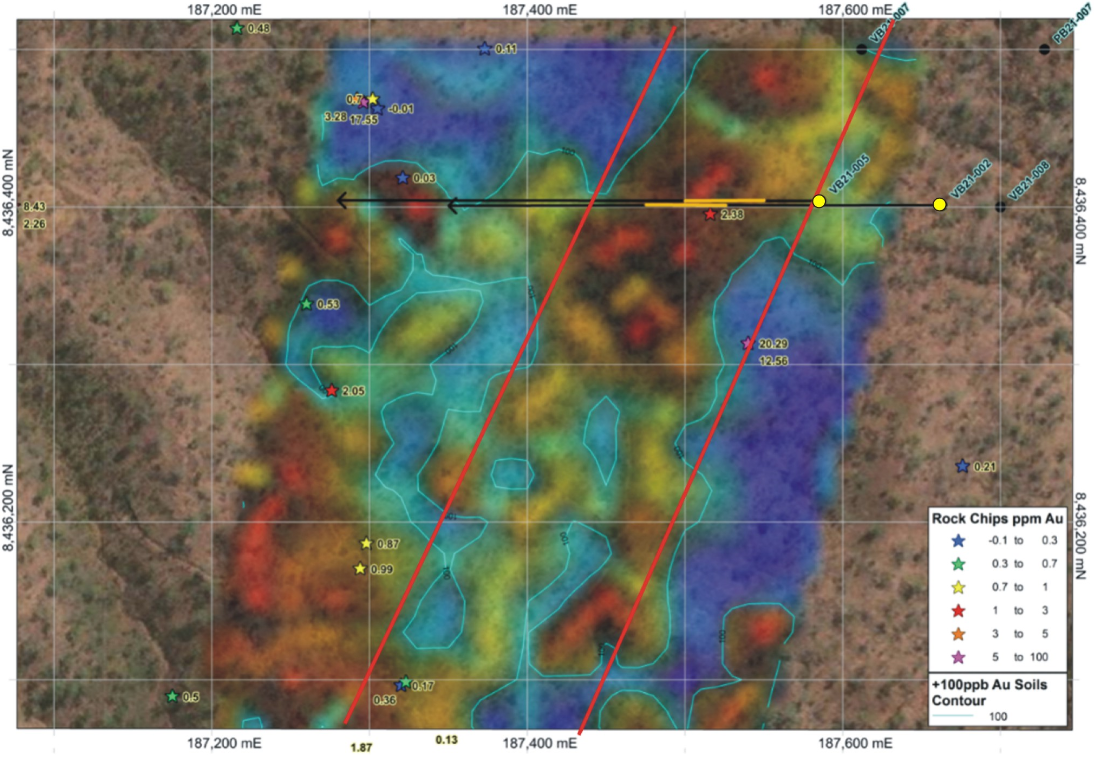

To demonstrate the resource potential at Mt Todd, the Company is drilling exploration targets adjacent to the Batman deposit and extending northeast to the Quigleys deposit, all within our mining licenses. The drilling program has focused on identifying connecting structures and mineralization between previously interpreted discreet deposits and the potential for efficient resource growth with future drilling along strike from the Batman deposit approximately 1.9 Km north to the Golf-Tollis/Penguin targets. Two principal types of structures are present in Figure 1; the red dashed lines represent structures with Batman-style sheeted vein mineralization and the light blue lines represent the connecting structures. The dark blue dashed lines show what are believed to be faults.

To date, Vista has completed 18 planned holes and drilled 6,365 meters in Phases 1 and 2 of the current program. Every drill hole has intersected mineralization consistent with our geologic model. Phase 3 drilling started in September and will include an additional 2,650 meters of drilling extending to Quigleys. Drilling is expected to continue into 2022. Our goal is to demonstrate the regional potential along a ~5.4 Km portion of the +24 Km Batman-Driffield Trend and to outline areas where future drilling can be undertaken to efficiently define additional gold resources.

Figure 1 – Relationship of known structural trends relative to existing mineral deposits and exploration targets

Summary of Q3 2021 Financial Results

On September 30, 2021, cash and cash equivalents totaled $16.0 million, which included net proceeds of $12.3 million from the Company’s July 2021 public offering.

Vista reported a net loss of $3.1 million or $0.02 per share for the three months ended September 30, 2021, compared to net income of $4.2 million or $0.05 per share reported for the three months ended September 30, 2020. The three month period ended September 30, 2020 included a gain of $3.5 million related to the sale of the Los Reyes project. The loss for the current quarter was in line with management’s expectations.

Management Conference Call

Management’s quarterly conference call to review financial results for the quarter ended September 30, 2021 and to discuss corporate and project activities is scheduled on Thursday, October 28, 2021 at 10:00 am MDT (12:00 pm EDT).

Participant Toll Free: (844) 898-8648

Participant International: (647) 689-4225

Conference ID: 8590039

This call will also be archived and available at www.vistagold.com after October 28, 2021. Audio replay will be available through November 18, 2021 by calling toll-free in North America (855) 859-2056 or (404) 537-3406.

If you are unable to access the audio or phone-in on the day of the conference call, please email your questions to

About Vista Gold Corp.

Vista is a gold project developer. The Company’s flagship asset is the Mt Todd gold project located in the Tier 1, mining friendly jurisdiction of Northern Territory, Australia. Situated approximately 250 km southeast of Darwin, Mt Todd is the largest undeveloped gold project in Australia and, if developed as presently designed, would potentially be Australia’s fourth largest gold producer on an annual basis, with lowest tertile in-country and global all-in sustaining costs. All major operating and environmental permits have now been approved.

For further information, please contact Pamela Solly, Vice President of Investor Relations, at (720) 981-1185.

Forward Looking Statements

This press release contains forward-looking statements within the meaning of the U.S. Securities Act of 1933, as amended, and U.S. Securities Exchange Act of 1934, as amended, and forward-looking information within the meaning of Canadian securities laws. All statements, other than statements of historical facts, included in this press release that address activities, events or developments that we expect or anticipate will or may occur in the future, including such things as our belief that management is nearing completion of a DFS; our expectation that the DFS will address recommendations from the 2019 pre-feasibility study and include minor updates of the Project design to be consistent with the approved Mining Management Plan and engineering and detailed costing in areas of the Project; our belief that using a higher gold price for mine planning purposes is expected to increase reserves and the life of mine; our expectation that our existing cash will fund the Company’s value enhancing programs, continue to fund working capital, and strengthen our position in discussions with potential partners; our expectation to drill an additional 2,650 meters in Phase 3 of the drill program and continue drilling into 2022; our expectation to advance on-site due diligence activities with potential partners once Australia’s borders re-open; and our belief that Mt Todd is the largest undeveloped gold project in Australia and, if developed as presently designed, would potentially be Australia’s fourth largest gold producer on an annual basis, with lowest tertile in-country and global all-in sustaining costs are forward-looking statements and forward-looking information. The material factors and assumptions used to develop the forward-looking statements and forward-looking information contained in this press release include the following: our approved business plans, exploration and assay results, results of our test work for process area improvements, mineral resource and reserve estimates and results of preliminary economic assessments, prefeasibility studies and feasibility studies on our projects, if any, our experience with regulators, and positive changes to current economic conditions and the price of gold. When used in this press release, the words “optimistic,” “potential,” “indicate,” “expect,” “intend,” “hopes,” “believe,” “may,” “will,” “if,” “anticipate,” and similar expressions are intended to identify forward-looking statements and forward-looking information. These statements involve known and unknown risks, uncertainties and other factors which may cause the actual results, performance or achievements of the Company to be materially different from any future results, performance or achievements expressed or implied by such statements. Such factors include, among others, uncertainties inherent in the exploration of mineral properties, the possibility that future exploration results will not be consistent with the Company’s expectations; there being no assurance that the exploration program or programs of the Company will result in expanded mineral resources; uncertainty of resource and reserve estimates, uncertainty as to the Company’s future operating costs and ability to raise capital; risks relating to cost increases for capital and operating costs; risks of shortages and fluctuating costs of equipment or supplies; risks relating to fluctuations in the price of gold; the inherently hazardous nature of mining-related activities; potential effects on our operations of environmental regulations in the countries in which it operates; risks due to legal proceedings; risks relating to political and economic instability in certain countries in which it operates; uncertainty as to the results of bulk metallurgical test work; and uncertainty as to completion of critical milestones for Mt Todd; as well as those factors discussed under the headings “Note Regarding Forward-Looking Statements” and “Risk Factors” in the Company’s latest Annual Report on Form 10-K as filed February 25, 2021 and other documents filed with the U.S. Securities and Exchange Commission and Canadian securities regulatory authorities. Although we have attempted to identify important factors that could cause actual results to differ materially from those described in forward-looking statements and forward-looking information, there may be other factors that cause results not to be as anticipated, estimated or intended. Except as required by law, we assume no obligation to publicly update any forward-looking statements or forward-looking information; whether as a result of new information, future events or otherwise.

Cautionary Note to United States Investors

The United States Securities and Exchange Commission (“SEC”) limits disclosure for U.S. reporting purposes to mineral deposits that a company can economically and legally extract or produce. The technical reports referenced in this press release uses the terms defined in Canadian National Instrument 43-101 – Standards of Disclosure for Mineral Projects (“NI 43-101”) and the Canadian Institute of Mining, Metallurgy and Petroleum (the “CIM”) – CIM Definition Standards on Mineral Resources and Mineral Reserves, adopted by the CIM Council, as amended (the “CIM Definition Standards”). These standards are not the same as reserves under the SEC’s Industry Guide 7 and may not constitute reserves or resources under the SEC’s newly adopted disclosure rules to modernize mineral property disclosure requirements (“SEC Modernization Rules”), which became effective February 25, 2019 and will be applicable to the Company in its annual report for the fiscal year ending December 31, 2021. Under the currently applicable SEC Industry Guide 7 standards, a “final” or “bankable” feasibility study is required to report reserves, the three-year historical average price is used in any reserve or cash flow analysis to designate reserves and all necessary permits and government approvals must be filed with the appropriate governmental authority. Additionally, the technical reports uses the terms “measured resources”, “indicated resources”, and “measured & indicated resources”. We advise U.S. investors that while these terms are Canadian mining terms as defined in accordance with NI 43-101, such terms are not recognized under SEC Industry Guide 7 and normally are not permitted to be used in reports and registration statements filed with the SEC. Mineral resources described in the technical reports have a great amount of uncertainty as to their economic and legal feasibility. The SEC normally only permits issuers to report mineralization that does not constitute SEC Industry Guide 7 compliant “reserves” as in-place tonnage and grade, without reference to unit measures. “Inferred resources” have a great amount of uncertainty as to their existence, and great uncertainty as to their economic and legal feasibility. It cannot be assumed that any or all part of an inferred resource will ever be upgraded to a higher category. U.S. Investors are cautioned not to assume that any part or all of mineral deposits in these categories will ever be converted into SEC Industry Guide 7 reserves.

Under the SEC Modernization Rules, the definitions of “proven mineral reserves” and “probable mineral reserves” have been amended to be substantially similar to the corresponding CIM Definition Standards and the SEC has added definitions to recognize “measured mineral resources”, “indicated mineral resources” and “inferred mineral resources” which are also substantially similar to the corresponding CIM Definition Standard. However there are differences between the definitions and standards under the SEC Modernization Rules and those under the CIM Definition Standards and therefore once the Company begins reporting under the SEC Modernization Rules there is no assurance that the Company’s mineral reserve and mineral estimates will be the same as those reported under CIM Definition Standards as contained in the technical reports prepared under CIM Definition Standards or that the economics for the Mt Todd project estimated in such technical reports will be the same as those estimated in any technical report prepared by the Company under the SEC Modernization Rules in the future.

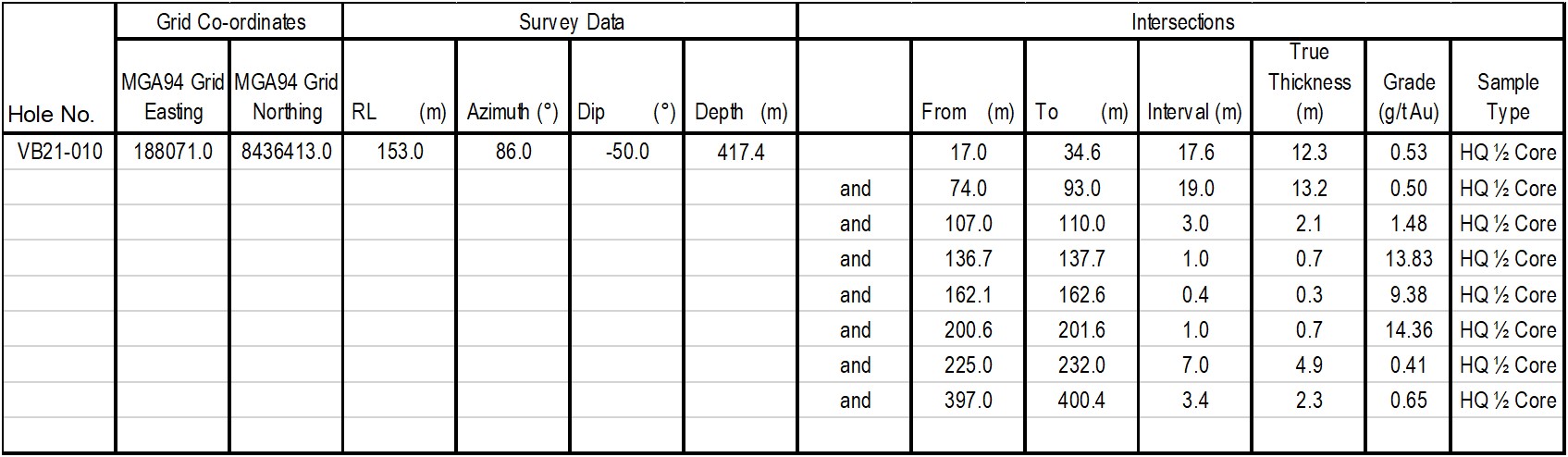

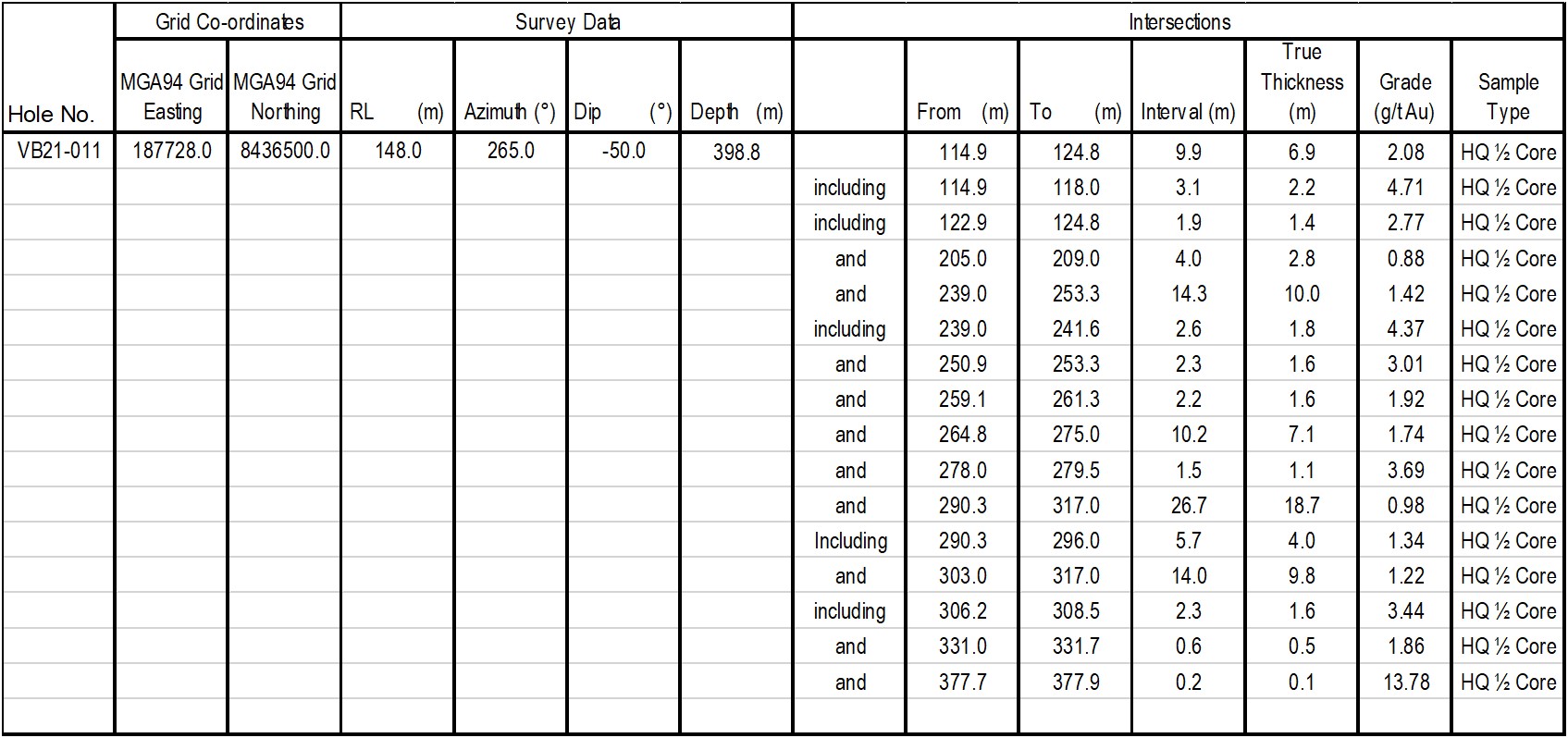

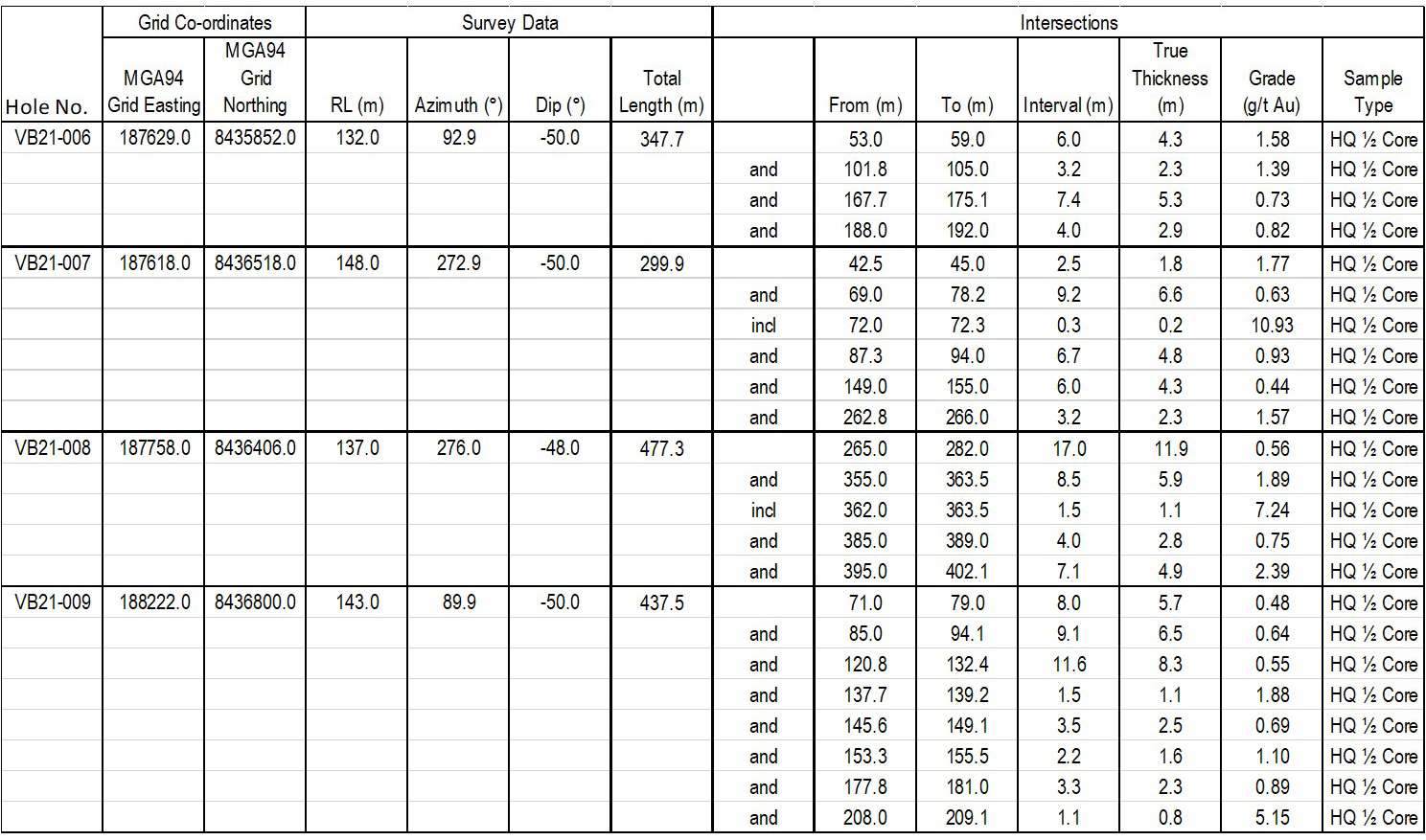

Vista Gold Corp. Announces Final Results from Phase 2 Drilling at Mt Todd

Denver, Colorado, September 22, 2021 – Vista Gold Corp. (NYSE American and TSX: VGZ) (“Vista” or the “Company”) today announced positive results for the two remaining holes in Phase 2 of the ongoing drilling program at the Company’s 100% owned Mt Todd gold project (“Mt Todd” or the “Project”) located in Northern Territory, Australia.

Highlights

VB21-012 – Intersected over 100 meters of mineralization, inclusive of three zones of +1 grams gold per tonne (“g Au/t”) subvertical vein-sets

- 10.0 meters @ 1.29 g Au/t from 469 meters down hole

- 22.7 meters @ 1.10 g Au/t from 503 meters down hole

- 13.2 meters @ 1.03 g Au/t from 566 meters down hole

VB21-013 – Drilled perpendicular to VB21-002 and VB21-005 to validate structural orientation

- 6.0 meters @ 1.25 g Au/t from 130 meters down hole

- 12.0 meters @ 3.11 g Au/t from 144 meters down hole

Frederick Earnest, President and CEO of Vista, commented, “Phase 2 of our drilling program successfully achieved our primary objective of identifying multiple areas north of the Batman deposit where additional resources might be added most efficiently in the future. In all, we drilled 3,725 meters in this phase and intersected good intervals and gold grades in each hole. We have verified continuity of gold mineralization extending from the Batman deposit northeast over 1.4 km and down dip more than 400 meters. Holes VB21-012 and VB21-013 are the last two holes in this phase of drilling. Our next phase of drilling will provide some infill to our drilling to date, but importantly, continue to step out toward the Quigleys deposit.”

“We were very pleased to have received a grant from the Northern Territory Government under its Geophysics and Drilling Collaborations Program (the “Program”) to co-fund VB21-012. This gave us the opportunity to drill a hole directed at increasing our understanding of the geology as we move north of the Batman deposit. The Program awarded $1.7 million in grants to support a diverse range of exploration drilling programs and geophysical surveys across the Northern Territory. Mt Todd was one of 15 successful projects to receive a grant from a total of 38 applicants. Fifty percent of the applicable direct drilling and assay costs, up to a maximum of A$110,000, will be co-funded from the Program.”

“Hole VB21-012 was drilled to a total depth of 901 meters. The primary objective was to intersect the granite intrusive. From our drilling at Batman, we expected the intrusive to be present at a depth of approximately 800 meters. We did not intercept the intrusive, but gained a great deal of information about the basement rocks at Mt Todd. And while not the primary objective of this hole, we intersected three zones of +1 g Au/t material within a broad zone of mineralization. Hole VB21-013 was drilled to validate the orientation of our drilling and to provide the assurance that we have not introduced a bias into our understanding of the structures due to drillhole orientation. I’m pleased with the thoroughness of our exploration programs and our understanding of the geology and resource growth potential in the area north of the Batman deposit.”

Mr. Earnest concluded, “In addition to the ongoing exploration, completing a definitive feasibility study (“DFS”) for Mt Todd will be an important milestone and catalyst. We are pleased to report that engineering and other work related to the DFS is on schedule and on budget. We are closely reviewing interim reports and look forward to announcing the results of the DFS in Q1 of 2022. Australia is making significant progress in achieving its vaccination goals and we are hopeful this will lead to a relaxing of the present travel restrictions, which will play an important role in obtaining a strategic development partner.”

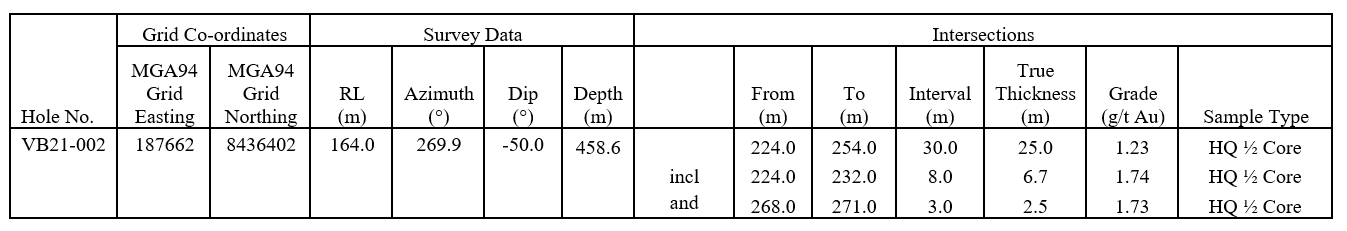

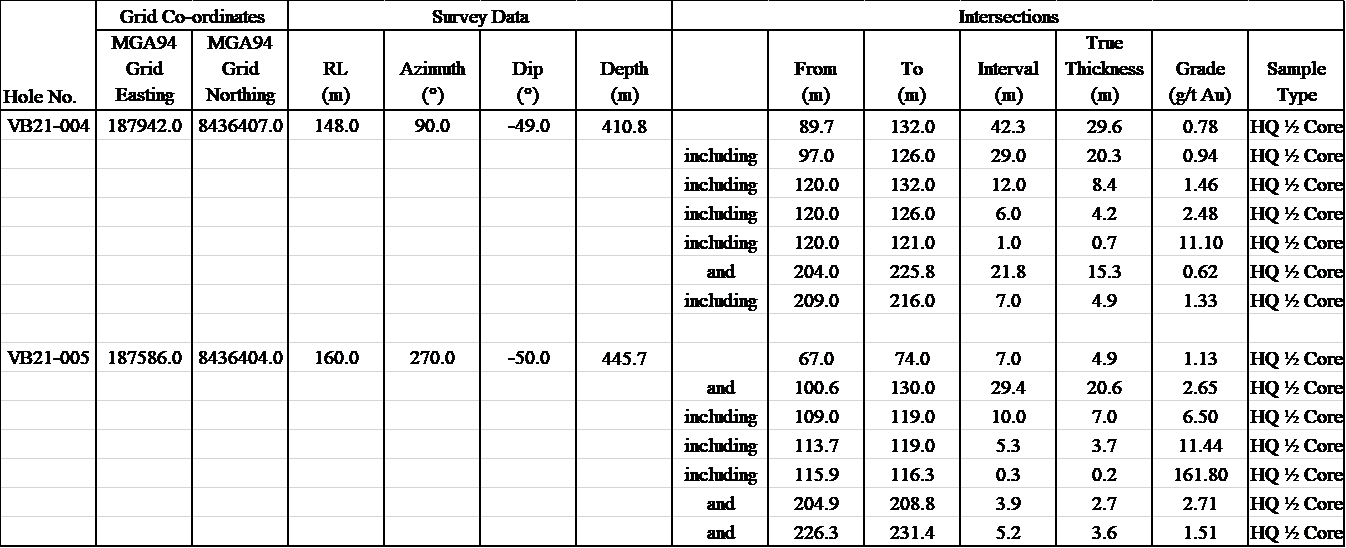

Table 1 – Summary of Assay Results

| Hole No. | Grid Co-ordinates | Survey Data | Intersections | ||||||||||

| MGA94 Grid Easting |

MGA94 Grid Northing |

RL (m) |

Azimuth (°) |

Dip (°) |

Depth (m) |

From (m) |

To (m) |

Interval (m) |

True Thickness (m) |

Grade (g/t Au) |

Sample Type | ||

| VB21-012 | 188435.0 | 8436405.0 | 155.0 | 260.9 | -50.0 | 901.0 | 469.0 | 479.0 | 10.0 | 6.4 | 1.29 | HQ ½ Core | |

| including | 477.0 | 479.0 | 2.0 | 1.3 | 4.48 | HQ ½ Core | |||||||

| and | 503.0 | 525.7 | 22.7 | 14.6 | 1.10 | HQ ½ Core | |||||||

| and | 555.3 | 579.2 | 23.9 | 15.3 | 0.77 | HQ ½ Core | |||||||

| including | 566.0 | 579.2 | 13.2 | 8.5 | 1.03 | HQ ½ Core | |||||||

| VB21-013 | 187423.0 | 8436409.0 | 169.0 | 86.4 | -53.0 | 311.9 | 130.0 | 136.0 | 6.0 | 3.9 | 1.25 | HQ ½ Core | |

| and | 144.0 | 156.0 | 12.0 | 7.9 | 3.11 | HQ ½ Core | |||||||

| including | 144.0 | 148.6 | 4.6 | 3.0 | 1.62 | HQ ½ Core | |||||||

| including | 151.0 | 154.0 | 3.0 | 2.0 | 2.67 | HQ ½ Core | |||||||

Notes:

| (i) | Results are based on 50g fire assay for Au. |

| (ii) | Intersections are from diamond core drilling with half-core samples with 1 meter representative samples. |

| (iii) | Core sample intervals were constrained by geology, alteration or structural boundaries, intervals varied between a minimum of 0.2 meters to a maximum of 1.2 meters. |

| (iv) | Mean grades have been calculated on a 0.4 g Au/t lower cut-off grade with no upper cut-off grade applied, and maximum internal waste of 4.0 meters. |

| (v) | All intersections are downhole intervals and reflect approximate true widths. |

| (vi) | All downhole deviations have been verified by downhole camera and/or downhole gyro. |

| (vii) | Collar coordinates surveyed by Earl James & Assoc., an independent surveyor, using Trimble R8 GNSS. |

| (viii) | The Company maintains a quality assurance/quality control (“QA/QC”) program, as further described below. |

| (ix) | The assay laboratories responsible for the assays were Northern Analytical Laboratories Pty Ltd (“NAL”), an independent ISO 9000 certified lab, Pine Creek, NT and Genalysis Laboratory Services Pty Ltd, Perth, WA, which is also independent from Vista. |

Discussion of Results

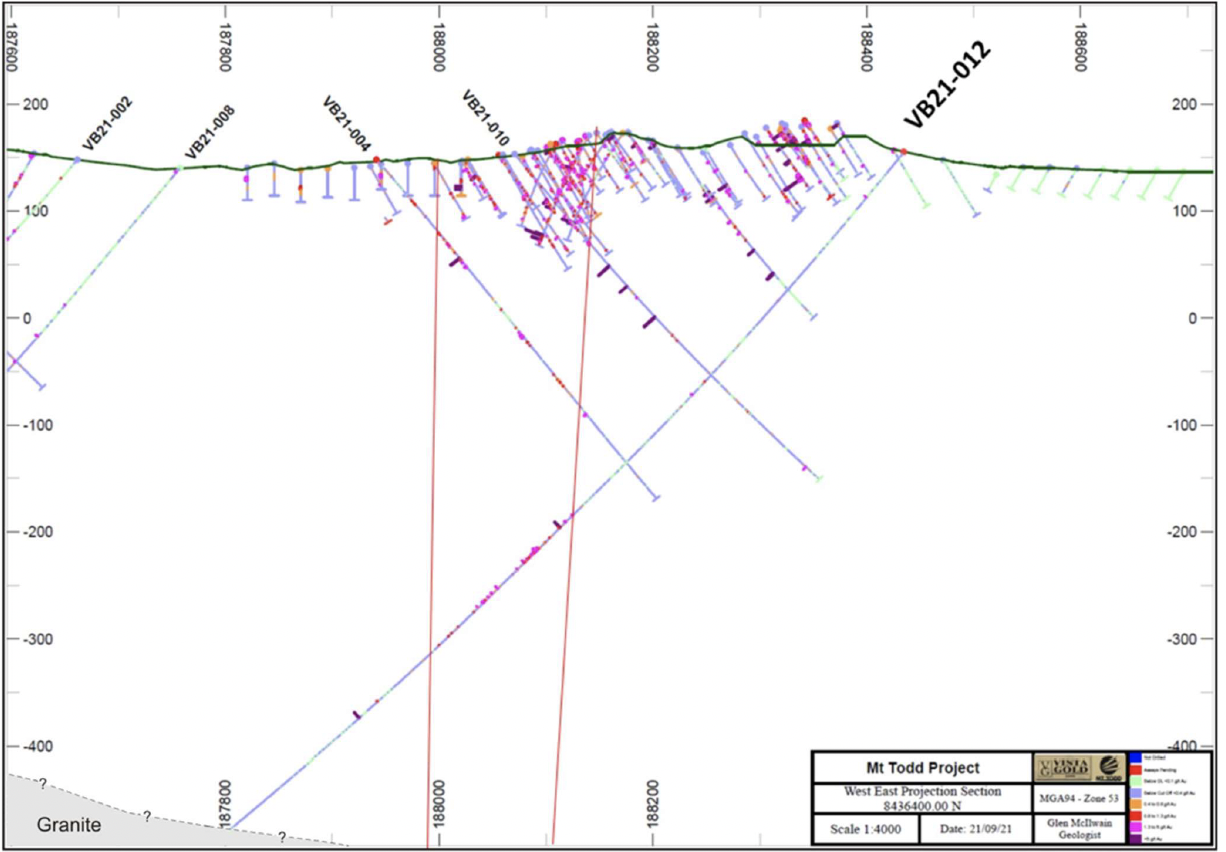

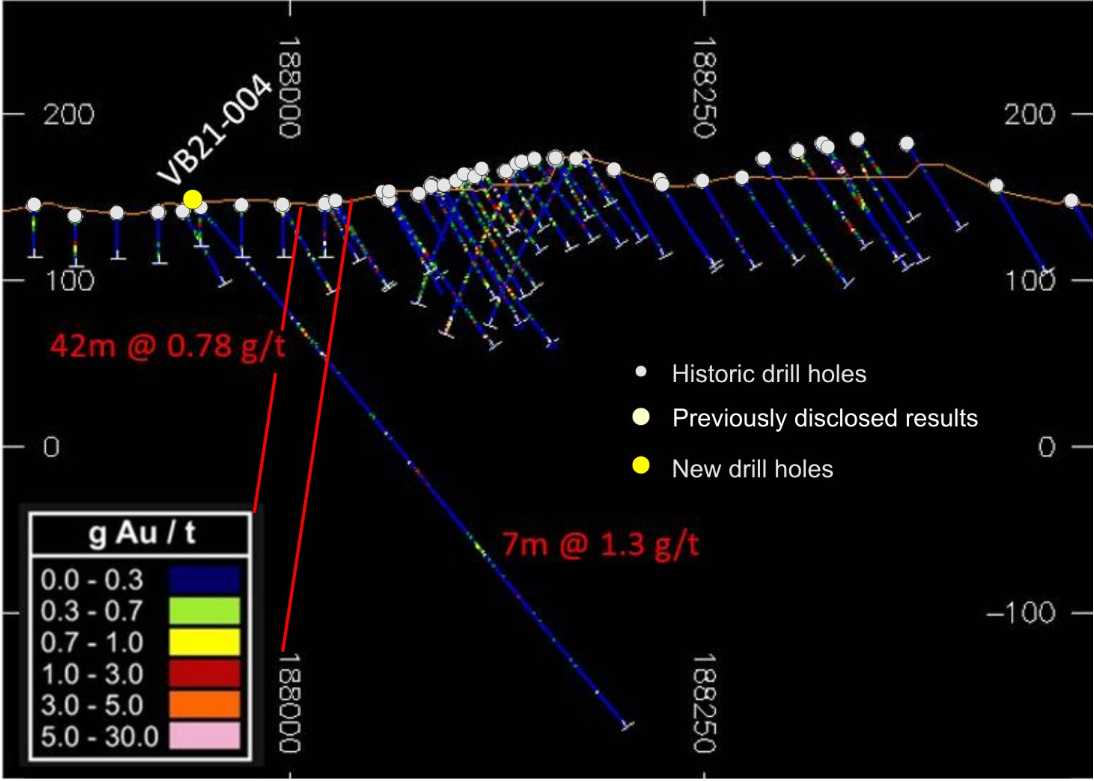

Hole VB21-012

VB21-012 was drilled to test the potential depth of the granitic intrusive under the Northern and Southern Cross zones and for an enriched zone within the Southern Cross Zone (“SXZN”) close to the intrusive. While VB21-012 did not intersect the intrusive, alteration intensity did increase with depth and, as veining persisted, the hole was pushed an additional 100 meters past planned depth (see Figure 2). VB21-012 has shown that the SXZN, both persists and thickens with depth. The SXZN has three +1 g Au/t zones with an overall width of 100 meters (when aggregated), with dip continuity of +500 meters and a strike length of approximately 1.1 km. Vein assemblages consist dominantly of quartz, pyrrhotite, chalcopyrite, and sphalerite, with galena occasionally present. The SXZN appears similar to the NXZN, which exhibits the potential to host grades twice that of the Batman deposit.

Consistent with our standard drilling protocols, VB21-012 was drilled with oriented core and has provided orientation data for bedding, veining and structures that will greatly assist in understanding the mineralizing controls and targeting future drilling.

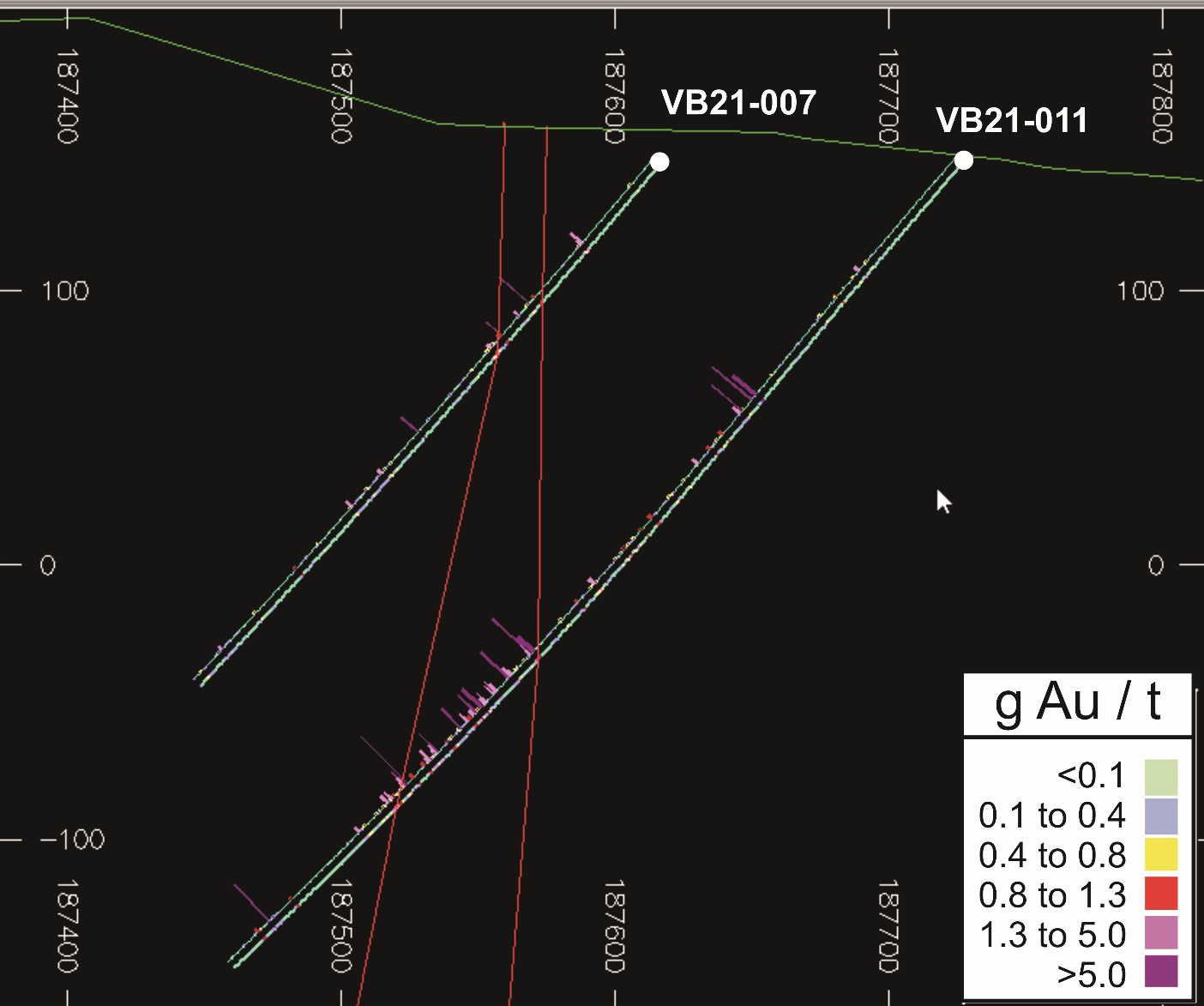

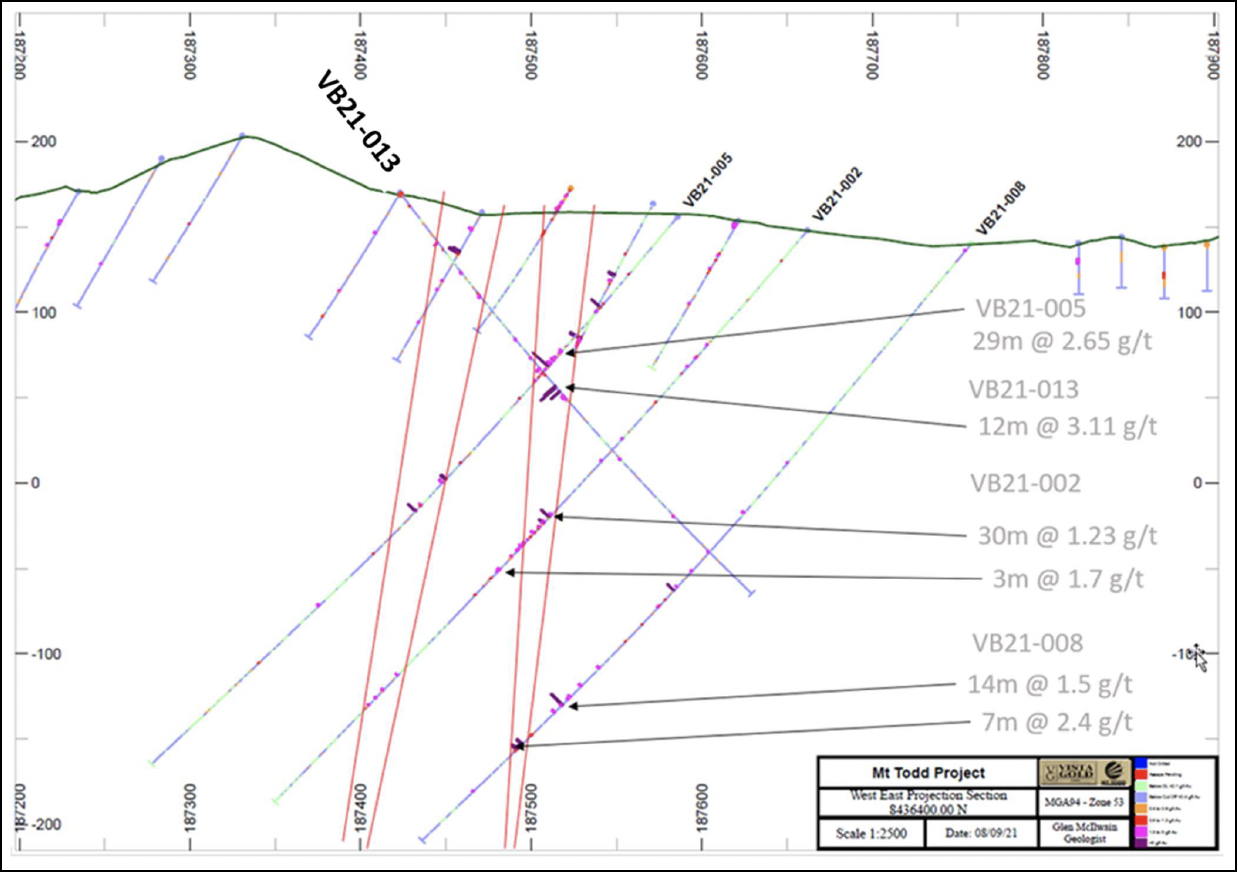

Hole VB21-013

VB21-013 was planned to intersect the Northern Cross Zone (“NXZN”) from the west instead of the east as drilled previously on section 6400N (approximately 1,000 meters north of the existing Batman Pit). VB21-013 intersected the NXZN between the intercepts in holes VB21-005 and VB21-002, while also confirming the thickness of the structure by intercepting it from the opposite direction. Structural measurements have indicated that at section 6400N, the NXZN mineralized veins are subvertical and strike nearly north-south. The veins vary in thickness and number. The NXZN has intersected four zones to date, two of which are very well developed on section 6400N.

The NXZN was intersected where predicted and displays strong upper and lower contact mineralization. Hole VB21-013, drilled from west to east, has shown a tighter, higher-grade structure than the holes drilled east to west. The revised drill direction appears appropriate and is consistent with the measured vein orientations of the high-grade.

A portion of future work will focus on defining high-grade mineralization within the NXZN, which is open in all directions.

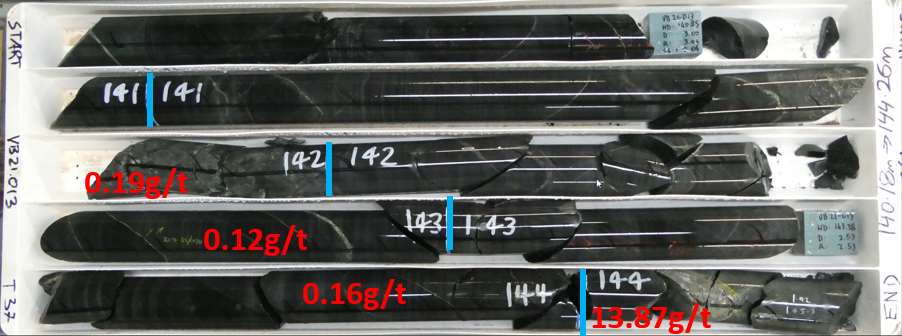

Photos – Drill intercepts from VB21-013 showing mineralization

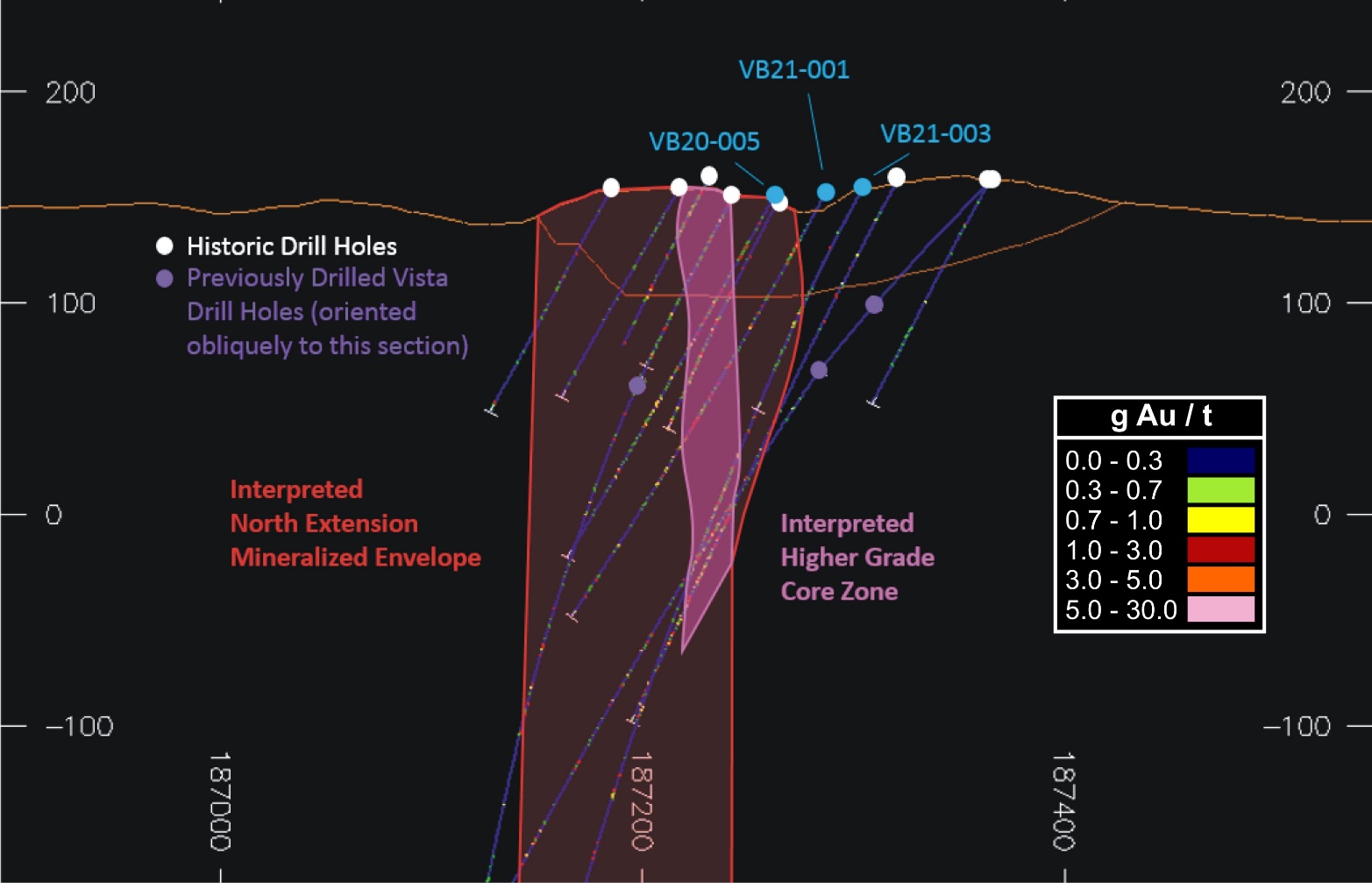

Figure 1 – Plan View of Drill Holes

Figure 2 - Cross Section with VB21-012

Figure 3 - Cross Section with VB21-013 and interpreted zones

The sampling method and approach for the surface geochemistry and grab samples is as follows:

- Soil samples are planned on a regular grid and a sample sheet is generated.

- GPS is used to locate sample positions and a pelican pick is used to clear debris and any topsoil from the sample location 3.

- The hole is dug to the B horizon and 7 to 10 kg of soil is collected and coarse sieved to remove stones etc., a fine mesh is then employed and the entire sample recovered post sieving is bagged.

- Soil sampling is usually undertaken in the dry season, however if wet samples are obtained, they are dried in the logging shed prior to sieving.

- Sample bags are calico and purchased pre-numbered, these are then packaged in groups of 5 for transportation to NAL, an independent ISO 9000 certified lab, Pine Creek, NT and Genalysis Laboratory Services Pty Ltd, Perth, WA, which is also independent from Vista.

- As the site is closed to public access, no special security measures are undertaken.

- A sample submission sheet is sent to the lab, detailing required methodology, and number of samples.

- No identifying data relating to sample location is recorded on the bags submitted or the paperwork beyond bag numbers.

Rock chip and soil geochemical samples are routinely collected to determine if the potential exists for anomalous gold values below the surface. The presence of anomalous gold grades is not a guarantee of subsurface mineralization. While both rock chip and soil samples have sampling procedures, it is not considered rigorous enough to be relied upon for use in the estimation of mineral resources. Surface soil and rock chip samples are merely considered to be potential indicators of subsurface mineralization. Since the rock chip and soil assays are not used in mineral resource estimation, it is rare that any additional QA/QC or check assaying would be completed. The data are used on an as received basis.

It is the QP’s (as defined below) opinion that the sample preparation methods and quality control measures employed before dispatch of samples to an analytical or testing laboratory ensured the validity and integrity of samples taken.

John Rozelle, Vista’s Sr. Vice President, a Qualified Person (“QP”) as defined by Canadian National Instrument 43-101 – Standards of Disclosure for Mineral Projects, has verified the data underlying the information contained in and has approved this press release. The information contained in this press release does not change any of the mineral resources or reserves estimates contained in Vista’s October 7, 2019 NI 43-101 Technical Report, Mt Todd Gold Project, 50,000 tpd Preliminary Feasibility Study, Northern Territory, Australia. The information contained in this press release is provided to inform the reader of the growth of our geologic understanding of the Project. There has been insufficient exploration to define a mineral resource with respect to the exploration target areas and it is uncertain if further exploration will result in the exploration target areas being delineated as a mineral resource.

Data Verification and QA/QC

The sampling method and approach for the drillholes are as follows:

- The drill core, upon removal from the core barrel, is placed into plastic core boxes;

- The plastic core boxes are transported to the sample preparation building;

- The core is marked, geologically logged, geotechnically logged, photographed, and sawn into halves. One-half is placed into sample bags as one-meter sample lengths, and the other half retained for future reference. The only exception to this is when a portion of the remaining core has been flagged for use in metallurgical testwork;

- The bagged samples have sample tags placed both inside and on the outside of the sample bags. The individual samples are grouped into “lots” for submission to NAL, a certified lab, for preparation and analytical testing; and

- All of this work was done under the supervision of a Vista geologist.

Processing of the core included photographing, geotechnical and geologic logging, and marking the core for sampling. The nominal sample interval was one meter. When this process was completed, the core was moved into the core cutting/storage area where it was laid out for sampling. The core was laid out using the following procedures:

- One meter depth intervals were marked out on the core by a member of the geologic staff;

- Core orientation (bottom of core) was marked with a solid line when at least three orientation marks aligned and used for structural measurements. When orientation marks were insufficient an estimated orientation was indicated by a dashed line;

- Geologic logging was then done by a member of the geologic staff. Assay intervals were selected at that time and a cut line marked on the core. The standard sample interval was one meter, with a minimum of 0.2 meters and a maximum of 1.2 meters;

- Blind sample numbers were then assigned based on pre-labeled sample bags. Sample intervals were then indicated in the core tray at the appropriate locations; and

- Each core tray was photographed and restacked on pallets pending sample cutting and stored on site indefinitely.